High-Yield in both the US and euro zone has experienced significant stress since the start of the year, posting negative total return performances. High-Yield (HY) corporate bonds have continued to suffer since the start of the year, posting a negative total return of 4.6% for the US index and 3.6% for the equivalent index in euro. It comes as no surprise that the worst-performing US sector was energy, down 18.3%, and the best performer was super retail, with a meagre 0.1% gain. Many factors lie at the root of the downslide in HY, and the following paragraphs will take a look at a few of them. Fall in the oil price increasing stress in High-Yield The downturn in commodity prices, especially the oil price since mid-2014, has been the cause of the widening of spreads in the energy sector and in the lowest-rated segment of the HY index. As the fall in the oil price has continued, the spreads have reached stressed levels and influenced the overall index (see graph below). Such contagion is due to the size of the energy sector and the sectors influenced by commodities in the index, but also to general worries over HY, as ex-energy spreads reached 700 basis points (bp) at the end of January 2016 (the overall index had posted 864bp as at 12 February 2016). Indeed, the 12-month correlation between the levels of HY spreads and the evolution of the oil price stands at about -0.

Topics:

Laureline Chatelain considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

High-Yield in both the US and euro zone has experienced significant stress since the start of the year, posting negative total return performances.

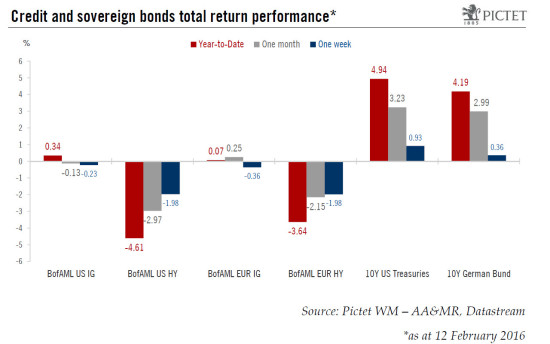

High-Yield (HY) corporate bonds have continued to suffer since the start of the year, posting a negative total return of 4.6% for the US index and 3.6% for the equivalent index in euro. It comes as no surprise that the worst-performing US sector was energy, down 18.3%, and the best performer was super retail, with a meagre 0.1% gain. Many factors lie at the root of the downslide in HY, and the following paragraphs will take a look at a few of them.

Fall in the oil price increasing stress in High-Yield

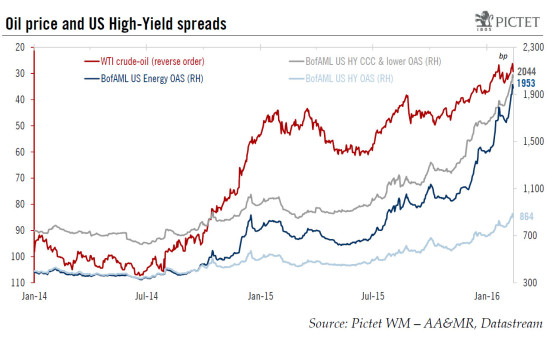

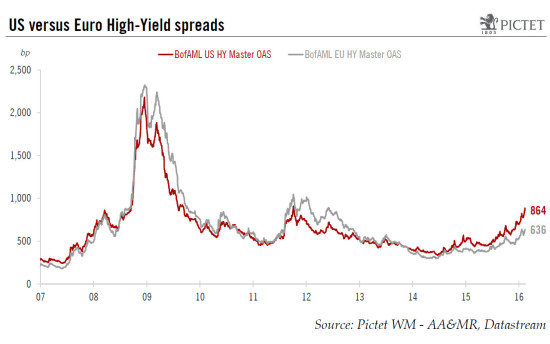

The downturn in commodity prices, especially the oil price since mid-2014, has been the cause of the widening of spreads in the energy sector and in the lowest-rated segment of the HY index. As the fall in the oil price has continued, the spreads have reached stressed levels and influenced the overall index (see graph below). Such contagion is due to the size of the energy sector and the sectors influenced by commodities in the index, but also to general worries over HY, as ex-energy spreads reached 700 basis points (bp) at the end of January 2016 (the overall index had posted 864bp as at 12 February 2016). Indeed, the 12-month correlation between the levels of HY spreads and the evolution of the oil price stands at about -0.8 for the US and the euro zone, which is unusually high and was last seen during the financial crisis of 2008. Regarding Euro HY, the correlation has been rising strongly since the beginning of the year, because the markets interpreted the fall in the oil price as a sign of weaker global growth, developed economies included.

The contagion to other sectors is indicative of markets realising that the fall in the oil price is also impacting the profitability of other companies through weaker growth in emerging markets and domestic industrial production. Such a reduction in profits is a source of concern as it reduces companies’ ability to pay off their debt. Moreover, the increase in HY yields raises the cost of debt, and for this reason the 12-month cumulative new issuance in Euro HY and even more so in US HY has been falling. The US HY issuance has seen its lowest level in the last five years year-to-date. Hence, US HY yields are too high to represent an attractive financing means for companies, which could quickly lack financing if banks keep tightening their lending conditions to firms. The banking sector has recently come under the spotlight, especially in the euro zone. It remains unclear if concerns are mainly due to changes in regulatory measures regarding banks’ subordinated debt or if investors are also questioning banks’ profitability (linked with the negative deposit rates) and their loan exposure to the energy sector and to emerging countries. CDS on US HY energy have been increasing strongly in line with the fall in the oil price as investors buy protection on these risky bonds. A similar move has been seen since autumn 2015 on the CDS for the overall Euro and USD HY indices, with the CDS on Euro subordinated banks' debt widening more since the beginning of 2016.

