Summary:

The foreign exchange market sees an average daily turnover of something on the magnitude of .6 trillion a day. In a week, the turnover is sufficient to more than cover world trade for a year. It is the largest of the capital markets. Trends in the currency market can last for years.

A little more than a year ago, we concluded that the dollar’s third significant rally since the end of Bretton Woods was over and that a cyclical dollar decline was at hand. Yet the dollar’s price is only known relative to another currency, and there are more than 100, or a basket of currencies. What exactly does it mean that the dollar’s “third significant rally” was over?

Here is a chart of the dollar that is the best measure of its economic impact. It a broad trade-weighted

Topics:

Marc Chandler considers the following as important:

4.) Marc to Market,

4) FX Trends,

China,

Currency Wars,

Featured,

newsletter,

policy mix,

twin deficits,

USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The foreign exchange market sees an average daily turnover of something on the magnitude of $6.6 trillion a day. In a week, the turnover is sufficient to more than cover world trade for a year. It is the largest of the capital markets. Trends in the currency market can last for years.

A little more than a year ago, we concluded that the dollar’s third significant rally since the end of Bretton Woods was over and that a cyclical dollar decline was at hand. Yet the dollar’s price is only known relative to another currency, and there are more than 100, or a basket of currencies. What exactly does it mean that the dollar’s “third significant rally” was over? |

|

|

Here is a chart of the dollar that is the best measure of its economic impact. It a broad trade-weighted measure the is adjusted for inflation. The real broad trade-weighted dollar index is the way the Federal Reserve thinks about the dollar as well. The chart here from Bloomberg goes back to the 1970s. Nixon broke the last link between gold and the dollar on August 15, 1971. There is an attempt to put Bretton Woods back together, but it fails. The first big dollar rally we associate with Reagan, though in fairness, it began before he took office. Nevertheless, the Reagan dollar rally was a function of the policy mix. There was a tight monetary policy from the Volcker Fed as double-digit inflation is squashed with punishing interest rates despite high unemployment. Meanwhile, Reagan pushed on the fiscal accelerator. Taxes were cut, and defense and social spending increased. Such a policy mix, loose fiscal and tight monetary policy, appears to be the most favorable for a currency.

The dollar enjoyed its first post-Bretton Woods rally, but it proved too much. The marked appreciation of the greenback led to a widening trade deficit and protectionism at home. The strength of the dollar was kindling inflation pressures in Europe and Japan. Officials from the G5 met at the Plaza Hotel in New York and agreed to drive the dollar lower through joint intervention. The dollar went through about a ten-year bear market.

Starting in the spring of 1995, the dollar’s second significant dollar rally began. The Clinton dollar rally was a function of the new technology rally, the age of the PC. Americans kept their savings at home, and foreign investors could not get enough of the new economy stocks. Another change took place, which was also important. Robert Rubin replaced Lloyd Bentsen at the head of the Treasury Department. He needed to distinguish himself from his predecessor and announced a “strong dollar policy.” This shift was important even though it was disputed nearly from the start, and the policy lasted for nearly two decades through Democratic and Republican administrations.

The “strong dollar policy” was never about the exchange rate per se. It was a pledge to investors and creditors that the US would not seek a weaker dollar to secure trade advantage or reduce its debt burden. Until then, the US had used the dollar’s exchange rate as a weapon to win concessions from Europe and/or Japan. Rubin broke from that tradition. It took several years, but the G7 and then the G20 embraced Rubin’s innovation. It was similar to an arms control agreement. We could pursue beggar-thy-neighbor competitive devaluations, but let’s agree to refrain. Let the exchange rate be determined by market forces while avoiding excessive volatility.

|

. |

|

Meanwhile, the euro was launched on January 1, 1999, and proceeded to slump. It was launched near $1.1760 and proceeded to rally the following day to around $1.19, but that was it. It would not see that level again until the middle of 2003. The euro proceeded to fall through $0.8500. Two developments took place that served to cap the dollar. The tech bubble popped, and the Europeans organized coordinated intervention to stop the euro from falling in October 2000, which entailed selling dollars.

The euro bottomed in October 2000, while the real broad trade-weighted dollar index rose for a bit longer before turning down and entering another roughly ten-year bear market. Recall in late 2007 and 2008, as the Great Financial Crisis was already unfolding, the euro reached $1.60, sterling poked above $2.10, and both the Australian and Canadian dollars were worth more than $1. My first book, Making Sense of the Dollar (Bloomberg 2009), was published. It was a self-conscious pushback against the day’s declinists that argued the dollar’s primary role in the world economy was over. It anticipated a new large cyclical dollar rally.

Many of the dollar’s bilateral nominal exchange rates had peaked, the real broad trade-weighted measure did not turn up until H2 2011. The recovery seemed to be fueled by the divergence of the policy response to the Great Financial Crisis and Europe’s secondary sovereign crisis. The US had taken early and aggressive action and was able to begin normalizing policy before most others. This resulted in widening interest rate differentials, for example. With Trump’s election in 2016, the US policy mix added fuel to the dollar’s cyclical advance. Fiscal policy became more expansionary, and the Fed’s monetary policy becomes less accommodative.

