Global confirmed coronavirus cases surpassed 100 million this week. There is no denying that the coronavirus pandemic has caused tremendous hardship and loss. To mitigate new cases climbing further, stricter lockdown and travel restrictions are being announced and implemented, with the curfew in the Netherlands as an example. Lock-down fatigue, as evidenced by the riots against this implemented curfew, is growing. Through it all, hope is on the horizon as vaccine roll-out plans are being implemented. Many governments continue to aim for herd immunity by autumn of this year. . Massive fiscal and monetary stimulus has been pumped into economies around the world to help ease the economic devastation for both individuals and businesses. Building on hope for herd

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Bitcoin, Commentary, Commodity inflation, Daily Market Update, Featured, gold as an inflation hedge, Inflation and gold, money printing, Money Supply, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Global confirmed coronavirus cases surpassed 100 million this week. There is no denying that the coronavirus pandemic has caused tremendous hardship and loss. To mitigate new cases climbing further, stricter lockdown and travel restrictions are being announced and implemented, with the curfew in the Netherlands as an example. Lock-down fatigue, as evidenced by the riots against this implemented curfew, is growing. Through it all, hope is on the horizon as vaccine roll-out plans are being implemented. Many governments continue to aim for herd immunity by autumn of this year. |

. |

|

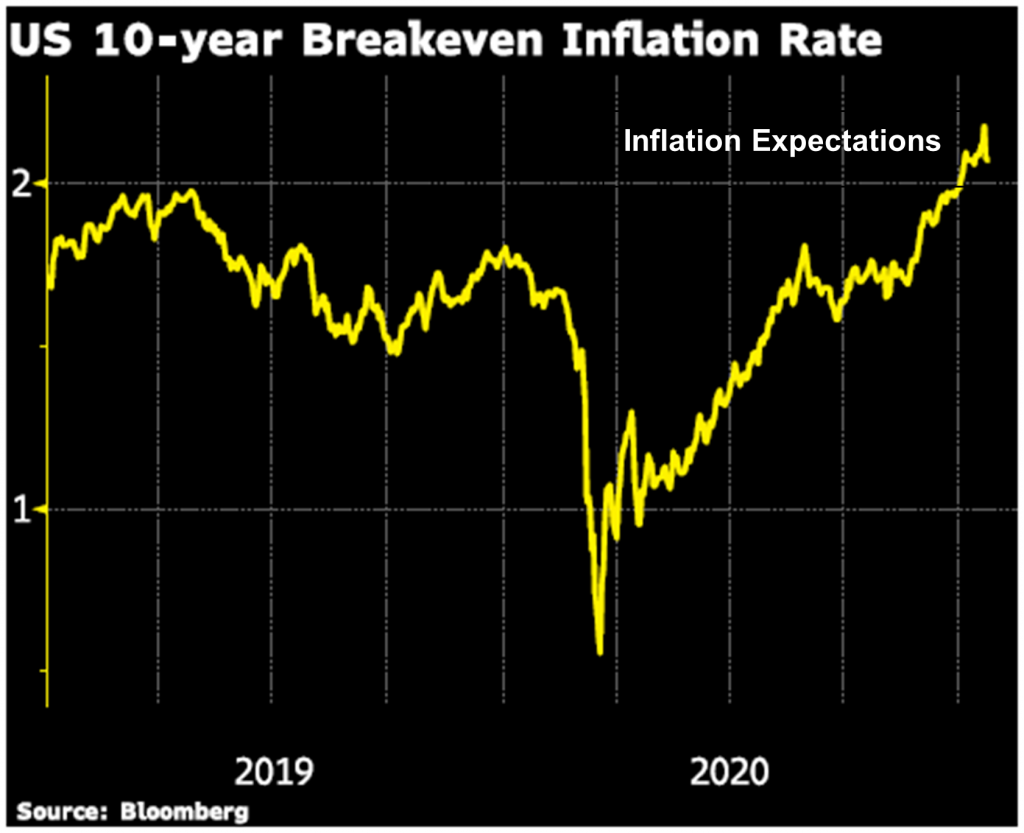

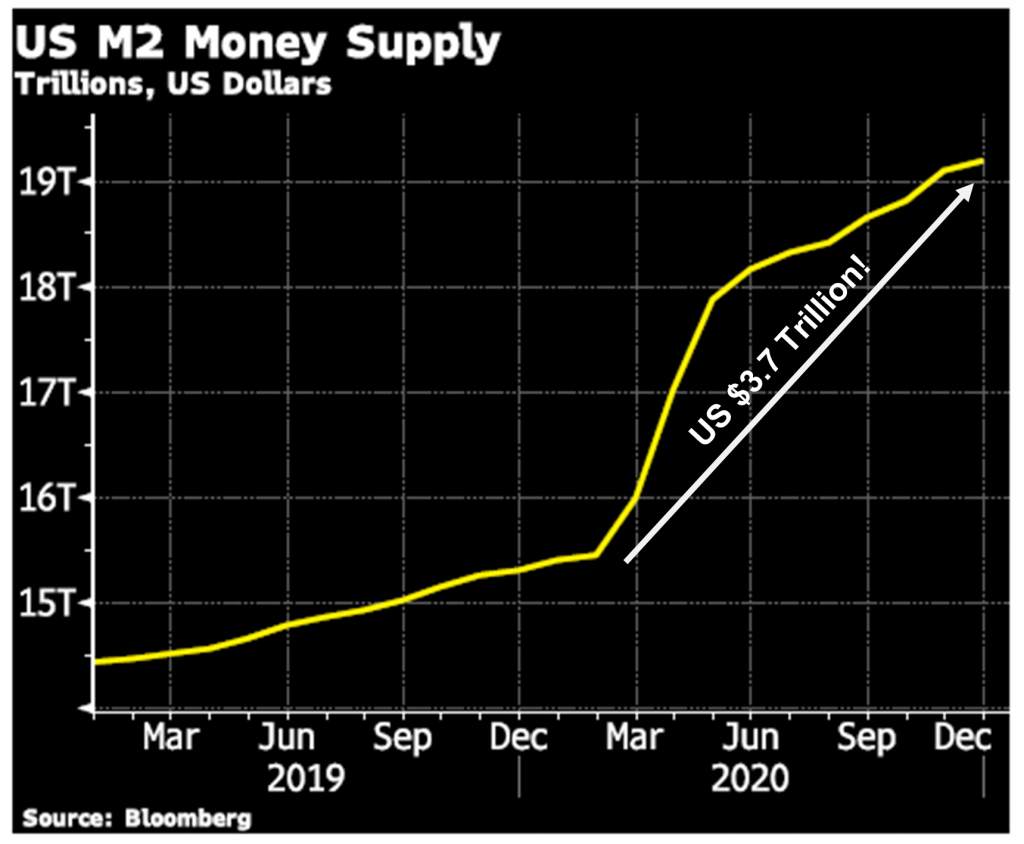