Rising default rates pushing HY spreads up

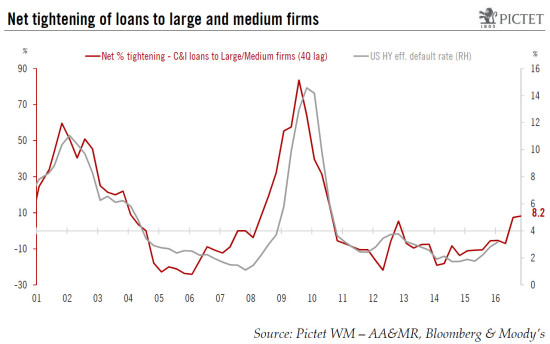

HY effective default rates, as calculated by Moody’s, continued to rise in 2015, reaching 3.2% for the US and 3.4% for the euro zone, levels last seen in 2012–2013. Moody’s forecasts that they will rise to 4.4% for the US index and fall to 2.9% for its euro counterpart by the end of 2016. This discrepancy is mainly due to anticipated divergence in monetary policies and the distinctness in the sector/rating exposure of both indices. The default rate is an important factor because it represents a lagging indicator of credit spreads, with the markets trying to anticipate rating agencies’ default rates.

Various factors influence default rates, such as corporate profits and leverage, the oil price or lending conditions. The ease with which banks attribute loans to non-financial corporations is a leading indicator of the HY default rate in the US. Conditions for lending to US companies noticeably tightened for the second time in a row in Q4 2015 and for the first time since the end of the financial crisis. As these conditions have tightened, the default rate should rise to 5% in 2016, which would tend to confirm Moody’s forecast.

Lack of liquidity in HY accentuating price volatility

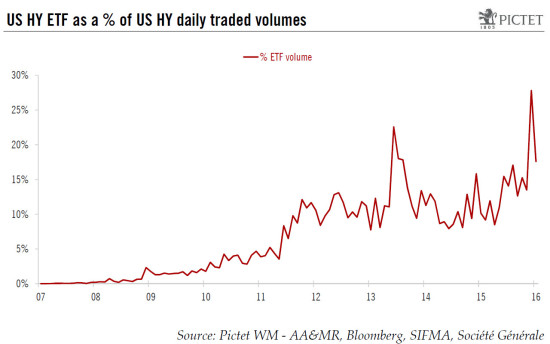

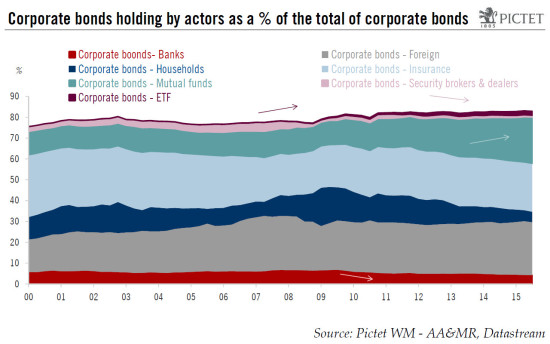

Obviously other factors than the default rates are also causing the sharp widening of credit spreads in HY, such as the lack of liquidity in this market, especially for the lowest-rated segment. Since the financial crisis, mutual funds and ETFs have increased their ownership of corporate bonds. US HY ETFs represent between 15% and 30% of the daily traded volumes in US HY bonds.

On the other hand, security brokers, dealers and banks have decreased their presence, mainly for regulatory reasons (see the chart below). In fact, such market-making activities require the costly immobilisation of capital on their balance sheets. This reduced presence is felt by investors because mutual funds and ETFs do not have the same aims and they are particularly exposed to investors’ moods, given that they have to sell bonds when facing redemptions. Such a mechanism is damageable in times of stress, as it accentuates the sell-off in the price of corporate bonds by the lack of buyers for the amount sold and spreads the selling pressure to all segments of the HY market independently of their fundamentals. This accentuates the contagion to better-rated bonds and to sectors other than those under stress, mainly energy and building materials.

Euro High-Yield less at risk than US High-Yield

We are more constructive on Euro HY as its energy sector exposure amounts to just 6% compared with 12% in US HY. However, its banking sector is significant and makes up 22% of the index (versus 5% for US HY). Euro HY also has issuers of a better quality, with only 6% of the debt rated CCC or lower (13% for US HY) and 65% with the best rating, set against 48% in US HY. Moreover, emerging-market exposure is more limited in the Euro HY than in the US HY (9% versus 12%). We also think that a more accommodative monetary policy in the euro zone could help to calm any further stress in Euro HY, for example if the European Central Bank (ECB) were to decide to buy euro corporate bonds through its quantitative easing programme. However, further cuts in the deposit rate without any other accommodating measures would probably accentuate the stress on the banking sector, as this reduces banks’ profitability. On the other hand, it remains unclear if the US Federal Reserve will significantly delay its tightening cycle, and what effect such a delay could have on US HY.

In contrast to US companies, euro zone companies have not benefited from attractive lending conditions until recently. In fact, lending growth to companies did not turn positive until mid-2015, and they should therefore not see any reduction in the ease of granting credit by euro zone banks in 2016, which seems to be gradually happening in the US. However, continued stress on the euro zone banking sector could lead to a premature tightening of lending conditions even with the ECB’s excessively loose monetary policy.

Overall, we think that a rebound in the oil price towards USD 45/b could provide an important relief to companies linked to the energy sector in the US HY, and could push yields down again. Such a rebound in the oil price would therefore provide a positive signal for the US HY market. On the contrary, a stabilisation of the oil price at around USD 30/b could precipitate a number of defaults in the energy sector and lead to a further rise in US HY yields and in the default rate. After such credit events, the default rate could normalise again and this could result in decreasing yields as the pressure comes down. For this reason, the occurrence of such credit events should be monitored as it could provide a good entry point to take advantage of the fall in US HY yields.