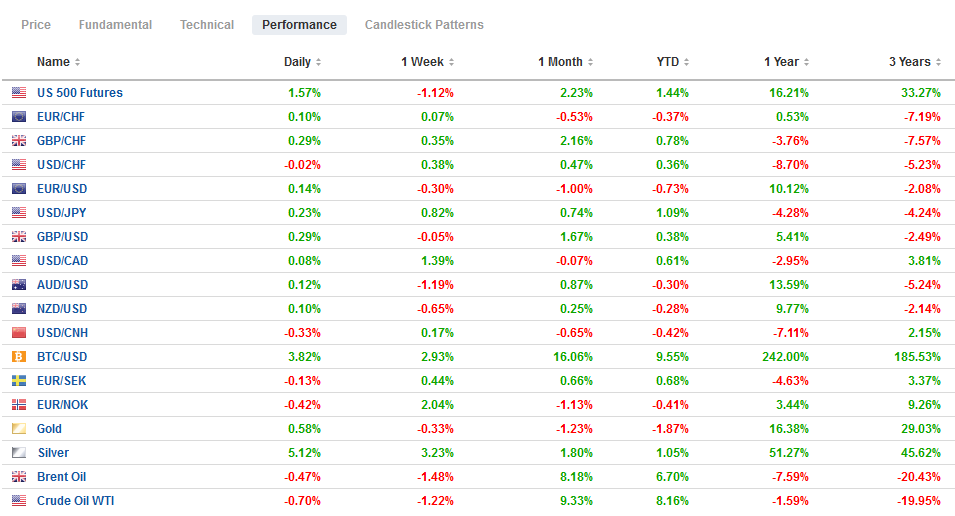

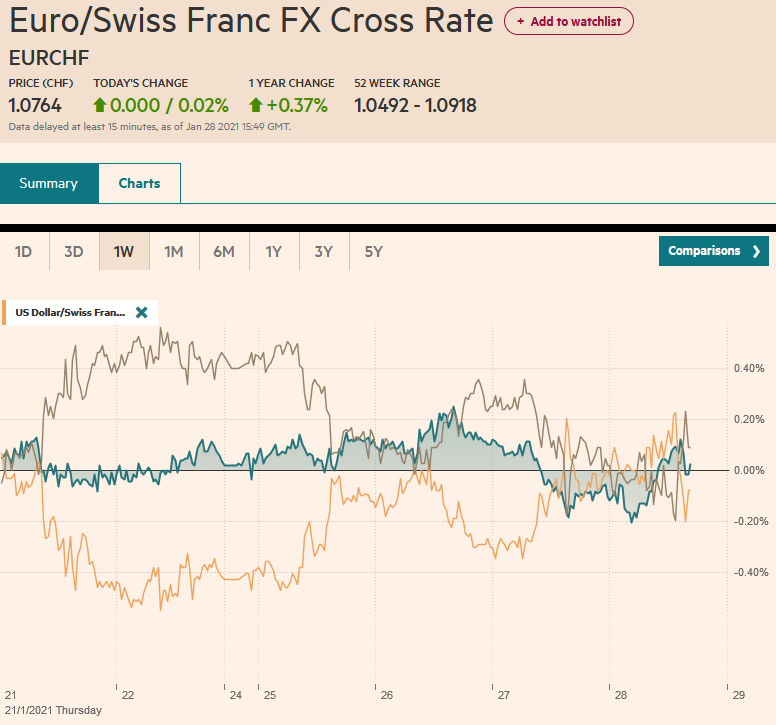

Swiss Franc The Euro has risen by 0.02% to 1.0764 EUR/CHF and USD/CHF, January 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The steepest loss in US equities since last October is rippling through the capital markets in the form of de-risking. The rout is not over, and the S&P 500 is poised to gap lower. Many of the largest markets in the Asia Pacific region were off around 2%. The nearly 1% loss in Europe’s Dow Jones Stoxx 600 leaves the benchmark virtually flat for the year. Even companies that beat earnings expectations, like Apple, have found little succor from investors looking for an exit. Bond markets appear to be drawing some support, but benchmark yields are only slightly lower, and the US

