From a low point of less than per barrel in mid-February, oil prices had risen to over by mid-March. If maintained, this rise will have an obvious impact on growth and inflation on both sides of the Atlantic. The use of a sophisticated macro-econometric model provides an insight into just how large the impact might be. Although oil prices have risen, the huge accumulation of oil stocks as a result of overproduction should serve as a brake on oil prices this year and next. Nevertheless, fundamentals are progressively reasserting themselves, enabling us to envisage a time when crude oil arrives at a “fair value” price per barrel. The use of a sophistical macro-econometric model that takes into account variations in the rate of the trade-weighted dollar and a wide variety of economic indicators enables one to arrive at what this ¨fair value” price for crude oil might be in the absence of geopolitical risk. Should global growth reach 3.4% this year (as per the International Monetary Fund’s January forecast) and should the trade-weighted value of the US dollar remain at current levels, then the model indicates that the “fair value” for crude oil would be US per barrel. Should the real trade-weighted rate for the dollar rise by 10% and global growth still come in at 3.4%, then the fair-value price of oil would be US.

Topics:

Jean-Pierre Durante considers the following as important: Macroview, oil GDP gro

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

From a low point of less than $30 per barrel in mid-February, oil prices had risen to over $40 by mid-March. If maintained, this rise will have an obvious impact on growth and inflation on both sides of the Atlantic. The use of a sophisticated macro-econometric model provides an insight into just how large the impact might be.

Although oil prices have risen, the huge accumulation of oil stocks as a result of overproduction should serve as a brake on oil prices this year and next. Nevertheless, fundamentals are progressively reasserting themselves, enabling us to envisage a time when crude oil arrives at a “fair value” price per barrel.

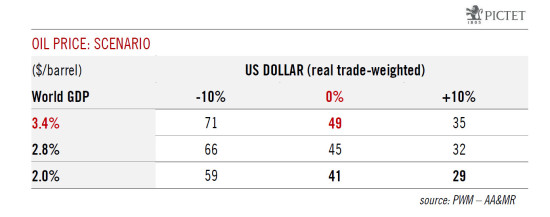

The use of a sophistical macro-econometric model that takes into account variations in the rate of the trade-weighted dollar and a wide variety of economic indicators enables one to arrive at what this ¨fair value” price for crude oil might be in the absence of geopolitical risk.

Should global growth reach 3.4% this year (as per the International Monetary Fund’s January forecast) and should the trade-weighted value of the US dollar remain at current levels, then the model indicates that the “fair value” for crude oil would be US$49 per barrel. Should the real trade-weighted rate for the dollar rise by 10% and global growth still come in at 3.4%, then the fair-value price of oil would be US$35. But should the trade-weighted value of the US dollar fall by 10%, then the fair value of oil would be $71 per barrel. By comparison, West Texas Oil was trading at around US$41 on March 21.

Delving further into macro-econometric modelling allows us to imagine the impact of possible changes in oil prices on economic growth and inflation. Thus, should the oil price average US$45 per barrel, GDP growth in the eurozone could come in at 1.2% this year instead of the 1.7% projected by Pictet Wealth Management (PWM), while eurozone inflation would rise from PWM’s central projection of 0.5% to 0.7%. The impact on the US of oil at US$45 per barrel would be less pronounced. According to the model, real GDP could turn out to be 1.7% in 2016 compared with PWM’s central hypothesis of 2.0%, while inflation could rise from a projected 1.5% to 1.7%.

In short, an oil price that held at an average US$45 per barrel in 2016 and 2017 would lower growth and boost inflation, with consequences for policy making by central banks.

These conclusions are arrived at using a macro-econometric model called Dynamic Stochastic General Equilibrium (DSGE). This model is used by central banks, notably by the ECB, to project likely growth and inflation scenarios based on data inputs from households, capital markets, banks etc… in the case of variations in oil prices. This modelling contributes to policy decisions undertaken by central banks.

Working in collaboration with the University of Lausanne, PWM has come up with a way of reproducing the DSGE model used by central banks.

For a fuller version of this analysis, follow this link