Swiss Franc The Euro has risen by 0.07% to 1.0779 EUR/CHF and USD/CHF, September 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The two recent market developments, push lower in stocks, and higher in the dollar is continuing. Tuesday’s gains in the S&P 500 and NASDAQ were unwound on Wednesday and this is helping drag global markets lower. The MSCI Asia Pacific Index fell for the fourth consecutive...

Read More »Europe’s Non-linear

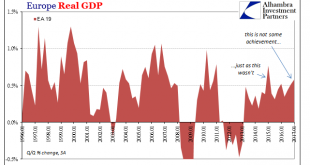

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant. For one, the European economy underperformed before 2008, too. Second, after 2008, really August 9, 2007, there isn’t nearly as much difference as...

Read More »Take-up of TLTRO loans is good news for euro bank credit

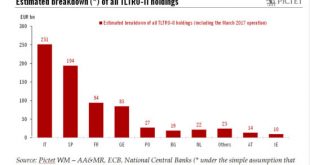

The ECB’s scheme of negative interest rate loans to banks has also helped boost inflation in the euro area.The fourth and final of the ECB’s Targeted Long-Term Refinancing Operations (TLTRO) today attracted EUR233bn in demand from 474 euro area banks, well above consensus (EUR110bn). Expectations of an ECB deposit rate hike may have boosted demand for this operation, as it provided a last opportunity for banks to secure four-year funding at a rate that can go as low as -0.40%.There is no...

Read More »Credit figures confirm our 2016 euro growth forecast

Strong money-supply growth in February enables us to maintain our forecast for euro area real GDP growth unchanged at 1.8% in 2016. Euro area bank credit flows increased again in February, in line with other indicators such as the ECB’s Bank Lending Survey (see the chart below) and quite remarkably given the challenging financial context in February. We continue to believe that the credit cycle has legs. Moreover, we expect the ECB’s new Targeted Long Term Refinancing Operations (TLTRO...

Read More »Scepticism over ECB’s TLTRO II programme is misplaced

We think some of the ECB’s critics are missing the point. In particular, we expect TLTRO II to lower bank funding costs, mitigate the adverse consequences of low (negative) rates on bank margins, strengthen the ECB’s forward guidance and improve the transmission of monetary policy. We expect the take-up at all four TLTRO II operations to exceed EUR500bn, of which roughly EUR400bn should be rolled over from TLTRO I. The resulting reduction in terms of the cost of negative rates could be...

Read More »The ECB delivers a bigger-than-expected package to support bank lending

The ECB announced measures that exceeded expectations, targeting the refi rate, its monthly asset purchases, a new corporate bonds purchase programme, new TLTROs and a negative rate. The deposit rate was cut as expected, but Draghi said that “no more cuts” were anticipated at this stage. The ECB’s Governing Council delivered a comprehensive policy package that exceeded market expectations by a large margin. The 10bp deposit rate cut to -0.40% was expected but other measures were not,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org