Today’s retail sales report was reassuring. We remain sanguine on consumption growth in 2016. Unsurprisingly, Fed Chair Yellen acknowledged the downside risks to the growth outlook but did not rule out a hike in March. Nominal total retail sales rose by 0.2% m-o-m in January, slightly above consensus expectations (+0.1%). Moreover, December’s number was revised up from -0.1% to +0.2%. Total sales were dented by a 3.1% m-o-m fall in nominal sales at gasoline stations (on the back of lower gasoline prices). Nominal auto sales increased by 0.6% m-o-m, in line with what already published data on unit car sales (real) were suggesting. Meanwhile, sales of building materials increased by a healthy 0.6%. Control sales: sharp rebound m-o-m in January As usual, it is important to look at what has happened to control (core) sales, i.e. sales excluding autos, gasoline and building-materials stores (the portion of retail sales that goes directly into consumption calculations). On that front, January’s results were quite reassuring. Following a contraction of 0.3% m-o-m in December, control sales bounced back by a strong +0.6% in January, well above consensus expectations for a 0.3% rise. The end result is that between Q4 2015 and January core retail sales grew by a solid 3.5% annualised, following a meagre +1.4% q-o-q in Q4 2015.

Topics:

Bernard Lambert considers the following as important: FED, Federal Reserve, GDP, Macroview, Retail sales, United States, Yellen

This could be interesting, too:

investrends.ch writes Neuer Fed-Chef Warsh könnte US-Geldpolitik umkrempeln

investrends.ch writes Powell-Ermittlungen erhöhen den Druck auf die Fed – Auswirkungen auf Gold und den Dollar

investrends.ch writes Trump deutet Powell-Nachfolge bis Jahresende an

investrends.ch writes Jerome Powell schürt Hoffnungen auf tiefere Zinsen

Today’s retail sales report was reassuring. We remain sanguine on consumption growth in 2016. Unsurprisingly, Fed Chair Yellen acknowledged the downside risks to the growth outlook but did not rule out a hike in March.

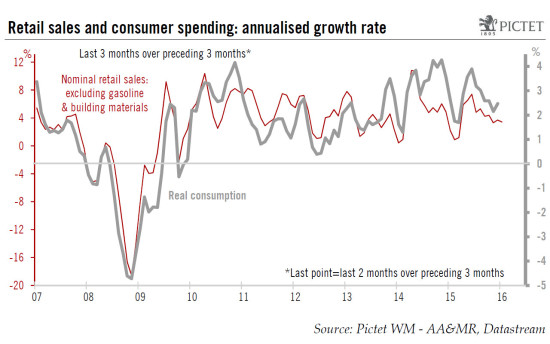

Nominal total retail sales rose by 0.2% m-o-m in January, slightly above consensus expectations (+0.1%). Moreover, December’s number was revised up from -0.1% to +0.2%. Total sales were dented by a 3.1% m-o-m fall in nominal sales at gasoline stations (on the back of lower gasoline prices). Nominal auto sales increased by 0.6% m-o-m, in line with what already published data on unit car sales (real) were suggesting. Meanwhile, sales of building materials increased by a healthy 0.6%.

Control sales: sharp rebound m-o-m in January

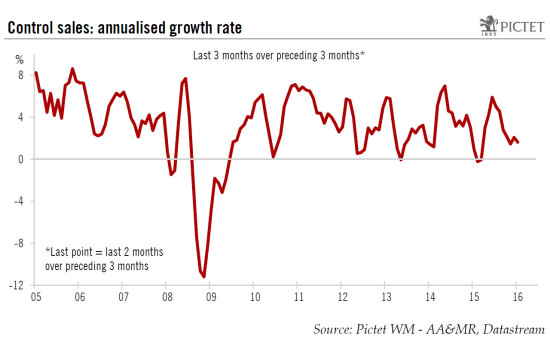

As usual, it is important to look at what has happened to control (core) sales, i.e. sales excluding autos, gasoline and building-materials stores (the portion of retail sales that goes directly into consumption calculations). On that front, January’s results were quite reassuring. Following a contraction of 0.3% m-o-m in December, control sales bounced back by a strong +0.6% in January, well above consensus expectations for a 0.3% rise. The end result is that between Q4 2015 and January core retail sales grew by a solid 3.5% annualised, following a meagre +1.4% q-o-q in Q4 2015.

Today’s solid retail sales suggest that real consumption growth may well prove relatively robust in January. However, retail sales are measured in nominal terms, they can be very volatile on a monthly basis and they are often revised substantially. In any case, core retail sales account for only around 25% of total consumption and they have often given a poor indication of overall consumption growth.

We remain sanguine on consumption in 2016

We remain optimistic on consumption growth in Q1. Admittedly, the turmoil on the financial markets may have somewhat dampened consumer confidence. However, at the same time – as we have just seen – core retail sales were more solid in January. Moreover, the index of ‘aggregate weekly payrolls’ – which is a good proxy for nominal household income coming in the form of private wages and salaries – rose strongly m-o-m in January and gasoline prices have fallen further over the past few weeks, providing further support for growth in real household incomes. In that context, we forecast that consumer spending will grow by around 2.8% q-o-q annualised in Q1, well above the growth rate recorded in Q4 2015 (+2.2%).