However, around the middle of 2019, we began warning that the third significant dollar rally since the end of Bretton Woods was coming to an end. Initially, our argument was three-fold. The policy mix was becoming less supportive. Interest rate differentials had peaked and began moving against the US, which, in the past, was the signal of the last phase of a dollar bull run, The dollar, as Trump and others pointed out, was overvalued against majors.

|

. |

Valuation is often elusive in the foreign exchange market. In their pure form, currencies do not have a yield stream that can be discounted. A basic approach, purchasing power parity, is predicated on the “law of one price,” which says that a basket of international goods should cost the same price when the currency conversion is made. To the extent there is a deviation, it shows a misalignment.

The OECD has a model of PPP. Here, the Bloomberg chart shows where the major currencies were relative to the OECD’s PPP at the end of August 2019. We noted that the dollar was not simply cheap in PPP terms but that the readings, especially for the euro and sterling, were extreme. The elastic that links price to value can stretch but rarely do the major currencies move more than 20%-25% beyond the OECD’s PPP measure. We concluded that the dollar was extremely stretched, especially against the euro and sterling and that it was losing its main supports (policy mix and rate differentials). Moreover, we understood asset managers to be overweight the dollar after its multiyear rally.

The pandemic outbreak generated some chaotic days in the markets, and even the US Treasury market was disrupted in ways that were not seen even during the Great Financial Crisis. The dollar was sought not only as a safe haven, but the unwinding of structured trades that used the dollar to fund the purchase of higher-yielding or more volatile assets (think emerging markets, for example) also lifted the dollar broadly. The Federal Reserve’s swap lines with other central banks were expanded, which helped stabilize the foreign exchange market. The emergency demand for dollars subsided, the use of the swap lines diminished, and the greenback’s underlying downtrend resumed.

While we may have been early on the dollar bear call, it has become the consensus view. When we listen to clients, participate in panel discussions, and read others’ arguments, it seems the bearish outlook can be framed as a return of the twin-deficits. A large current account and budget deficit do not always translate into a depreciating dollar, but this time it likely will. The US is not expected to offer the interest rate or growth differentials that attract the world’s savings at current prices.

That said, the new US stimulus pushes out the pending fiscal cliff and gives the world’s largest economy a proverbial shot in the arm. It may lift the dollar in the first part of the New Year after experiencing a sharp sell-off in recent months. Momentum, market positioning, and the skew in the options market all warn of the risk of an upside correction in the dollar, even if the precise timing is difficult to predict. At the same time, the pandemic in Europe, lockdowns, and a seemingly less aggressive approach to the vaccine (including orders), suggesting a bleak Q1 21.

However, the euro pullback is likely to provide an opportunity for nimble businesses and asset managers to align with the underlying trend. The euro is still cheap relative to the OECD’s PPP (not the first or last word, but a useful historic metric). The twin-deficit problem will likely be aggravated by the growth differentials and additional stimulus that the Biden administration will likely seek and a Federal Reserve committed to relating the economy and not tightening as early in the labor market cycle as it has in the past. We think the euro can rise toward $1.30 in 2021 and look for sterling to appreciate toward$1.40. That dollar weakness may put it a little below JPY100. The Australian dollar can see $0.8000, while the greenback falls toward CAD1.22.

Working with Bloomberg, we launched a new currency index to monitor the dollar this year. It is a GDP-weighted index (BWCI) of the top 12 economies, with the eurozone counting for one. Half are what are commonly called emerging markets, and half are high-income countries. The nominal GDP estimates by the World Bank are used, and when the adjustment is made in 2021, it is likely that the Chinese yuan moves into second place behind the dollar and ahead of the eurozone. India will either move into fifth place ahead of the UK in the 2021 setting or 2022.

|

. |

This BWCI monthly chart goes back to 2005. After peaking in 2011, it moves lower with the Obama/Trump dollar rally. After hitting a low in 2016, the BWCI bounces as the dollar is set back, but the rally resumed. When we began talking about the end of the third rally since the end of Bretton Woods, it looked as if the BWCI was going to hold above the 2016 low, but alas, it made a new low in March. Since that low, the Bannockburn World Currency Index has appreciated by nearly 8.5%. Another 3% appreciation will test the 2018 high, but there may be potential to around 107 on the index, which is almost 5.5% higher than prevailing levels.

Janet Yellen will succeed Steven Mnuchin at the head of the US Treasury Department. The Treasury and the Federal Reserve appeared to work together well when the pandemic first broke. The central bank was given emergency authority, backed by funds from Congress. However, after the election results were clear, a gap between the two opened as Treasury Secretary Mnuchin opted not to extend the emergency facilities while the Fed argued that even though they were lightly used, they still provided a backstop and signaling value. Investors saw, for example, that the mere authority to buy so-called fallen angel bonds (those that lost their investment-grade rating due to the pandemic) had salutary effects before a red cent was spent. The combination of Yellen’s experience as Fed Chair and her pragmatism suggests scope for heightened cooperation between the central bank and Treasury Department while preserving the former’s independence. Biden will get a chance to put his mark on the Federal Reserve, via the power of appointment, in 2022.

