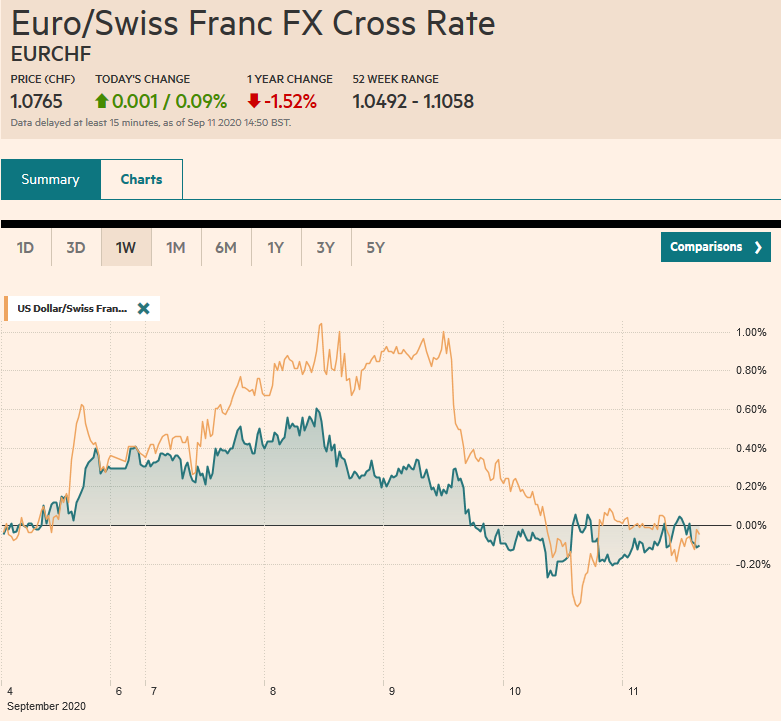

Swiss Franc The Euro has risen by 0.09% to 1.0765 EUR/CHF and USD/CHF, September 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Yesterday’s roller-coaster price action has not had much impact on today’s activity. The slide in US equities after early gains failed to prevent Japanese, Chinese, and Hong Kong equities from advancing, though other markets in the region were not as resilient. It is the first back-to-back weekly loss of the MSCI Asia Pacific Index since May. Europe’s Dow Jones Stoxx 600 is flat to slightly higher, but the weekly gain is offsetting the lion’s share of last week’s decline. It has been a volatile week for US shares, and while the S&P 500 is called higher, it is nursing a 2.5% loss

Topics:

Marc Chandler considers the following as important: 4) FX Trends, 4.) Marc to Market, Brexit, Currency Movement, ECB, Featured, Japan, newsletter, USD

This could be interesting, too:

RIA Team writes The Benefits of Starting Retirement Planning Early in Your Career

Swissinfo writes Swiss residential real estate to remain in demand in 2025

Thomas J. DiLorenzo writes Stakeholder Capitalism and the Corporate KPI Cult

Swissinfo writes Parliament stalemate on abolishing Swiss homeowner tax

Swiss FrancThe Euro has risen by 0.09% to 1.0765 |

EUR/CHF and USD/CHF, September 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Yesterday’s roller-coaster price action has not had much impact on today’s activity. The slide in US equities after early gains failed to prevent Japanese, Chinese, and Hong Kong equities from advancing, though other markets in the region were not as resilient. It is the first back-to-back weekly loss of the MSCI Asia Pacific Index since May. Europe’s Dow Jones Stoxx 600 is flat to slightly higher, but the weekly gain is offsetting the lion’s share of last week’s decline. It has been a volatile week for US shares, and while the S&P 500 is called higher, it is nursing a 2.5% loss in the past three sessions after dropping 2.3% last week. It is the first two-week decline since the end of April./beginning of May. European benchmark yields are 2-4 bp lower, while the US 10-year sits near 68 bp, a few lower than a week ago. The dollar is weaker against most of the major currencies. The yen and sterling are exceptions. The dollar is in less than a quarter of a yen range above JPY106.05, and sterling has been knocked by the Brexit developments. It is roughly a 3.7% decline this week is the largest in six months. Emerging market currencies are mostly firmer, though Turkey, Korea, and Indonesia are struggling. The JP Morgan Emerging Market Currency Index is virtually flat so far here in September. Gold is steady after reversing lower from $1966 yesterday and settled about $20 lower. Oil is little changed today. October WTI is continuing to trade within Wednesday’s range (~$36.15-38.45). It is off around 6% this week after tumbling 7% last week, for the largest decline in April. |

FX Performance, September 11 |

Asia PacificAbe’s most likely successor, Suga, who is expected to be confirmed at LDP leader and Prime Minister next week, appeared to walk back comments made yesterday seemingly to endorse another unpopular hike in the sales tax. Today he indicated that no such increase will be needed in the next decade. Part of Abe’s agenda pertaining to strengthening Japan’s military capabilities is unfilled but among the departing Prime Minister’s last efforts is to secure preventative capabilities to take out an adversary’s missile base. Separately, Japan’s August producer prices were 0.5% lower than a year ago, improving from -0.9% in July. Another increase is likely in September before the base effect works against it in October. In October 2019, Japanese producer prices jumped 1.1%. |

