The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data today, and according to the report, price inflation during the month decelerated slightly, coming in at the lowest year-over-year increase in fifteen months. According to the BLS, Consumer Price Index (CPI) inflation rose 6.5 percent year over year during December, before seasonal adjustment. That’s the twenty-second month in a row of inflation above the Fed’s arbitrary 2-percent inflation target, and it’s fifteen months in a row of price inflation above 6.0 percent. Month-over-month inflation fell for the first time in five months, with the CPI falling 0.1 percent from November to December. December’s year-over-year growth rate is down from June’s high of 9.1 percent,

Topics:

Ryan McMaken considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

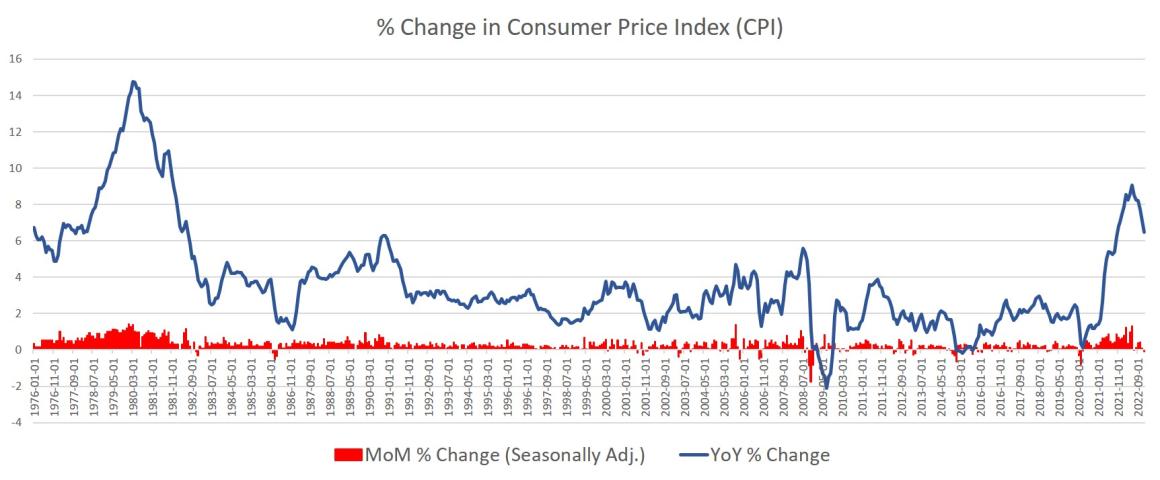

| The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data today, and according to the report, price inflation during the month decelerated slightly, coming in at the lowest year-over-year increase in fifteen months. According to the BLS, Consumer Price Index (CPI) inflation rose 6.5 percent year over year during December, before seasonal adjustment. That’s the twenty-second month in a row of inflation above the Fed’s arbitrary 2-percent inflation target, and it’s fifteen months in a row of price inflation above 6.0 percent.

Month-over-month inflation fell for the first time in five months, with the CPI falling 0.1 percent from November to December. December’s year-over-year growth rate is down from June’s high of 9.1 percent, which was the highest price inflation rate since 1981. But December’s growth rate still keeps price inflation above growth rates seen in any month during the 1990s, 2000s, or 2010s. December’s increase was the fourteenth-largest increase in forty years. |

|

| The ongoing price increases largely reflect price growth in food, energy, transportation, and shelter. Gasoline and used car prices, on the other hand, fell and mitigated the overall CPI increase. Nevertheless, the prices of essentials overall saw big increases in December over the previous year.

