Virus numbers are rising across Europe and the US; the dollar is softening as risk-off sentiment ebbs It is a fairly quiet day in the US; there is a glimmer of hope about a fiscal deal in the US; recent US data support the widely held view that more stimulus is needed The final week of Brexit negotiations is upon us in Brussels and the pendulum is swinging towards optimism; Turkish assets may be one of the biggest causalities of the conflict between Armenia and Azerbaijan US-China tensions remain elevated; China’s industrial profits continue to rebound, up 19.1% y/y in August; RBI rescheduled its planned policy meeting; Malaysia’s external trade figures came in much weaker than expected Virus numbers are rising across Europe and the US. Fed Chair Powell has been

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Virus numbers are rising across Europe and the US; the dollar is softening as risk-off sentiment ebbs

- It is a fairly quiet day in the US; there is a glimmer of hope about a fiscal deal in the US; recent US data support the widely held view that more stimulus is needed

- The final week of Brexit negotiations is upon us in Brussels and the pendulum is swinging towards optimism; Turkish assets may be one of the biggest causalities of the conflict between Armenia and Azerbaijan

- US-China tensions remain elevated; China’s industrial profits continue to rebound, up 19.1% y/y in August; RBI rescheduled its planned policy meeting; Malaysia’s external trade figures came in much weaker than expected

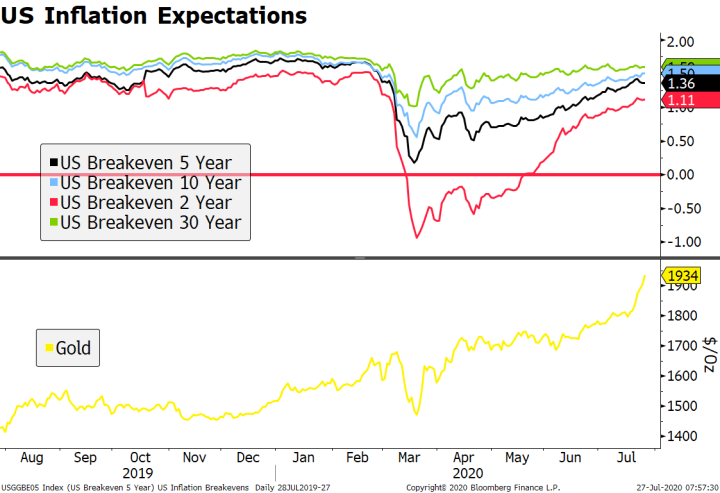

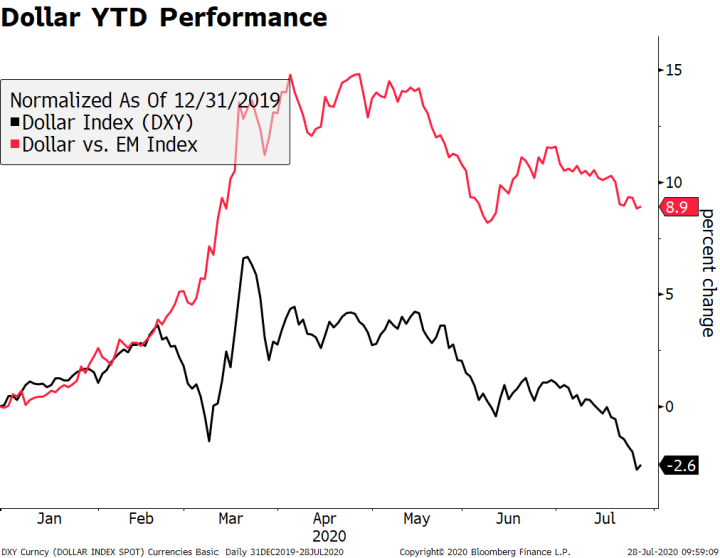

Virus numbers are rising across Europe and the US. Fed Chair Powell has been clear in his assessment that there can be no sustainable recovery in the US until the virus is under control. We are nowhere near that and the US economic data are likely to continue softening. That is dollar-negative. Period. Observers may note that the rising numbers in Europe are also a headwind. They are, but those nations have shown an ability to push the curve down, whereas the US has not. That said, markets are starting the week in risk-on mode as most global equity markets are higher on the day.

