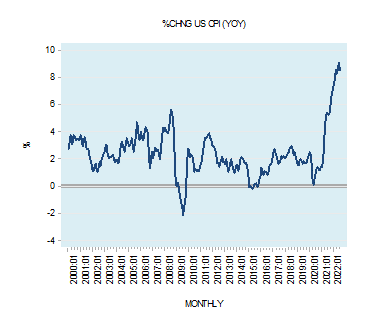

A decline in the yearly growth rate of the Consumer Price Index (CPI) to 8.5 percent in July from 9.1 percent in June has prompted many commentators to suggest that inflation has likely peaked. If this assessment is valid then it is held Fed policy makers are unlikely to push for an aggressive interest rate tightening in the months ahead. Before one decides to agree or disagree on the likely interest rate policy of the Fed there is the need to ascertain what do we mean by inflation. . The Essence of Inflation The subject matter of inflation is embezzlement. Historically, inflation has originated when a country’s ruler such as the king would force his citizens to give him all of their gold coins under the pretext that a new gold coin was going to replace the old

Topics:

Frank Shostak considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

| A decline in the yearly growth rate of the Consumer Price Index (CPI) to 8.5 percent in July from 9.1 percent in June has prompted many commentators to suggest that inflation has likely peaked. If this assessment is valid then it is held Fed policy makers are unlikely to push for an aggressive interest rate tightening in the months ahead. Before one decides to agree or disagree on the likely interest rate policy of the Fed there is the need to ascertain what do we mean by inflation. |

The Essence of Inflation

The subject matter of inflation is embezzlement. Historically, inflation has originated when a country’s ruler such as the king would force his citizens to give him all of their gold coins under the pretext that a new gold coin was going to replace the old one. In the process, the king would falsify the content of the gold coins by mixing it with some other metal and return diluted gold coins to the citizens (see Murray N. Rothbard’s explanation in What Has Government Done to Our Money?).

Because of the dilution of the gold coins, the ruler could now mint a greater amount of coins and pocket for his own use the extra coins minted. What was now passing as a pure gold coin was in fact a gold alloy coin.

The increase in the number of coins brought about by the debasement of gold coins causes inflation, as debasement caused the inflation of gold coins. As a result of inflation of coins, the ruler can engage in an exchange of nothing for something (he can engage in an act of diverting resources from citizens to himself).

Under the gold standard, the technique of abusing the medium of the exchange became much more advanced through the issuance of receipts unbacked by gold. Inflation, therefore, becomes an increase in receipts that are not backed by gold.

The holder of an unbacked receipt could now engage in an exchange of nothing for something. This produced a situation where the issuers of the unbacked paper receipts could now divert goods and services to themselves without contributing to the production of those goods and services.

In the modern world, money proper is no longer gold but rather coins and notes in circulation—i.e., cash—hence, inflation is an increase in cash.

According to Ludwig von Mises:

To avoid being blamed for the nefarious consequences of inflation, the government and its henchmen resort to a semantic trick. They try to change the meaning of the terms. They call “inflation” the inevitable consequence of inflation, namely, the rise in prices. They are anxious to relegate into oblivion the fact that this rise is produced by an increase in the amount of money and money substitutes. They never mention this increase. They put the responsibility for the rising cost of living on business.

Ayn Rand writes:

“Inflation” is defined in the dictionary as “undue expansion or increase of the currency of a country, esp. by the issuing of paper money not redeemable in specie.”

Rand continues:

Inflation is not caused by the actions of private citizens, but by the government: by an artificial expansion of the money supply required to support deficit spending. No private embezzlers or bank robbers in history have ever plundered people’s savings on a scale comparable to the plunder perpetrated by the fiscal policies of statist government.

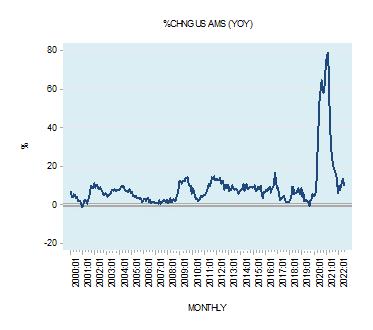

| Observe that inflation is not a general increase in prices. What we are saying that inflation is increases in the money supply. Following this, we can suggest that after climbing to 79 percent by February last year the yearly growth of our monetary measure AMS fell to 10.5 percent by June this year. This means that inflation has peaked in February last year.

When money is expanded—i.e., generated out of “thin air”—the holders of the newly generated money can divert to themselves goods without contributing to the production of goods. As a result, wealth generators who have contributed to the production of goods discover that the purchasing power of their money has fallen since there are now less goods left in the pool. Once wealth generators have less goods at their disposal obviously this is going to hurt the formation of wealth. As a result, economic growth is going to come under pressure. General increases in prices, which follow increases in the money supply, only point to an erosion of wealth. Price increases however did not cause this erosion. Likewise, it is increases in money supply and not increases in prices that erodes the real incomes of pensioners and low-income earners. As a rule, they are the last receivers of the newly pumped money often called the “fixed-income groups.” |

An Increase in Goods Supply Cannot Undo Inflation

For most economists, if an increase in the money supply is matched by the increase in the production of goods, then there is no increase in general prices (as measured by price indices) and no inflation emerges. This is an error, since inflation has very much taken place—i.e., the money supply has increased—and this increase cannot be undone by a corresponding increase in the production of goods and services.

To continue the king example, once a king has created more gold alloy coins that masquerade as pure gold coins, he can exchange nothing for something irrespective of the growth rate of the production of goods. Regardless of what the production of goods is doing, the king is now engaging in an exchange of nothing for something—i.e., diverting resources to himself by paying nothing in return.

Can Inflation Emerge While Prices Stay Unchanged?

If an increase in the money supply occurs for a given stock of goods, this means that more money is going to be exchanged for a given stock of goods, all other things being equal. Obviously, the purchasing power of money is going to fall, as prices of goods increase (more money per unit of a good). In this case, general increase in prices is going to be associated with inflation.

But now consider the following case: the growth rate in money is in line with the growth rate in goods supply. Consequently, the prices of goods on average do not change. Do we have inflation here or don’t we? For most commentators, if an increase in the money supply is exactly matched by the increase in the supply of goods no increase in general prices is going to take place and therefore no inflation emerges. This way of thinking is erroneous since inflation has taken place—i.e., the money supply has increased. The increase in money supply—i.e., the increase in inflation—sets in motion all the negative side effects that money printing does, including the menace of the boom-bust cycle, regardless of the increase in the supply of goods.

According to Rothbard:

The fact that general prices were more or less stable during the 1920s told most economists that there was no inflationary threat, and therefore the events of the great depression caught them completely unaware.

Conclusion

Contrary to the popular definition, inflation is not about general rises in prices but about increases in the money supply. General increase in prices as a rule develops because of the increase in money supply. The harm that most people attribute to rises in prices is in fact due to increases in money supply. Hence, policies that are aimed at countering inflation without identifying what is it all about only make things much worse.

If inflation has peaked in February last year, then the Fed’s tight interest rate stance is going to exacerbate the downward pressure on the momentum of money supply. This will burst various bubble activities that emerged on the back of the expanding momentum of money supply. A tighter interest rate stance is also will inflict damage on the wealth generating process. Given that the pool of wealth is likely to be under severe pressure because of the ever-expanding government and the Fed’s tampering with markets this raises the likelihood of the economy plunging into a severe economic slump.

Tags: Featured,newsletter