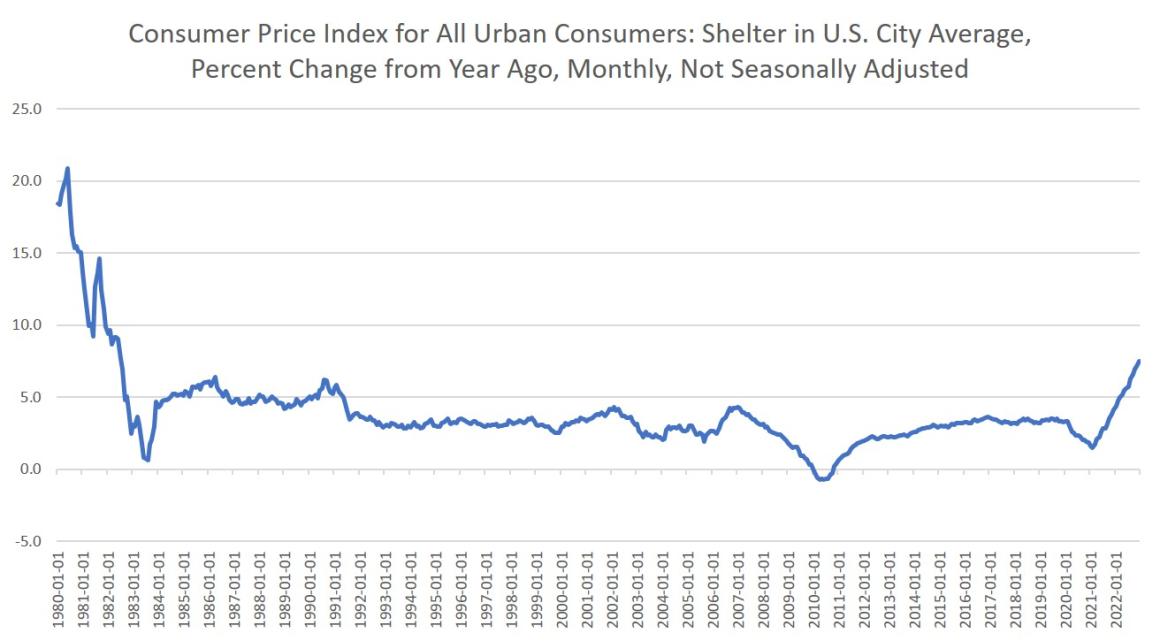

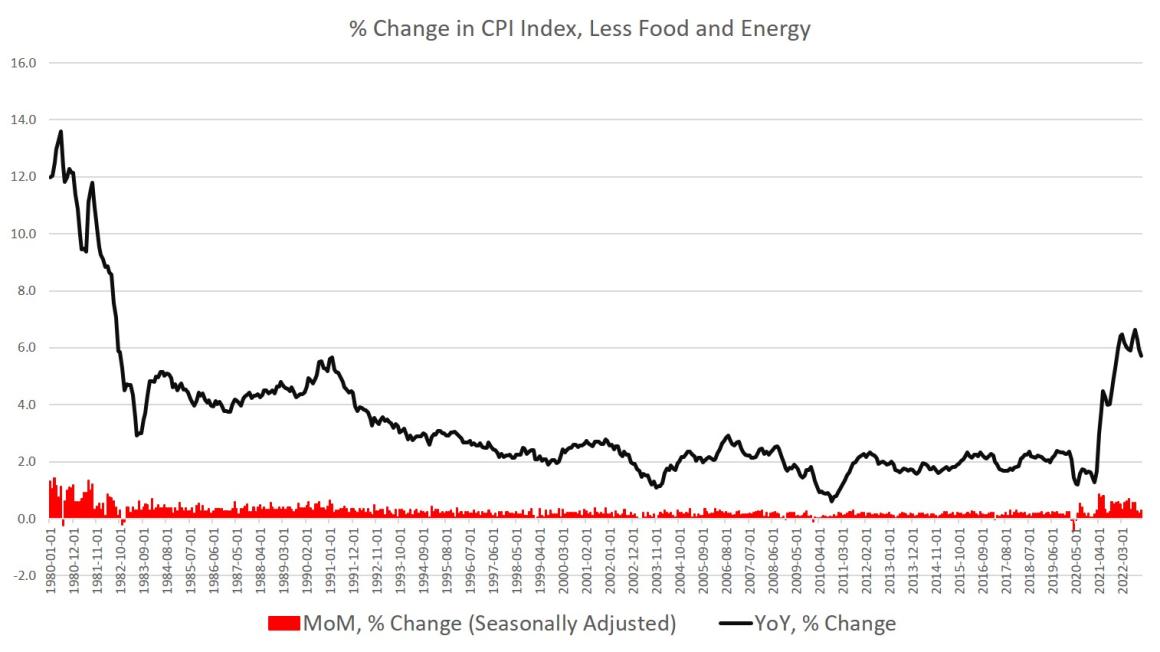

For example, “food at home”—i.e., grocery bills—was up 10.4 percent in December over the previous year. Energy services were up 15.6 percent. Shelter was up by 7.5 percent. As of December there is, as of yet, no sign of price growth in shelter slowing down. Last month, shelter prices increased by 7.1 percent, and YoY growth only continued into December having now reached the highest growth rate since July of 1982. Month-over-month growth in shelter costs also remains among the largest we’ve seen in 40 years. In the seasonally adjusted numbers, shelter prices rose 0.8 percent, the highest since June 1982: Meanwhile, so-called core inflation—CPI growth minus food and energy—has barely fallen from the forty-year high reached in September. In December, year-over-year growth in core inflation was 5.7 percent. That’s down slightly from November’s growth rate of 5.9 percent. September’s year-over-year increase of 6.7 percent was the largest recorded since August 1982. Month-over-month growth in this measure was positive from November to December as well, with prices minus food and energy growing 0.3 percent. Month-to-month growth has been positive in every month since May 2020. |