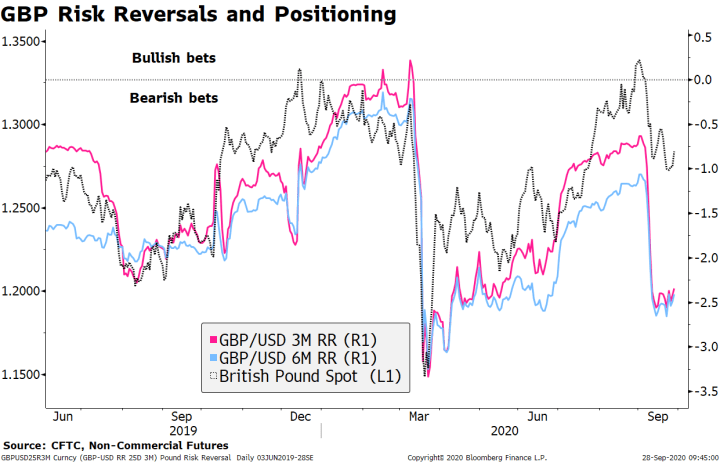

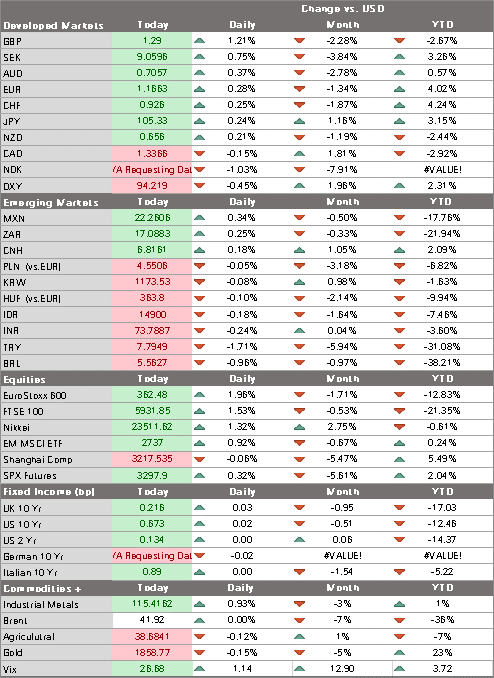

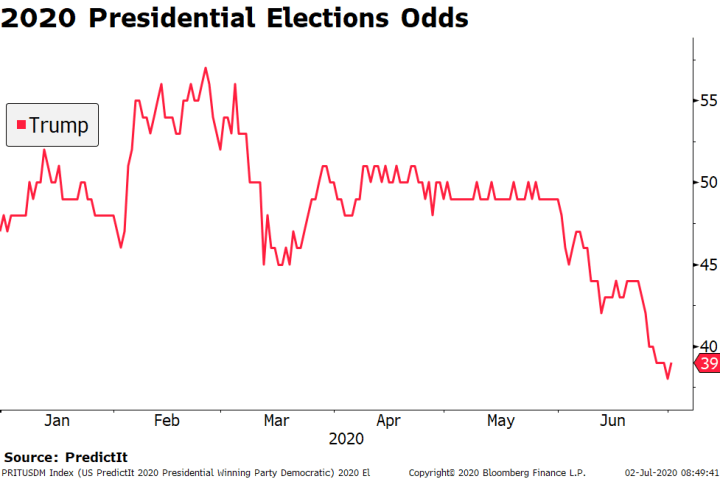

The dollar is softening as risk-off sentiment ebbs. DXY traded Friday at the highest level since July 24 near 94.742 but has since given up all of that day’s gains. We need to see a break of the 94.774 and 95.489 areas to signal that the dollar rally will continue. The equivalent objectives for the euro come in near $1.16 and $1.15. Sterling is leading today’s gains in majors on renewed Brexit optimism. We continue to view the recent dollar bounce as a positioning adjustment rather than a trend change. The broad-based weak dollar trend should eventually resume as we remain negative on the dollar due to the now-familiar combination of an ultra-dovish Fed and softening US economic data.

AMERICAS

It is a fairly quiet day in the US. Dallas Fed manufacturing activity for September will be reported and is expected at 9.5 vs. 8.0 in August. So far, the regional Fed surveys have held up fairly well. Mester speaks. The US data picks up midweek, culminating in the key jobs report Friday, where consensus sees gain of 850k.