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Currrency Movement, EUR/CHF, Featured, FOMC, Germany, newsletter, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.02% to 1.0764 |

EUR/CHF and USD/CHF, January 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The steepest loss in US equities since last October is rippling through the capital markets in the form of de-risking. The rout is not over, and the S&P 500 is poised to gap lower. Many of the largest markets in the Asia Pacific region were off around 2%. The nearly 1% loss in Europe’s Dow Jones Stoxx 600 leaves the benchmark virtually flat for the year. Even companies that beat earnings expectations, like Apple, have found little succor from investors looking for an exit. Bond markets appear to be drawing some support, but benchmark yields are only slightly lower, and the US 10-year is straddling the 1%-level. The dollar is higher. The gains are most pronounced against the dollar bloc. The yen, often supported by dramatic risk-off moves, is under pressure as it flirts with the low set earlier this month (~JPY104.40). It is the euro that is holding up best and is little changed through the European morning. Emerging market currencies are mostly a sea of red, though the Turkish lira and Chinese yuan are notable exceptions and posting minor gains. The JP Morgan Emerging Market Currency Index is trading lower for the fifth session of the past six. Money fleeing other markets does not appear to be drawn to gold, which is holding below its 200-day moving average (~$1850). It also is off for the fifth session in the past six. Even the largest drawdown of US crude oil inventories (9.9 mln barrels) has not deterred the selling. A recovering late in the European morning has seen March WTI recover to nearly flat on the day after dropping around 1% in earlier turnover. |

FX Performance, January 28 |

Asia Pacific

The focus has been on the dramatic decline in equities, and macroeconomic news has been light. The main economic data report was Japanese December retail sales. The 0.8% decline was a touch more than expected, and it followed a 2.1% decline in November. However, the 0.3% year-over-year decline was a little better than expected. Tomorrow, Japan reports December employment and industrial output figures. Industrial production is expected to have contracted by around 1.5% after a 0.5% decline in November. The labor market has deteriorated under the pandemic and formal state of emergency. The unemployment rate may have ticked up to 3%, and the jobs-to-applicant may have deteriorated.

The dollar is firm against the yen and knocking on the year’s high near JPY104.40. A move above JPY104.50, which the (61.8%) retracement of the decline since the November high just shy of JPY105.70. Initial support is seen by JPY104.20, yesterday’s high. The Australian dollar’s bullish outside up day on Tuesday was followed by a bearish outside down day yesterday. Follow-through selling today pushed the Aussie a little below $0.7600, to a new low for the month/year. A break of $0.7590 could signal a test on $0.7500, which is the (38.2%) retracement of the rally that began in early November. Resistance is now seen around $0.7660. The PBOC set the dollar’s reference rate at CNY6.4845, which was a little stronger than the banks Bloomberg surveyed expected. The dollar rose to almost a two-week high around CNY6.4950 before easing back toward CNY6.47. The PBOC continued its draining campaign, and overnight repo has increased to 3.05%, the highest in nearly six years. The Lunar New Year celebration begins on February 11, and the financial system will need liquidity injections around it, but funding costs may remain elevated. The rising repo rate deters the funding of bond purchases, and China’s 10-year yield is near 3.20%, its highest in a month.

Europe

German states are reporting the January CPI figures, and the sharp jump that was expected is, in fact, being delivered. Germany, it will be recalled, temporarily cut its VAT in H2 20. The tax holiday ended, and this, and rising energy, is the driving force. The EU harmonized figures will be released later today and are expected to have posted around a 0.3% gain on the month, and the year-over-year rate is seen near 0.5%, up from -0.7% in December and first reading above zero since last June. It will likely feed into an uptick in the aggregate eurozone figures due next week.

