We think some of the ECB’s critics are missing the point. In particular, we expect TLTRO II to lower bank funding costs, mitigate the adverse consequences of low (negative) rates on bank margins, strengthen the ECB’s forward guidance and improve the transmission of monetary policy. We expect the take-up at all four TLTRO II operations to exceed EUR500bn, of which roughly EUR400bn should be rolled over from TLTRO I. The resulting reduction in terms of the cost of negative rates could be substantial, up to EUR2bn by 2018 on aggregate. The ECB announced a series of new Targeted Long-Term Refinancing Operations (TLTRO II) as a key element of its March policy package, with the aim of lowering bank funding costs and supporting bank lending. Critics like to cite the old dictum “You can lead a horse to water, but you can't make it drink” – in other terms, the ECB can’t force a bank to lend however low (or negative) interest rates fall. TLTRO II, say the critics, is no game-changer.

Topics:

Frederik Ducrozet considers the following as important: deposit rates, ECB, European banks, Macroview, negative rates, TLTRO, TLTRO II

This could be interesting, too:

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

Marc Chandler writes Tomorrow’s China Briefing Did Not Prevent the Continued Slide in Chinese Stocks Today

Marc Chandler writes Soft US Headline CPI is Unlikely to Be Sufficient to Reanimate Expectations of another Large Fed Cut

Marc Chandler writes What Can Powell Say that the Markets Do Not Already Know?

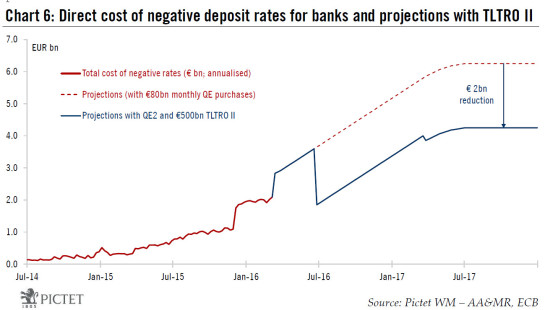

We think some of the ECB’s critics are missing the point. In particular, we expect TLTRO II to lower bank funding costs, mitigate the adverse consequences of low (negative) rates on bank margins, strengthen the ECB’s forward guidance and improve the transmission of monetary policy. We expect the take-up at all four TLTRO II operations to exceed EUR500bn, of which roughly EUR400bn should be rolled over from TLTRO I. The resulting reduction in terms of the cost of negative rates could be substantial, up to EUR2bn by 2018 on aggregate.

The ECB announced a series of new Targeted Long-Term Refinancing Operations (TLTRO II) as a key element of its March policy package, with the aim of lowering bank funding costs and supporting bank lending. Critics like to cite the old dictum “You can lead a horse to water, but you can't make it drink” – in other terms, the ECB can’t force a bank to lend however low (or negative) interest rates fall. TLTRO II, say the critics, is no game-changer.

Yet we think critics are missing the point as TLTRO II will: i) ease monetary conditions; ii) provide significant backstop funding for banks, especially in the euro area periphery; iii) mitigate the pressure of negative rates on bank margins; iv) strengthen the ECB’s forward guidance; v) improve the transmission of other ECB measures, including asset purchases; and vi) support stronger credit flows to the private sector, at least at the margin.

We expect the take-up at all four planned TLTRO II operations to exceed EUR500bn, of which roughly EUR400bn will be rolled from TLTRO I—but even if banks’ demand ends up lower and a small share only translates into extra lending flows, it should still be welcomed.

On average, euro area banks need to expand their eligible loan portfolio by around 1.2% annually in 2016 and 2017 in order to qualify for the maximum reduction, i.e. to receive the 0.40% subsidy on their TLTRO II holdings. We believe that a majority of banks will be in a position to meet their augmented benchmarks assuming the recent positive trend in credit flows continues in the next couple of years. The resulting reduction in terms of the cost of negative rates could be substantial, up to EUR2bn by 2018 on aggregate.

Against this backdrop, we maintain our scenario of a strengthening cyclical recovery, with euro area GDP growing at around 1.8% this year and next, above potential, on the back of rising domestic demand (household consumption and investment) fuelled by bank credit.

