EM performance this week will hinge crucially on whether US equity markets can find some traction. If sustained, last week’s equity rout could lead to a deeper generalized risk-off trading environment this week that would weigh on EM FX and equities. As it is, markets are already digesting weaker economic data and rising virus numbers in countries that had crushed the curve. ECB meeting this week may hint at further easing to come, which could help risk assets recover a bit. AMERICAS Chile reports August trade Monday. August CPI will be reported Tuesday, with headline inflation expected to fall a tick to 2.4% y/y. If so, this would be the lowest since September and nearing the bottom of the 2-4% target range. The bank has been on hold since its last 50 bp cut

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

![]() EM performance this week will hinge crucially on whether US equity markets can find some traction. If sustained, last week’s equity rout could lead to a deeper generalized risk-off trading environment this week that would weigh on EM FX and equities. As it is, markets are already digesting weaker economic data and rising virus numbers in countries that had crushed the curve. ECB meeting this week may hint at further easing to come, which could help risk assets recover a bit.

EM performance this week will hinge crucially on whether US equity markets can find some traction. If sustained, last week’s equity rout could lead to a deeper generalized risk-off trading environment this week that would weigh on EM FX and equities. As it is, markets are already digesting weaker economic data and rising virus numbers in countries that had crushed the curve. ECB meeting this week may hint at further easing to come, which could help risk assets recover a bit.

AMERICAS

Chile reports August trade Monday. August CPI will be reported Tuesday, with headline inflation expected to fall a tick to 2.4% y/y. If so, this would be the lowest since September and nearing the bottom of the 2-4% target range. The bank has been on hold since its last 50 bp cut March 31. Next policy meeting is October 15 and no change is expected then. Last week, the bank upgraded its 2020 GDP forecast to between -4.5 to -5.5% from -5.5% to -7.5% previously. It cited early pension withdrawals, record low interest rates, and government stimulus as the main factors for the improved outlook. Indeed, the bank estimated that the pension withdrawals will amount to around 6% of GDP, of which half would go into consumption.

Mexico reports August CPI Wednesday. Headline inflation is expected to accelerate to 4.04% y/y from 3.62% in July. If so, it would be the highest since May 2019 and above the 2-4% target range. Banco de Mexico has cut rates at every meeting this year. At its last meeting August 13, it cut rates 50 bp to 4.5% and signaled further easing was likely. Next policy meeting is September 24 and rising inflation makes this a tough call. While we had thought another 50 bp cut to 4.0% was likely, the bank may be forced to do a more cautious 25 bp move then. July IP will be reported Friday and is expected to fall -13.4% y/y vs. -16.7% in June.

Brazil reports August IPCA inflation Wednesday. It is expected to accelerate slightly to 2.43% y/y from 2.31% in July. If so, it would be the third straight month of acceleration and the highest since April and just below the 2.5-5.5% target range. At the last COPOM meeting August 5, it cut rates 25 bp to 2.0% and left the door open for further easing. Next meeting is September 16 and no change is expected then. July retail sales will be reported Thursday and are expected to rise 2.1% y/y vs. 0.5% in June.

Peru central bank meets Thursday and is expected to keep rates steady at 0.25%. The bank has been on hold since its last 100 bp cut April 9. CPI rose 2.14% y/y in August, near the center of the 1-3% target range. Congressional committees will debate draft legislation this week allowing a second round of withdrawals from pension savings, bypassing a motion to have the bill go straight to a full floor vote.

EUROPE/MIDDLE EAST/AFRICA

South Africa reports Q2 GDP Tuesday. The economy is expected to have contracted an astounding -47.2% SAAR vs. -2.0% in Q1. Q2 current account and July manufacturing output will be reported Thursday. The former is expected at -0.8% of GDP, while the latter is expected to contract -13.9% y/y. At its last meeting July 23, SARB cut rates 25 bp to 3.5% and implied the easing cycle was over. Next policy meeting is September 17 and no change is expected then. However, with the economy still weak, we see some risk of a dovish surprise.

Hungary reports July trade Tuesday. August CPI will be reported Wednesday, along with central bank minutes. Headline inflation is expected to rise a tick to 3.9% y/y. If so, it would be the third straight month of acceleration and the highest since March. After cutting rates 15 bp at the June and July meetings, the bank remained on hold in August. Next policy meeting is September 22 and no change is expected then in light of the weaker forint and rising price pressures.

Czech Republic reports July industrial and construction output and trade data Monday. August CPI will be reported Thursday, with headline expected to fall a tick to 3.3% y/y. if so, inflation would remain above the 1-3% target range. The bank has been on hold since its last 75 bp cut May 7. Since then, the koruna has gained about 3% against the euro and basically negates that last cut. Next policy meeting is September 23 and no change is expected then.

ASIA

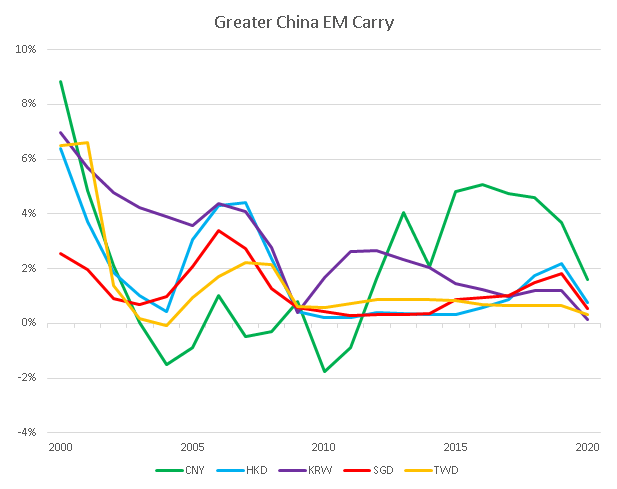

China reports August trade Monday. Exports are expected to rise 7.5% y/y while imports are expected to rise 0.2% y/y. August CPI and PPI will be reported Wednesday, with the former expected to rise 2.4% and latte expected to fall-1.9% y/y. Policymakers are fully focused on boosting growth, not fighting inflation. As it is, the firmer yuan should help limit inflation in the coming months. Money and loan growth data may come out either late this week or early next week. Both new loans and aggregate financing are expected to pick up from July.

Taiwan reports August trade Monday. Exports are expected to rise 0.8% y/y while imports are expected to rise 0.7% y/y. August CPI will be reported Tuesday, with headline expected to fall -0.41% y/y vs. -0.52% in July. The central bank cut rates 25 bp to 1.125% in March but then left rates steady in June. Next quarterly policy meeting is September 17 and no change is expected then. However, given ongoing risks to growth, we see risks of a dovish surprise.

Bank Negara Malaysia meets Thursday and is expected to keep rates steady at 1.75%. It has cut rates at all four policy meetings this year for a total of 125 bp of easing. One analyst sees a 25 bp cut to 1.5%. CPI fell -1.3% y/y in July, the fifth straight month of deflation. The central bank does not have an explicit inflation target but continued deflations warns of a possible dovish surprise this week. July IP and manufacturing sales will be reported Friday. IP is expected to rise 1.1% y/y vs. -0.4% in June.

Tags: Articles,Emerging Markets,Featured,newsletter