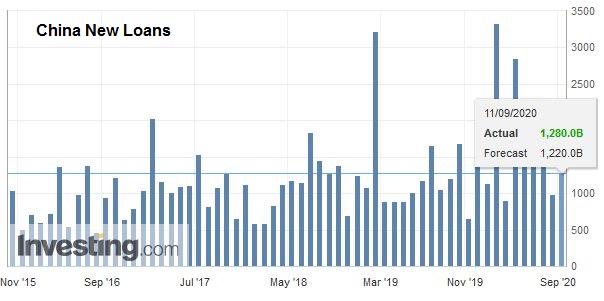

China New Loans, August 2020(see more posts on China New Loans, ) Source: investing.com - Click to enlarge |

| Although there was talk earlier this week that the US might extend its demand that TikTok is sold or be banned in America, the announcement late yesterday confirmed the September 15 deadline. On a different front, the PBOC identified a $73 mln discrepancy between capital inflows and outflows between its data and the State Administration for Foreign Exchange (SAFE). It indicated today that it was due to how securities investments were bucketed. Many observers see large discrepancies and will not be satisfied with this answer. Lastly, China’s lending figures for August were released and showed a larger than expected rise, mostly driven by the so-called shadow-banking, which are non-bank financial institutions, but especially the wealth management arms of banks. Banking lending increased by a third but overall lending more than doubled to CNY3.58 trillion, the most since March. |

China M2 Money Stock YoY, August 2020(see more posts on China M2 Money Stock, ) Source: investing.com - Click to enlarge |

The dollar has been confined to a range roughly between JPY105.80 and JPY106.40 this week. The option for about $510 mln at JPY106 that expires today has probably been dealt with, but there is another option for $480 mln at JPY106.35 that may still be alive. The dollar settled last week near JPY106.25. The Australian dollar is firm near $0.7300. The week’s high was set yesterday closer to $0.7325, which is the (61.8%) retracement of the decline from September 1 push above $0.7400. It finished last week near $0.7280. The PBOC set the dollar’s reference rate at CNY6.8389, a little lower than the median bank model in the Bloomberg survey. The dollar settled at CNY6.8425 at the end of last week. This is the seventh consecutive week it has moved lower against the yuan.

Europe

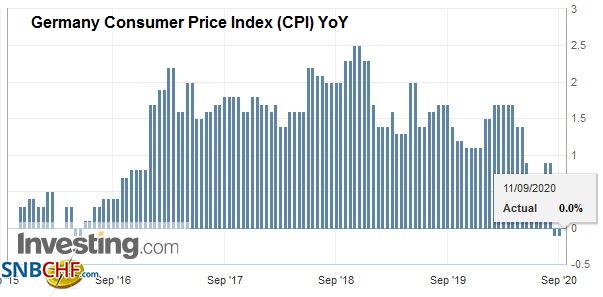

The ECB did not change its stance yesterday, and President Lagarde played down the significance of the euro’s recent rise. Talk of its 10% move is an exaggeration as it takes the euro from its low point in late March. It was still flat for the year at the end of June. It rallied strongly in July but moved broadly sideways in August. It threatened to move higher only after the FOMC adopted an average inflation target. The ECB’s Q4 GDP forecast is for 3.1% growth, down from 3.2% in June. The year’s forecast was revised up to show an 8% contraction instead of 8.7%, and this is mostly due to Q3 growth. Like Germany, it raised this year’s forecast but shaved next year’s (5% instead of 5.2%). The ECB did not seem too bothered by the loss of momentum in the survey data. Lagarde reiterated Lane’s comment and said the ECB would “carefully monitor” the implication of the euro on inflation, but also noted that price pressures have been dampened by lower energy prices and subdued demand. Confounding observers, the ECB revised higher next year’s CPI forecast to 1.0% from 0.8% and left the 2022 forecast unchanged at 1.3%. Less than 24 hours after Lagarde concluded her press conference, Lane seemed to emphasize the euro’s strength again.

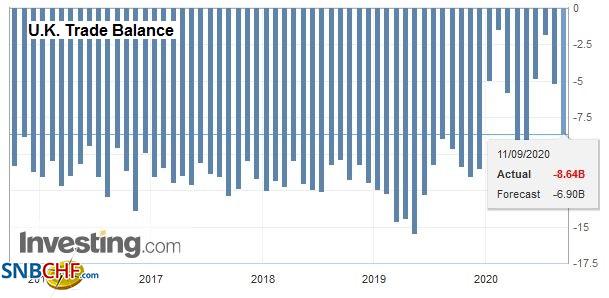

| The UK government’s “Internal Market Bill,” which overrides the Withdrawal Agreement and the Northern Ireland protocol, has been a significant blow to the prospects of a trade agreement and bolsters the risk of a disruptive end of the standstill arrangement at the end of the year. The UK government has refused to retract the bill. Sterling has born the brunt of the anxiety of investors. It is easily the worst-performing currency in the world this week, losing approximately 3.6% against the dollar and almost 4% against the euro. Three-month implied volatility is above 12% for the first time since April. It finished last week below 9.7%. The euro approached GBP0.9300, a five-month high. |