|

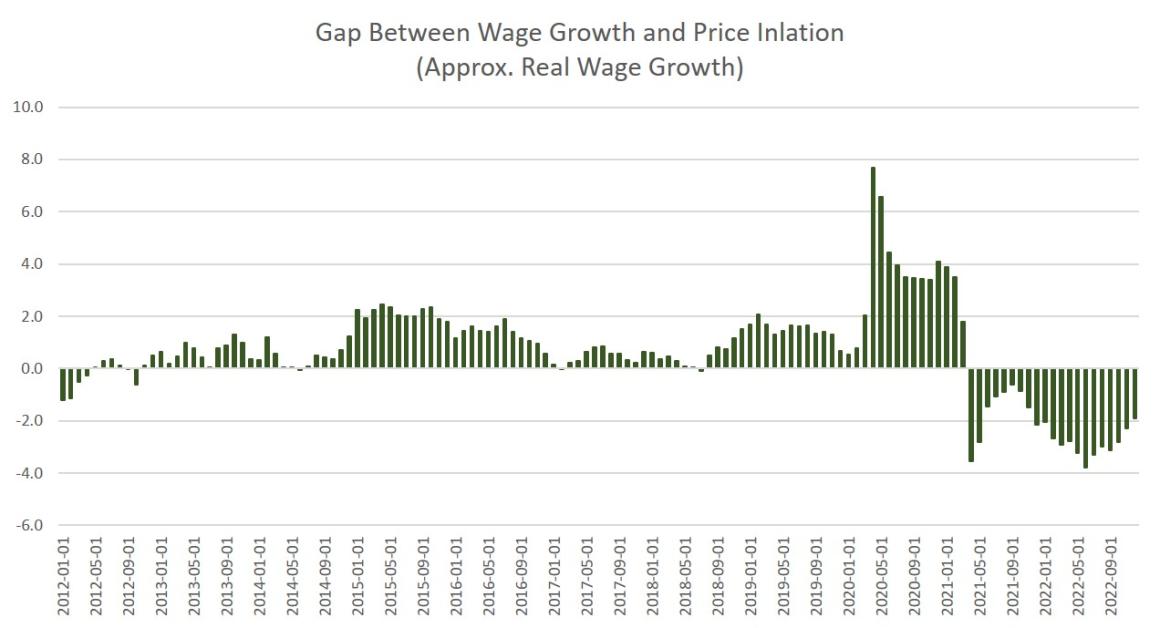

Meanwhile, December was yet another month of declining real wages, and was the twenty-first month in a row during which growth in average hourly earnings failed to keep up with CPI inflation. According to new employment data released last week by the BLS, hourly earnings had increased 4.6 percent in December year, over year, meaning wage growth fell behind inflation:

Celebrate a 6.5 Percent Inflation Rate?Many pundits and politicians were quick to claim the slowing CPI inflation numbers show that inflation is “falling.” The Biden Administration, for example, repeatedly uses variations on the words “fall” or “falling” to describe price inflation. Of course, this is only true if one ignores the year-over-year change, and certainly ignores the larger trend in which the CPI is up 15 percent since December of 2019. For those whose wages have increased by 15 percent over the past three years, they may be keeping up (barely) with rising prices. But as for people on fixed incomes? Forget about it. Moreover, ordinary people trying to build up savings are taking a financial beating. Since December 2019, the Dow Jones has gone up 14 percent. Savvy traders are perhaps managing to almost keep up with price inflation. But more mundane investments are very much in the hole, and savings in savings accounts is rapidly losing value. Savers are earning 4 percent on some of the best high-yield accounts, but regular savings accounts are still paying under 1 percent. With price inflation at 6.5 percent, savers are simply losing money. Moreover, retirement accounts and other investments that are heavily invested in Treasurys are losing money. The ten-year bond is at a measly 3.4 percent. For most of 2022—when CPI inflation was coming in from 7 to 9 percent—the ten-year bond was often below 3 percent. In other words, savings and investment funds held by regular people—people who can’t afford the risky process of “chasing yield”—are shrinking. |

|

Will the Fed Pivot to Lowering Interest Rates Again?Nonetheless, some corners of Wall Street are optimistic that even a minor slowing inflation is a very good sign. This isn’t because Wall Street is especially opposed to price inflation, but because Wall Street interprets slowing inflation as a sign the Federal Reserve will soon force down interest rates again if inflation is seen as ebbing. Wall Street has become so addicted to easy money from the Fed now that nearly all economic news is interpreted through the lens of “what will the Fed do next?” (There’s very little actual capitalism going on among the financial classes in America in 2022.) The slowing in CPI inflation, of course, has been partly due to the fact the Federal Reserve has eased up on quantitative easing and other efforts to force down interest rates. That means less new money entering the economy, but both Wall Street and Washington hate that. Yet, price inflation is bad enough that the Fed worries it could get out of hand, which would lead to political instability. So, even with today’s numbers showing a slight slowing in price inflation, many investors remained unconvinced the Fed is about to turn back to an easy-money regime. After all, as we note above, food, shelter, and energy, are all still rising at brisk rates. Biden was quick to focus on gasoline in his public remarks, but the fact that gasoline has fallen to the non-bargain price of around $3.30 a gallon is hardly a reason to declare inflation pain dead or dying. |

What really remains to be seen is how fast the Fed will cave to pressure from the Washington to push interest rates back down so as to keep payments on the national debt manageable. It easy to see why the Federal government needs a return to a low-interest regime. In the third quarter, the Federal government’s current expenditures for interest payments rose by 13.6 percent, year over year, which was the largest since 1960. If that continues, the need to pay interest will force Congress to cut back spending on popular programs like Medicare. Thus, current growth in interest payments—fueled by higher interest rates—is a political problem. After all, Congress and the White House have no plans to scale back deficit spending, and they need government debt at low interest rates to keep the gravy train going at full speed.

Tags: Featured,newsletter