Yellen inherits a dollar policy that is in disrepair. Trump repeatedly tried talking the dollar lower. That the impact was minimal is beside the point. If the Biden administration wants to demonstrate that the defection from the international order that the US was instrumental in building and extending was an anomaly, it cannot simply articulate a new dollar policy. It must embrace the G7 and G20 position that it previously insisted upon and re-commit to the arms control arrangement under which markets determine exchange rates. Recognizing that floating exchange rates often mean volatile exchange rates, excessive volatility needs to be avoided.

Citing China as a currency manipulator in 2019 for the first time since 1994 and then reversing itself when Beijing agreed to a trade deal (Phase 1, which the Trump administration says China is fulfilling but private estimates suggest otherwise. See here and here.) undermined the credibility of the report. In the waning days of 2020 and his tenure, Mnuchin cited Switzerland and Vietnam as currency manipulators and added Taiwan, India, and Thailand to its watch-list.

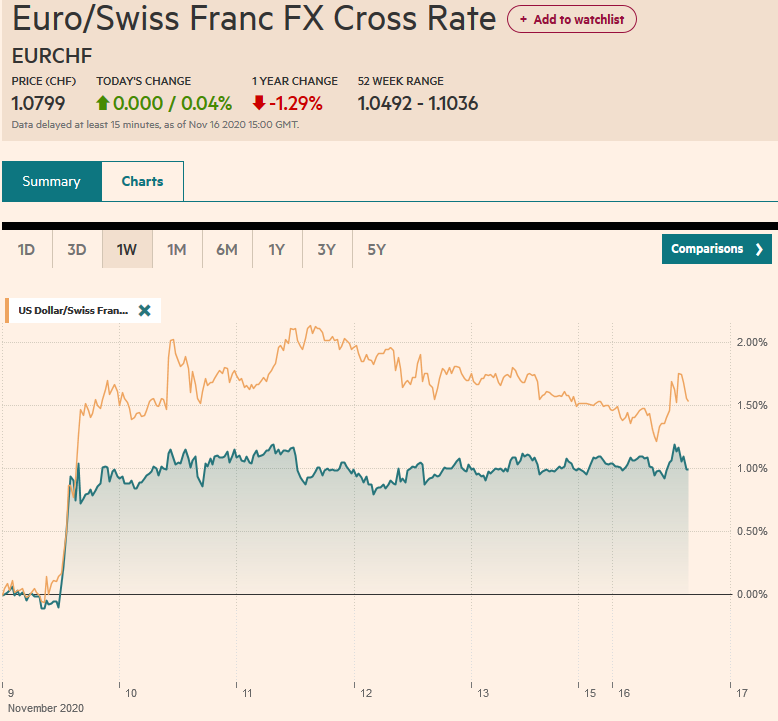

The policy has been neutered. Within minutes of the Treasury’s announcement, Switzerland denied it manipulated the franc for trade advantage and reaffirmed its commitment to intervene as necessary in the foreign exchange market, for example. Working with Congress, Yellen needs to recraft the US approach. The current account deficit remains wide, and the growing US watch-list (which ironically now includes two of the 19 countries that share the euro and ECB) illustrates the problem with mechanistically applying quantitative measures while ignoring the context and strategic interests. The focus on bilateral trade relations is also misguided.

Exchange rates are important. They can and have been weaponized. It contributes to the destabilizing global imbalance. Unilateral approaches are bound to fail. An enhanced role for the IMF in surveillance of direct and indirect activity in the foreign exchange market, increased transparency of exchange rate management, and offering a benchmark of valuation, would be helpful. It would strengthen the center and global governance. A stranger multilateral effort needs a stick too besides a carrot, and this discussion should be launched by the new US Treasury Secretary committed to the arms control agreement.

China closely manages its exchange rate. Too much and too opaque for most observers. Yet, from mid-May through mid-December, Chinese officials managed an appreciating yuan. Year-to-date, the yuan is among the strongest of emerging market currencies, gaining about 6.4% against the greenback. The yuan appreciated against all but a handful of major currencies as well. The appreciation of the yuan is a prima facia case that Beijing sees it in its interest. The currency is plenty competitive for trade purposes, as the record trade surplus illustrates. However, China’s integration into the global capital markets requires that the yuan is responsive to macroeconomic fundamentals. Otherwise, international asset managers who have reportedly bought more than $215 bln of Chinese bonds and stocks this year will think twice.

The yuan’s internationalization requires a country with a large trade surplus, attractive rate differentials, the strongest economy, and capital inflows to have an appreciating currency. Full stop. These dynamics suggest that further yuan appreciation is likely in 2021. The yuan’s appreciation in 2020 largely offsets its depreciation in 2018 and 2019. We suspect there is scope and tolerance for another 5% appreciation of the yuan in 2021, which would take the dollar toward CNY6.20.

Tags:

#USD,

China,

Currency Wars,

Featured,

newsletter,

policy mix,

twin deficits