Germany Consumer Price Index (CPI) YoY, August 2020(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

| Separately the UK reported the economy expanded by 6.6% in July, a little less than expected, after growing 8.7% in June. Industrial output and construction were stronger than expected, but services were a touch weaker, and the goods trade deficit larger than projected. |

U.K. Trade Balance, July 2020(see more posts on u-k-trade-balance, ) Source: investing.com - Click to enlarge |

The developments with the EU, however, cast a cloud over an uncertain economic outlook. The developments suggest that more action from the BOE is likely in Q4. Note that the Bank of England (along with the Fed and BOJ) holds its policy-making meeting next week. Note that the UK sold six-month bills today with a negative yield for the first time.

The euro’s inability to sustain the upward momentum that had carried it above $1.19 was disappointing, but there has been no follow-through selling today. It has held above $1.18 and set session highs near $1.1870 in the European morning (after Lane spoke). There is an option for around 900 mln euros at $1.19 that expires today and another for 1.1 bln euros that expire there on Monday. We expected expectations of a dovish FOMC next week to keep the euro supported. Sterling is lower for the seventh session of the past eight. The next technical areas of note are the 200-day moving average near $1.2735 and the (38.2%) retracement of the entire rally since the March lows, found near $1.2690.

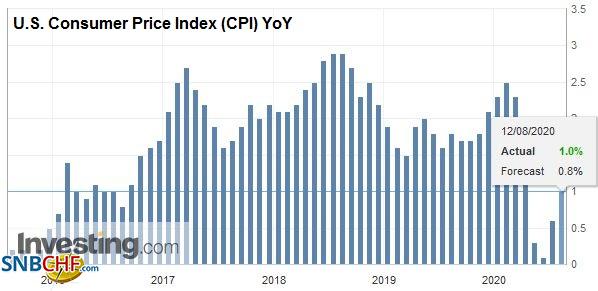

AmericaThe US reports August CPI figures ahead of the weekend. The core and the headline rates rose by 0.6% in July, but smaller increases are expected for last month. The headline rate ix expected to rise by around 0.3%, which would lift the year-over-year rate to 1.2% from 1.0%, which is still fairly benign. |

U.S. Consumer Price Index (CPI) YoY, August 2020(see more posts on U.S. Consumer Price Index, ) Source: investing.com - Click to enlarge |

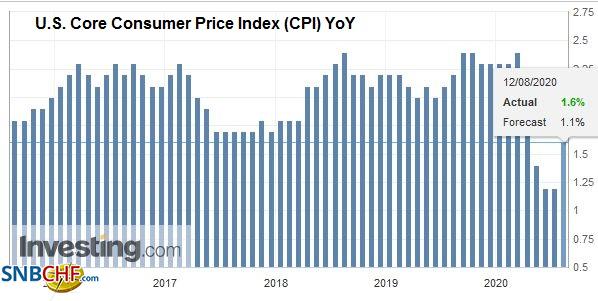

| Most economists expect the core rate to firm by 0.2%, leaving the year-over-year rate at 1.6%. Barring a surprise, the data is unlikely to have much impact. |

U.S. Core Consumer Price Index (CPI) YoY, August 2020(see more posts on U.S. Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

Canada reports Q2 capacity utilization figures, which are not a market-mover even in the best of times. This week, the Bank of Canada kept policy steady and is committed to buying C$5 bln of government bonds a week. We suspect that it is more likely to slow its purchases, perhaps next year, than to increase them. Mexico reports July industrial output figures. Industrial production is expected to have expanded by 5.8% in July after a nearly 18% jump in June. This seems to be the broad pattern in many countries: a strong rebound in May and/or June and then slowing in July and/or August. Earlier this week, Mexico reported CPI above 4% for the first time since H1 19, and this is seen reinforcing ideas that Banxico is on hold.

The US dollar is holding onto a big figure gains against the Canadian dollar this week, having closed last week near CAD1.3060. It is pulling back from CAD1.3260 in the middle of this week. Yesterday’s low near $1.3120 may offer initial support. However, the greenback is poised to snap an eight-week slide against the Canadian dollar that began near CAD1.3600. Initial resistance is pegged near CAD1.3200, and there is an option for about $970 mln struck at CAD1.3220 that will be cut today. The greenback’s decline against the peso is set to conclude its fifth consecutive week. The relatively high yield is its main support. The outside down day on Wednesday saw follow-through selling yesterday, and the US dollar has been unable to resurface above its 200day moving average (~MXN21.57). The next downside target is MXN21.00.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,Currency Movement,ECB,Featured,Japan,newsletter