Our scenario for household consumption in 2016 overall remains unchanged. Employment growth should slow somewhat and the massive boost to real income that the fall in gasoline prices has implied in 2015 will not be repeated this year, at least not to the same extent. However, job creation should remain healthy, while wage increases are likely to pick up gradually. Regarding the beneficial effect from the fall in oil prices, although the oil windfall should be lighter overall this year compared with 2015, it should nevertheless be sizeable, particularly in H1. Following the recent supplementary fall in gasoline prices, we estimate that the positive impact on real disposable income growth should reach almost 1.5 point of percentage q-o-q annualised in Q1 2016, following a positive support of 1.0 percentage point in Q4 2015. Moreover, a substantial part of last year’s windfall was not spent. In other words, the saving rate is currently quite high (5.5% in December), and may well fall over the coming months. The consequence of all this is that we continue to expect healthy consumption growth overall in 2016, although it is likely to slow somewhat from the high rate recorded on average in 2015. On a yearly average basis, we continue to expect consumption growth to settle at a robust 2.7% in 2015, following 3.1% in 2015.

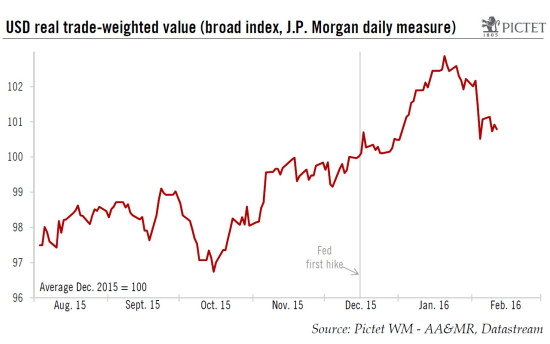

Turning to overall economic growth, recent developments are without doubt quite concerning. Equities have fallen further, corporate credit spreads have risen further and concerns about world growth have intensified. It could damp business and consumer confidence and weigh on firms' spending and hiring plans. The turmoil on financial markets certainly represents a downside risk for the economy. However, in terms of global financial conditions, we believe what happens to the trade-weighted dollar is of more importance for the US growth outlook. And on that front, although the movements recorded in December and during most of January were quite concerning, the downward correction recorded since then is somewhat reassuring. Between 16 December (when the Fed hiked) and 20 January, the real trade-weighted dollar appreciated by around 2.8%. Since then, about three-quarters of that rise has disappeared (see chart below). Moreover, long-term Treasury yields and mortgage rates have fallen noticeably so far this year.

Therefore, and although the current situation appears quite challenging for forecasters, we do not want to overact following recent developments in the financial markets. Of course, downside risks have clearly increased recently and if stock market indices continue to fall heavily and a full blown worldwide financial crisis develops, the US economy will not be immune. However, this is still not our main scenario. We believe a serious downturn in the US economy remains unlikely for this year and we continue to expect US growth to remain relatively healthy. Our forecasts that GDP growth will reach 2.0% q-o-q annualised in Q1 and 2.0% on average in 2016 remain unchanged.

Yellen acknowledged the downward risks

Important this week was also Fed Chair Janet Yellen’s semi-annual testimony to Congress. In short, she did not really send any new signals. Her comments were pretty close to January’s FOMC statement and to what W. Dudley said last week. Of course, unsurprisingly, Chair Yellen acknowledged that “financial conditions in the United States have recently become less supportive of growth, with declines in broad measures of equity prices, higher borrowing rates for riskier borrowers, and a further appreciation of the dollar”. She added that “these developments, if they prove persistent, could weigh on the outlook for economic activity and the labor market, although declines in longer-term interest rates and oil prices provide some offset”. However, all this did not sound particularly dovish given the circumstances. And although she talked about downside risks to economic growth (“Foreign economic developments, in particular, pose risks to US economic growth”), this was followed by a sentence on upside risks: “Of course, economic growth could also exceed our projections for a number of reasons, including the possibility that low oil prices will boost US economic growth more than we expect”.

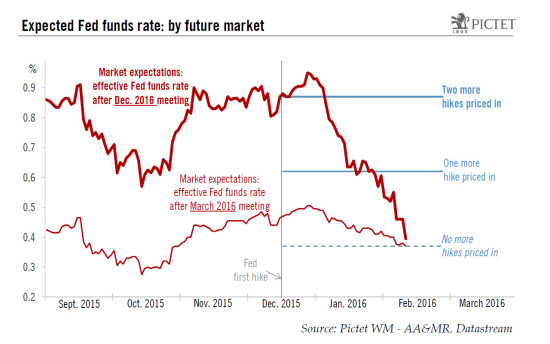

Regarding future rate hikes, without much surprise either, Ms Yellen did not rule out a hike in March. She just repeated the ‘mantras’ that “the FOMC anticipates that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate” and that ”monetary policy is by no means on a preset course”. On the potential use of negative rates, during the Q&A part of her testimony, Ms Yellen said that the option was open and being examined by the Fed but that it was too soon to drop the FOMC tightening bias.

In any event, a hike in March appears very unlikely in our view, and in the view of the markets. Actually, according to future markets, the probability that a hike occurs before the year is out is now around zero (see chart above). And we have to go as far as June 2018 to find a contract that implies that a hike is fully priced in.

We are less pessimistic than that. Following recent developments, the probability that the FOMC will wait later than June before acting again has probably increased further, and we may have to adjust our forecasts sooner rather than later. However, for the time being, our scenario is still that the Fed will remain on hold in March, and then hike twice, once in June and once in December.