There is a glimmer of hope about a fiscal deal in the US. This is still nothing to get excited about, in our view, especially after the administration decision to go ahead with the Supreme Court nomination ahead of the elections. Still, House Speaker Nancy Pelosi sound a bit more optimistic, saying that Democrats my look to pass a version of the package in the House. House Democrats will reportedly stake out a $2.4 trln starting point, while Senate Republicans have yet to move from their last package of around $500 bln. The Problem Solvers Caucus tried to split the difference at $1.5 trln but their plan got nowhere.

Recent US data support the widely held view that more stimulus is needed. Virtually every data set has shown a sequential slowdown in the monthly gains. Yes, this is to be expected. However, if the economy stalls out with tens of millions still out of work, those jobs may be lost forever. As it is, personal income data due out Thursday is expected to drop -2.4% m/m in August. This reflects the loss of enhanced unemployment benefits in July and was clearly a factor behind the weak retail sales reading.

It’s also worth stressing that fiscal stimulus was never meant to be the solution to the pandemic recession. It was meant to be a bridge loan of sorts that kept the economy on life support until the virus was controlled, at which time the economy could begin reopening safely. That is clearly not happening, not with US virus numbers on the rise again after a modest dip during the summer. Because the virus has not been brought under control, the economy faces more headwinds and needs another dose of fiscal stimulus to keep it alive during the winter months, when things will surely get more difficult.

| EUROPE/MIDDLE EAST/AFRICA

The final week of Brexit negotiations is upon us in Brussels and the pendulum is swinging towards optimism. The EU’s chief negotiator Michel Barnier is reported to be “determined to reach a deal.” We also got positive headlines from the UK’s chief negotiator David Frost. There is still about a month remaining for the “realistic deadline” for a deal to be ratified but, as usual, everything will probably happen at the last minute. Still, sterling is outperforming on the day and options markets are showing a slightly smaller demand for downside protection. Meanwhile, the rebellion against PM Johnson’s emergency powers is growing in ranks. It’s starting to look increasingly difficult for him to continue pushing for further lockdown measure, at least not without a wider discussion. But senior officials in Johnson administration are supposedly pushing for stricter measures. From a markets point of view, Turkish assets may be one of the biggest causalities of the conflict between Armenia and Azerbaijan. Turkey backs Azerbaijan, while Russia has a mutual defense pact with Armenia. Russia sells weapons to both countries and was the main broker in the ceasefire agreement during the 2016 flair-up, so we presume it will play a pivotal role in the conflict again. The Turkish lira is down nearly 1% against the dollar, by far the outlier, and equity markets are unchanged against a global risk-on session. After the surprise hike Thursday, the Turkish central bank continued to tighten conditions. It limited funding at the new 10.25% policy rate, forcing banks to go to more expensive options and boosting the average cost of funds to 10.88% Friday. Yet the lira has already given up all of its post-hike gains and is trading at new all-time lows and so further backdoor tightening is likely. Next policy meeting is October 22 and another policy hike become more likely then if the lira continues to weaken. |

GBP Risk Reversals and Positioning, 2019-2020 |

| ASIA

US-China tensions remain elevated. The US imposed export restrictions on China’s largest chipmaker SMIC. US firms must apply for a license to export certain products to SMIC, as the Commerce Department said that the company its subsidiaries present “an unacceptable risk of diversion to a military end use.” However, SMIC has not yet been put on the so-called US entities list, which means the restrictions are not yet as severe as those imposed on Huawei. Elsewhere, a US Federal judged issued a temporary injunction on the Trump administration’s order to ban the TikTok app from online platforms. However, the judge declined to grant a temporary injunction on a separate set of restrictions scheduled to take effect November 12. On the data front, China’s industrial profits continue to rebound, up 19.1% y/y in August. This is the second month of near-20% growth and the fourth consecutive positive print, supporting the now established recovery narrative. The Reserve Bank of India rescheduled its planned policy meeting that was to begin tomorrow. The decision was due Thursday and the bank was expected to keep the repo rate steady at 4.0%. No reason was given and the RBI said that “The dates of the MPC’s meeting will be announced shortly.” Due to high inflation, the RBI unexpectedly left rates unchanged at its last meeting August 6. We do not want to read too much into the delay but we suspect it reflects a very divided MPC. We saw a small chance of a dovish surprise this week if the rupee remains relatively firm. Malaysia’s external trade figures came in much weaker than expected. Exports contracted -2.9% y/y in August and imports fell -6.5% y/y, both well below forecasts. The disappointment was in large part down to petroleum exports and electronics. |

Tags: Articles,Daily News,Featured,newsletter