Everything you ever wanted to know about TLTROs (but were afraid to ask)

The ECB will conduct a series of four TLTRO II operations each quarter between June 2016 and March 2017, with a fixed maturity of four years and an interest rate that can be as low as the deposit rate (currently -0.40%). Some technical details are still missing in the initial press release but, overall, TLTRO II offers long-term funding to banks with much more favourable terms and conditions than TLTRO I:

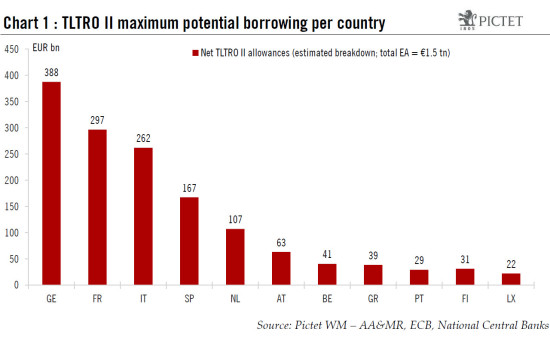

- Borrowing amounts: banks will be allowed to borrow up to 30% of the amount of eligible loans (all loans to non-financial corporations and households with the exception of mortgages) that they were holding on their balance sheet at end-January 2016, net of any residual amount borrowed in the first two TLTRO I operations conducted in 2014. At the aggregate euro area level, this will result in a potential TLTRO II allowance of around EUR1,500bn, or EUR1.7tn (30% of EUR5.6tn in eligible loans), less EUR212bn borrowed in the first two TLTRO I operations (see Chart 1 for an estimated breakdown by country). As usual, banks will need to post collateral at the ECB against any TLTRO II borrowing.

- Maturity: TLTRO II operations will have a fixed maturity of four years (until March 2021) as opposed to a fixed term (September 2018) for the TLTRO I programme.

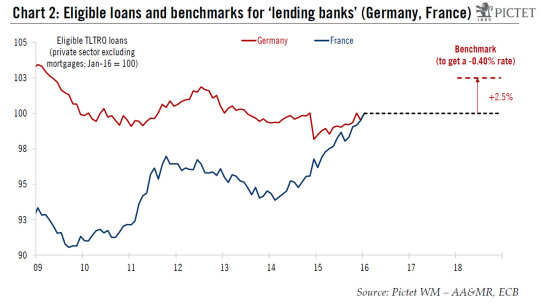

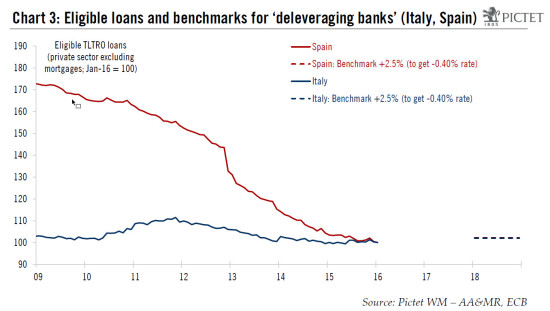

- Interest rate: the rate applied to TLTRO II will initially be fixed at the refi rate (0% currently), similar to TLTRO I, but banks will be granted a reduction by 2018 (with retroactive effects), depending on them meeting specific conditions linked to lending benchmarks. At best, banks will end up ‘paying’ the ECB’s deposit rate, ie receiving40% annually on the amounts borrowed from all TLTRO II, if they exceed their benchmark by 2.5% over two years. The exact formulae is complicated, with a distinction made between banks whose eligible loans expanded over the 12 months to January 2016 (‘lending banks’) and banks whose eligible loan portfolios shrunk over the same period (‘deleveraging banks’).

We estimate that most banks will be in a position to meet their augmented benchmarks and thus benefit from the lowest TLTRO II rate possible (see below).

- Repayments: banks will have the option to repay TLTRO II each quarter starting in 2018, but contrary to TLTRO I there will be no mandatory early repayments in cases where the lending benchmarks are not met. In other words, the only ‘risk’ that banks are facing is that rather than receiving a 0.40% subsidy, TLTRO II loans are priced at 0% for four years should they fail to meet the ECB’s (arguably loose) target between February 2016 and January 2018. As such, TLTRO II will provide unconditional liquidity to banks at 0% cost, against collateral.

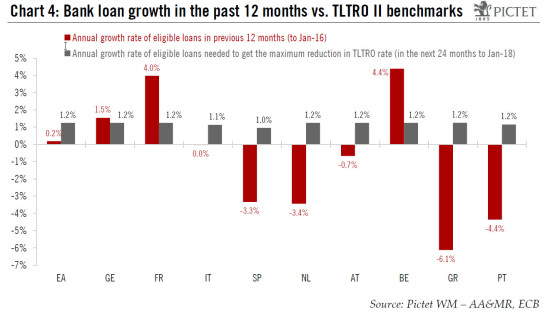

Chart 4 shows bank credit flows in the 12 months compared with the implied effort in terms of loan growth that would be needed for banks to obtain the lowest rate possible (-0.40%) under the terms of TLTRO II[1]. On average, euro area banks need to expand their eligible loan portfolio by around 1.2% annually in 2016 and 2017 in order to qualify for the maximum reduction,

i.e. to receive the 0.40% subsidy on their TLTRO II holdings each year[2]. While in some countries, this target is above the growth rate in eligible loans recorded over the past few years, we believe that a large majority of banks will be in a position to meet their augmented benchmarks assuming the recent trend of modest improvement in credit flows continues in the next couple of years, as reflected in the ECB’s Bank Lending Survey in particular (the next release on 19 April will be of particular interest).

