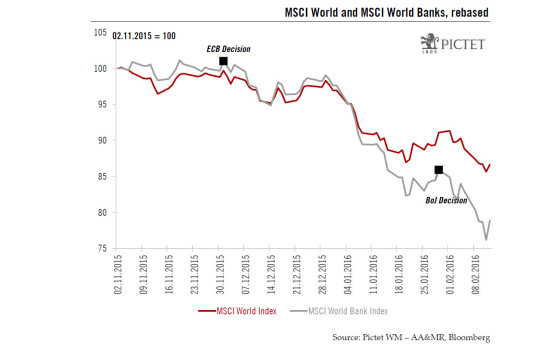

Recent equity market peaks coincided with the ECB and BoJ decisions to impose negative rates. From December 1st to last Friday, the MSCI World index declined by 14%. During the same period, the MSCI world banks index declined by 24%. Recent chronology of events Since 2009 and up until recently, central bank action has helped to stabilise equity markets. Looking at recent events, it now seems that the opposite is becoming true. The last two monetary decisions (ECB on 3 December 2015 and BoJ on 29 January 2016) coincided with intermediary peaks in developed market indices. In the second case, the Bank of Japan’s decision interrupted the rebound that had been taking place since from 20 January. Thus, from their November 2015 top to last Friday, the declines on the S&P500, Stoxx600 and Topix amount to 12%, 17% and 25% respectively. More disturbing still, the banking sectors were big negative contributors in this correction, with underperformances of 9% in the US, 11% in Europe and 18% in Japan. Moreover, those declines have pushed the valuation ratios of banking sectors to their lowest level since 2012, indicating the markets’ doubts about banks’ balance sheet stability in all three regions. Finally, CDS on bank subordinated debt have recently shown some signs of stress, indicating that the weakness in equity valuations is also reflected in credit markets.

Topics:

Alexandre Tavazzi and Jacques Henry considers the following as important: banks, BoJ, ECB, Financials, Interest rates, Macroview, negative interest rates, negative rates, rates

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes Dollar Bulls Catch Breath

Recent equity market peaks coincided with the ECB and BoJ decisions to impose negative rates. From December 1st to last Friday, the MSCI World index declined by 14%. During the same period, the MSCI world banks index declined by 24%.

Recent chronology of events

Since 2009 and up until recently, central bank action has helped to stabilise equity markets. Looking at recent events, it now seems that the opposite is becoming true. The last two monetary decisions (ECB on 3 December 2015 and BoJ on 29 January 2016) coincided with intermediary peaks in developed market indices. In the second case, the Bank of Japan’s decision interrupted the rebound that had been taking place since from 20 January. Thus, from their November 2015 top to last Friday, the declines on the S&P500, Stoxx600 and Topix amount to 12%, 17% and 25% respectively. More disturbing still, the banking sectors were big negative contributors in this correction, with underperformances of 9% in the US, 11% in Europe and 18% in Japan. Moreover, those declines have pushed the valuation ratios of banking sectors to their lowest level since 2012, indicating the markets’ doubts about banks’ balance sheet stability in all three regions. Finally, CDS on bank subordinated debt have recently shown some signs of stress, indicating that the weakness in equity valuations is also reflected in credit markets. These numbers and the timing of the declines seem to suggest a relationship between the recent implementation of negative interest rates and market reaction.

In our 2016 strategy, we have often mentioned that the weakness in energy prices was a source of stress in the High Yield bond market and that this stress was then transmitted to the equity market. Oil prices and commodity weakness account for a large part of the earnings downgrade seen in the US and European markets. The recent market behaviour indicates that financial stress may also come from central banks' actions. Understanding the mechanism at work will help us determine what is needed for the situation to stabilise and eventually improve.

Why?

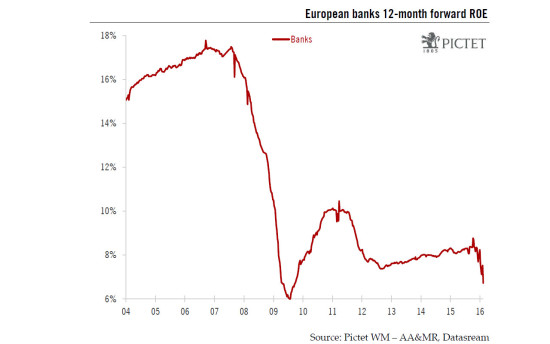

Negative interest rates impact banks’ profitability through different channels. First, as banks are asked to pay interest on their deposits at the central bank, this tends to penalise banks with large excess cash positions. Second, as the whole yield curve flattens (long and short-term yields are at the same level), it penalises banks’ interest margin. On the funding side, once rates are below zero, banks cannot report the full negative interest to their depositors. Third, it makes banks’ treasury operations more challenging as a result of negative yields on sovereign bonds. In Europe, the Bund yield curve is negative up to 8 years of maturity. In Japan, the BoJ decision pushed 10Y rates to zero for the first time in history. The same can be said with short-term interbank lending as negative rates make it unprofitable for banks with excess cash to lend to those needing it. Thus, interbank liquidity tends to decline in a negative rate environment.