Massive fiscal and monetary stimulus has been pumped into economies around the world to help ease the economic devastation for both individuals and businesses. Building on hope for herd immunity being reached and restrictions being lifted towards yearend, the question arises: Is CPI inflation on the horizon? Central banks are generally forecasting inflation to be in the range of their 2% targets for the next several years, and although, inflation expectations have risen sharply since the March 2020 low, they are still not out of line to pre-coronavirus levels. |

US 10-year Breakeven Inflation Rate, 2019-2020 |

Below are four reasons that we expect higher inflation over the next several years.

|

US M2 Money Supply, 2019-2020 |

|

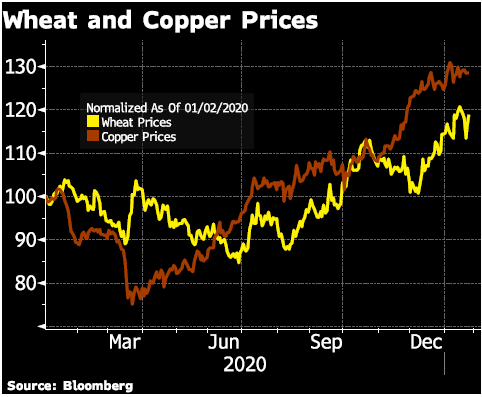

Wheat and Copper Prices, 2020 |

Some have compared the re-opening of the economy to the roaring 1920s – the new age of economic prosperity and spending. Three things are needed for consumer price inflation to take hold: too much money, chasing, to few goods. Currently, the only piece missing is the chasing – and once the vaccine reaches a significant majority of the population chasing of goods and services is likely to gain momentum – and demand will outstrip supply in key sectors of the economy. Part of it, will of course be temporary, but part of it is growth of a new economy with reduced global trade and increase emphasis on made at home products. In the coming new age of spending and inflation – gold is a tried-and-true inflation hedge! |

|

Tags: Commentary,Commodity inflation,Daily Market Update,Featured,gold as an inflation hedge,Inflation and gold,money printing,Money Supply,newsletter