How much will banks borrow? The EUR1.5tn question

Any estimate of the actual take-up in the ECB’s TLTRO II is fraught with considerable uncertainty. For a start, banks should decide to switch existing TLTRO I holdings into new TLTRO II borrowing at more attractive terms. After today’s TLTRO I operation (the 7th of the series), which attracted EUR7.3bn demand from 19 banks, the total amount borrowed under those operations now stands at EUR425bn. We estimated that around EUR400bn of TLTRO I money will be rolled over into TLTRO II in June 2016.

Any additional net demand for upcoming TLTRO II may be limited given that most banks have more than enough liquidity to meet their needs at this stage. Moreover, regulatory constraints could force banks to continue to issue ‘bail-in-able’ debt in the next few years, reducing the potential for debt refinancing while maintaining a diversified base of funding.

Still, other motivations include a further lowering of borrowing costs, especially for peripheral banks in an environment of negative rates and compressed margins, as well as the potential for carry trade, i.e. a free option for banks to add to their (arguably already elevated) holdings of sovereign bonds. In all, we ‘guestimate’ that TLTRO II could attract more than EUR100bn in additional net demand, resulting in a cumulated TLTRO II take-up of at least EUR500bn, with upside risks.

TLTRO criticism looks misplaced

We think most critics are missing the point as regards TLTRO II. The issues of banks’ appetite for ECB cash and the transmission to lending flows are debatable, but there are other positives that tend to be overlooked, in our view, in terms of the impact of TLTRO II on: i) broader monetary conditions; ii) term funding costs for smaller peripheral banks; iii) the cost of negative rates and pressure on bank margins; iv) the ECB’s forward guidance; and v) the transmission of other ECB’s measures including asset purchases.

As regards the cost of negative rates, the effect of TLTRO II is very difficult to calculate but we expect the net reduction to be substantial, up to EUR2bn on an annual basis by 2018. The switch from TLTRO I to TLTRO II will provide banks with a net subsidy that may or may not be booked immediately in treasury accounts, but will eventually help compensate the aggregate cost of negative deposit rates. The difficulty comes from the distribution of excess reserves within the system (banks borrowing at the TLTROs are not the same as those parking the liquidity at the ECB)[3]. In fact, peripheral banks hold less than 10% of excess reserves subject to negative rates. Therefore, TLTRO II are likely to benefit peripheral banks disproportionally relative to core banks.

Under our assumptions for TLTRO take-up and ECB’s asset purchases running at a EUR80bn monthly rate starting next month, excess liquidity will rise to around EUR1.5tn by 2017 (from EUR650bn currently), the direct cost of negative rates will rise from EUR2bn to around EUR6bn, but TLTRO II will reduce the negative rate bill by around EUR2bn, to EUR4bn on an annual basis, as shown in Chart 6. As a reminder, euro area banks’ Net Interest Income was EUR320bn in 2015, broadly stable over recent quarters.

As regards forward guidance, the ECB’s statement made it clear that policy rates will “remain at present or lower levels for an extended period of time, and well past the horizon of our net asset purchases”, i.e. at least well into 2017. The TLTRO II have strengthened the ECB’s forward guidance considerably in that any policy rate hike before March 2021 – the maturity of the last March 2017 TLTRO – would potentially result in the ECB losing interest income on that particular operation. To be clear, this should not prevent the ECB from hiking rates before 2021, but the result is a ‘soft guarantee’ and a stronger case for policy divergence with the US, which the ECB hopes will eventually result in currency depreciation.

Lastly, the ECB has described the policy measures in its March package as complementary, together helping inflation to rise towards the 2% target over the medium-term. Indeed, we think the ECB’s staff forecasts for 2018 will be revised up soon (see Quantifying ECB’s stimulus – an extra 0.3% boost to inflation). Against this backdrop of ECB support, we maintain our scenario of a stronger cyclical recovery, with euro area GDP growing at around 1.8% this year and next, above potential, on the back of rising domestic demand (consumption and investment) fuelled by bank credit.

[1] Also, any net demand for TLTRO II that is not rolled over from TLTRO I will increase the level of excess liquidity and thus the aggregate cost of negative rates for depositors, while potentially reducing the amount of other refinancing operations, including ECB’s MRO currently standing at EUR63bn.

[2] There is one important caveat to this approach given that national aggregate estimates of lending benchmarks can deviate from the sum of individual banks’ own benchmarks. This is true for TLTRO I as well. In particular, even if banks from country X beat their lending benchmarks on an aggregate level, that does not mean that all banks from country X will benefit from the maximum rate reduction.

[3] Note that net credit flows may not be equal to the change in lending stocks over the same period due to technical adjustments in terms of reclassifications and revaluations.