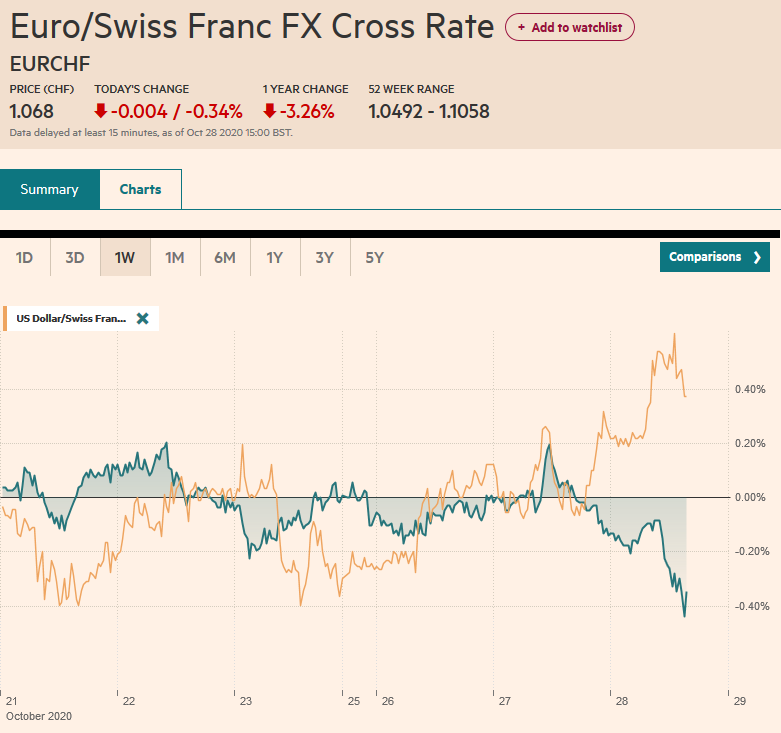

Swiss Franc The Euro has fallen by 0.34% to 1.068 EUR/CHF and USD/CHF, October 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Sickened by the surging virus, animal spirits are bed-ridden today. Several European countries are experiencing the most fatalities and illnesses in several months, and policymakers are responded with national restrictions. In 32 US states, hospitalizations have surged by over 10% in the past week. In the Asia Pacific region, China, South Korea, and the Australian market were the islands green on red equity screens that reflect the decline in nearly every place else. In Europe, the Dow Jones Stoxx 600 is off around 2.5% in late morning turnover. The tenth decline in 12 sessions has

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Brazil, Canada, COVID-19, Currency Movement, Featured, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.34% to 1.068 |

EUR/CHF and USD/CHF, October 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

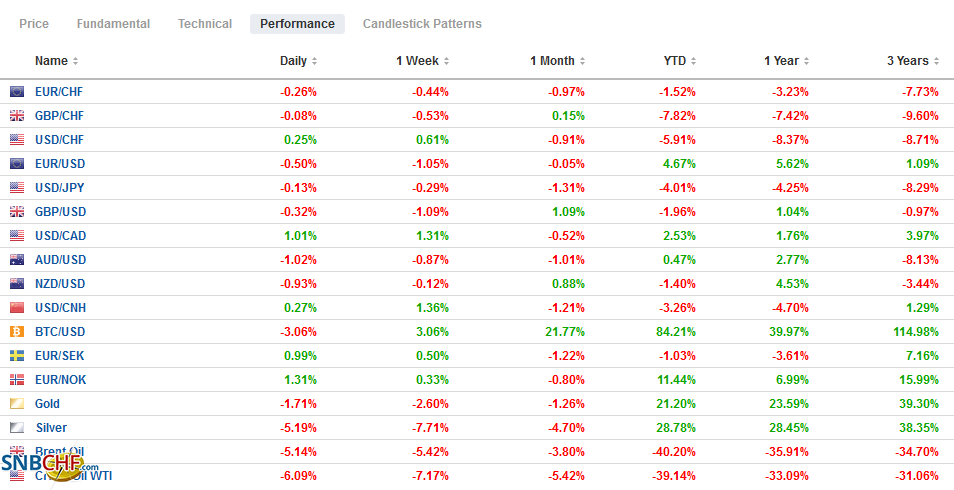

FX RatesOverview: Sickened by the surging virus, animal spirits are bed-ridden today. Several European countries are experiencing the most fatalities and illnesses in several months, and policymakers are responded with national restrictions. In 32 US states, hospitalizations have surged by over 10% in the past week. In the Asia Pacific region, China, South Korea, and the Australian market were the islands green on red equity screens that reflect the decline in nearly every place else. In Europe, the Dow Jones Stoxx 600 is off around 2.5% in late morning turnover. The tenth decline in 12 sessions has brought the benchmark about 8% lower to reach levels not seen in five months. US shares are heavier, and the S&P 500 is trading electronically about 1.5% lower. US 10-year Treasuries and German Bund are picking up a safe haven bid. The 10-year US yield is near 0.75%, and the German benchmark is below minus 64 bp. Peripheral yields, especially in Greece and Italy, are underperforming. The dollar, too, has caught a bid and is firmer against most of the world’s currencies but the Japanese yen. Emerging market currencies led by the beleaguered Turkish lira are lower. The JP Morgan Emerging Market Currency Index is off for the third consecutive session and is down nearly 1% this week. Gold is slipping lower as its asset function offsets its safe-haven role, and is struggling to hold above $1900. Oil has slumped. Between doubts about demand and rising US inventories (API estimate 4.5 mln barrel build) keeps crude under pressures. December WTI settled last week a little below $40 a barrel and now struggles to hold above $38. |