Impact for the banking sector

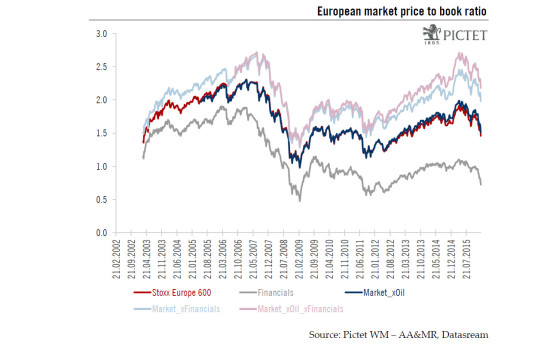

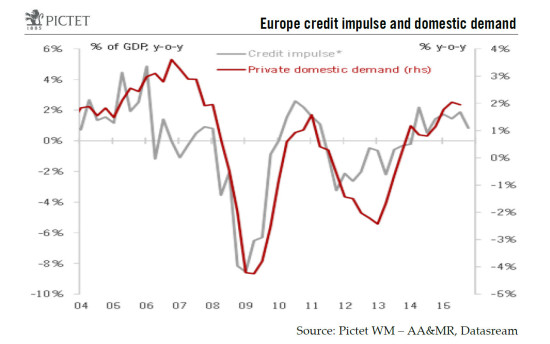

If we are correct about our analysis and banks’ profitability is indeed negatively impacted, then we see two immediate consequences. First, the incentive of banks to lend in such an environment is impaired as the profitability of new loans tends to be low and sometimes lower than existing loans (please refer to the following blog post for a more detailed analysis of the European banking sector). Thus, profit generation by banks in the coming years may not be as high as expected, particularly as central banks continue to guide rates lower. Second, this may impact new capital generation by banks and thus may impact the ability of some of them to comply with the Basel III regulations by 2019. In the event of any capital shortfall, some institutions may be forced to issue new capital (equity or bonds) or, in an extreme case, to reduce their risk-assets. As already seen in this cycle, asset reductions have a negative effect on the economic cycle, particularly as a positive credit cycle is needed to support the economic recovery. Hence the negative market reaction to the recent central bank action. This reaction has recently become even more negative as it has become clear since last November that there no longer seems to be any floor under negative rates. Consequently, uncertainty over the profitability of the banking sector has increased with a clear market impact: the lower the central bank rates, the higher the valuation discount applied to bank stocks, the higher the uncertainty and the higher the resulting market volatility.

Direct impact on markets

First, the uncertainty surrounding US, European and Japanese bank profitability has already had an impact on the sector forward price to book, as it has declined to its lowest level since 2012 (0.75, 0.59 and 0.60, respectively). Uncertainty about the earnings growth of banks has had the same effect on their price earnings ratio. Thus a part of the underperformance of cyclicals versus defensives can be partly attributed to banks’ underperformance as well as to the energy and material sectors. Second, given their weight, in broader indices (5.4% in the S&P500, 11.7% in Stoxx600 and 7.4% Topix), any change in banks’ estimated profits has an impact on the growth of broader market earnings. Since the end of last year, the contribution of banks to expected earnings growth has remained broadly unchanged in developed equity markets. Meanwhile, most of the decline in expected growth came from the energy and cyclical sectors. Any downward revision would further reduce the already small 2016 expected EPS growth rate. The 2016 expected EPS growth rate for the S&P500 currently stands at 3.1% and the contribution of financials is 1.4%. In the case of the Stoxx600, the contribution of financials represents 1.4% out of 4.3% expected growth. Thus, financials represent 45% of the S&P’s 2016 growth and 32% of the Stoxx 600’s growth.

Indirect impact on markets

Any change in the credit cycle tends to affect equity markets as credit growth is an essential component for economic growth, particularly in times of recovery (Europe and Japan). Any indication of a slowdown in credit is thus perceived as a negative factor for economic growth and corporate earnings as it represents a de facto tightening of monetary conditions. Hence, there is a negative feedback loop as central bank actions have an important effect on commercial banks’ profitability, their lending policy and, as a consequence, overall macroeconomic and earnings expectations.

Conclusion

Recent decisions by the ECB and the BoJ coincided with the start of major market corrections. During these events, the banking sectors in all developed markets substantially underperformed the main indices. Markets are clearly indicating that negative rates and no indication of a floor are becoming a source of lower profitability, financial instability and potential economic weakness. Needless to say, these factors explain not only lower equity prices, but also higher credit spreads in lower-quality bank bonds. In this case, it should become apparent to all central bankers that the damaging consequences of negative rates outweigh the positive ones*. Since November of last year, equity markets have reacted to this new reality and we expect them to remain very sensitive to monetary decisions in the coming weeks. Beyond a technical rebound and for a more sustainable rise to take place, we need central banks to understand the unintended consequences of their recent decisions and act accordingly.

*A more detailed note about potential central bank’s coming decisions will be published shortly.