After announcing it would look into the euro’s reaction to the pandemic policy response on Tuesday, ECB officials were trying to play up the chances of a rate cut on Wednesday. Some officials claimed the market is under-estimating the risks of a rate cut. The deposit rate is at minus 50 bp. A few basis points seem to be discounted by the OIS strip. In this context, it is important to note that officials think the reversal rate, that rate at which the negative rate is counterproductive, is a little lower than minus 50. A five or ten basis point cut into deeper negative territory, partly blunted by the “dual rate” regime, means it is not the floor for rates (TLTRO funds are offered at minus 100 bp if lending targets are met) is a policy option. However, the impact on the economy, inflation expectations, or the euro seem minimal at best. In this context, we note that the dollar’s gains since earlier this month have taken place as the US 10-year premium has narrowed over German bunds.

The euro held a few hundredths of a cent above the month’s low set on January 18 (~$1.2055) yesterday and is straddling unchanged levels late in the European morning. Immediate resistance is seen in the $1.2125 area. The 20-day moving average (~$1.2175) has capped upticks since around January 11. On the downside, a break of the $1.2050 area could be significant from a technical perspective, and maybe the neckline of a head and shoulders pattern that could project toward $1.18. Sterling made a new marginal high yesterday, near $1.3760 but could not sustain the upward momentum and retreated by a cent in the North American session. It slipped to $1.3630 today. It remains within the week and a half broad sideways action. A break of $1.36 or a close below $1.3635 would weaken the technical tone.

America

The Federal Reserve did not break new ground yesterday. Its decision to stop offering scheduled term repo operations is a technical adjustment as need (and demand) has dried up. The FOMC statement recognized that the pace of the economy and employment has slowed. It noted that lower oil prices and weaker demand were holding down inflation. Powell reiterated that with more than 10 mln people unemployed and with the economy a long way from a full recovery, it is premature to talk about tapering and exit. It was only in December that the forward guidance that the long-term assets would be bought at least at the current pace until “substantial progress” is made toward the Fed’s objectives. Powell also explained that the Fed recognizes that prior to the pandemic, the US, Europe, Japan, and many other countries struggled to reach the inflation targets. While acknowledging inflation dynamics do change, Powell argued, it is a gradual process.

The US economic calendar is packed today. The highlight is the first look at Q4 GDP. A Reuters survey found a median forecast for 4% growth at an annualized pace. As Powell drew attention to, manufacturing and housing have been robust, while many services have been depressed. If the median is right, it will leave the US economy about 2.3% smaller than it was at the end of 2019. Activity in the first part of the New Year may have slowed further, but assuming that the virus is brought under control, a robust second half is expected.

Other data points today include weekly jobless claims, where a small decline from 900k is expected. Next week the US non-farm payroll report is out, and the early call is for around a 100k increase after a 140k fall in December. The December goods trade balance is also reported today. The average shortfall through November was $74.06 bln, up from $71.4 bln in the first 11 months of 2019 and $72.6 bln for the same period in 2018. New home sales are expected to recover after falling 11% in November. The KC Fed’s manufacturing survey and December inventory data will likely be lost in the shuffle, overshadowed by the other data.

Canada reports building permits, which typically is not a market-moving report even if US GDP was not being reported at the same time. The market may not react much either to Mexico’s December trade figures today. However, it has seen remarkable improvement in 2020 as domestic demand was stifled. Consider that Mexico reported an average trade surplus of $2.56 bln a month in the January-November period. In the same 2019 period, the trade surplus averaged $206 mln, and in the 2018 period, it recorded an average monthly deficit of $1.4 bln. The trade surplus, strong worker remittances, and portfolio inflows (drawn to its relatively high rates) help explain the peso’s recovery from the steep sell-off last spring.

A week ago, the US dollar fell to its lowest level against the Canadian dollar (~CAD1.2590) since April 2018. It posted an outside up day against yesterday, and follow-through buying today has lifted the greenback to CAD1.2880, the highest level in a month. This area corresponds to a (38.2%) retracement objective of the US dollar’s slide since early November. The next retracement objective (50%) is closer to CAD1.2980. Initial support may be seen near CAD1.2820. In a like fashion, the greenback has been bid to its highest level against the Mexican peso (~MXN20.42) since the spike o December 21 to around MXN20.6650. Ahead of it, resistance may be encountered in the MXN20.47-MXN20.50 area.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Currrency Movement,EUR/CHF,Featured,FOMC,Germany,newsletter,USD/CHF