FX Performance, October 28 |

Asia Pacific

Australia’s Q3 CPI was a touch firmer than expected at 0.7% year-over-year. It is up from the -0.3% rate in Q2. The quarterly increase was 1.6% after -1.9%. However, the underlying measures (trimmed mean and weighted median) were have been considerably steadier. The year-over-year measures were steady at 1.2% and 1.3%, respectively. A recovery in oil prices and higher childcare costs were among the key drivers. The takeaway is that there is still scope for more central bank action, and many anticipate a move as early as next week, November 2. A rate cut and more aggressive bond-buying (maybe longer-dated) are possible.

Yesterday, Beijing announced its third policy adjustment that impacts the yuan. The first was reducing to zero the reserve requirement on forward currency transactions. The second was raising the quota for qualified domestic institutional investors (QDII) to invest offshore. The third allowed banks to drop the “counter-cyclical” component when quotes are submitted for setting the reference rate. It was a “block box” element and was understood as a control mechanism. All three measures are policy levers, short of intervention, which Beijing uses as it deems necessary. Each was thought to signal an official attempt to influence the pace of the yuan’s appreciation. We anticipated a phase of consolidation up to CNY6.72 but acknowledge that policymakers’ near-term intention is not clear.

The dollar reached a low near JPY104.15 in late Asia transactions. It has not traded below JPY104 since the chaos in March. Stops and optionality are struck around it. Today, there is a roughly $420 mln option at JPY103.90 that will be cut. On the upside, there are nearly $3 bln of options struck between JPY104.85 and JPY105.00 that expire. The JPY104.50-JPY104.60 could cap uptick now. The Australian dollar has traded on both sides of yesterday’s range, but so far, it remains, as it has this week, within the range seen before the weekend (~$0.7100-$0.7160). Initial support below $0.7100 is seen near $0.7085. The PBOC set the dollar’s reference rate at CNY6.7195, slightly above the Bloomberg survey’s median bank model.

Europe

The surging pandemic is the main story in Europe, and it is eclipsing other news. The ECB meets tomorrow. The second wave of the virus adds more pressure on the ECB, but on balance, it is expected to use dovish rhetoric to prepare investors for a move in December. The big four EMU countries are being ravaged. In France, the fatalities are highest since April, and a month-long national lockdown is less severe than the earlier one will likely be announced shortly. Italy has the most fatalities since May. New social; restriction measures have been enacted. It is overshadowing the government’s approval of the 5.4 bln euro spending package. In Germany, Merkel is calling for tighter restrictions, and the Covid disruption appears to be throwing a wrench in CDU plans to begin formally picking her successor. Spain saw a 59% increase in the number of cases from the previous day.

The euro is off for the third consecutive session. It settled last week near $1.1860 and fell to a low of nearly $1.1740 in the European morning. The trendline drawn off the late September low near $1.16 and the mid-October low around $1.690 is found today around $1.1730. There is are options at $1.18 and $1.1805 for around 1.8 bln euro that may prevent much of a recovery. Sterling is being sold through $1.30 in Europe and is pushing through the 20-day moving average (~$1.2980), which it has not closed below this month. It remains within the range set last Wednesday (~$1.2940-$1.3175). Below there, the next chart support is seen in the $1.2900-$1.2925 band. The euro fell to almost GBP0.9015 today, a five-day low but has recovered to around GBP0.9060.

America

The US advance goods trade balance for September and some inventory data will be the last data points for economists and their Q3 GDP forecasts. Record growth is expected after a record collapse in Q2. Most forecasts appear to be between 25% and 35% on a quarterly annualized pace, with which many are familiar. In Q2, the economy contracted by 31.4%.

The Bank of Canada meets today. Its description of the economic situation and any cues about its intentions, including other policy tools, will command attention, as the central bank is not expected to take fresh action. Separately, note that yesterday the US formally removed the tariffs on Canadian aluminum. Apparently, a “voluntary export restriction” has been negotiated and retroactive to September 1.

The Canadian dollar remains among the most sensitive of the majors to the shift in risk appetites. It is not surprising then that it is under pressure today. For the third consecutive session, the US dollar is making higher highs. The greenback is near $1.3240 as its approaches the mid-October high around CAD1.3260, which is also about the (50%) retracement of the decline since the September 30 high near CAD1.3420. Intermittent resistance is seen near CAD1.33. The Mexican peso is sliding. The greenback set a new low for October yesterday near MXN20.8320 and bounced to close a little above MXN21.00. It has poked above MXN21.27 today to approach last week’s high (~MXN21.2950), and above there, the MXN21.50 area beckons. Lastly, Brazil’s central bank holds a policy meeting later today, and with the Selic rate already at 2%, below the recent inflation prints, a steady hand is expected. The Brazilian real has not recovered as well as the Mexican peso in recent months. The dollar closed at five-months highs yesterday (~BRL5.7060) and may test BRL5.80 today. The record high was set in mid-May near BRL5.9715.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Brazil,Canada,COVID-19,Currency Movement,Featured,newsletter