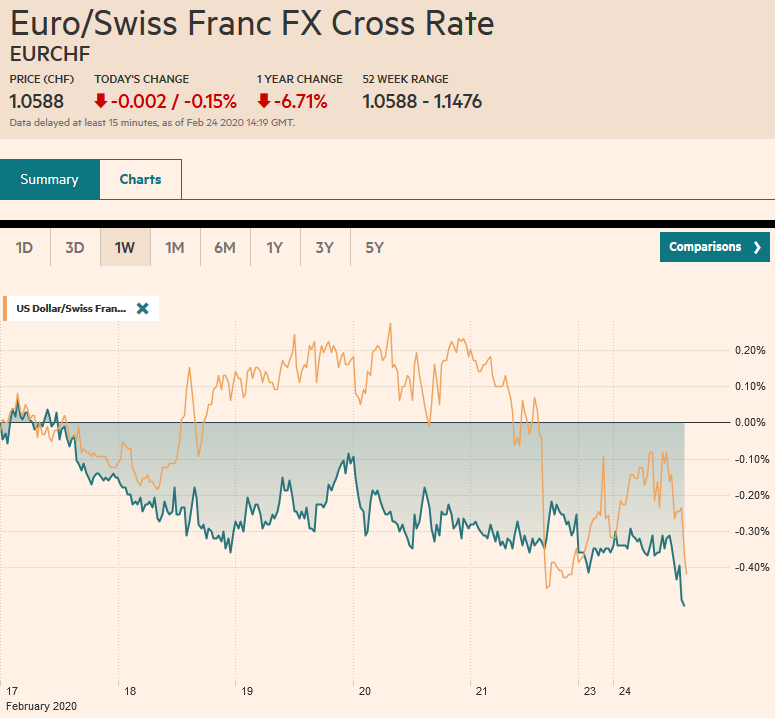

Swiss Franc The Euro has fallen by 0.15% to 1.0588 EUR/CHF and USD/CHF, February 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The ring of containment of Covid-19 has grown from China. The new frontline is Japan, South Korea, Italy, and Iran. A lockdown of around 50k people near Milan and Austria blocking trains from Italy is scaring investors. Asian markets fell, but South Korea bore the brunt with a nearly 4% decline. The national holiday in Japan spared local equities. Europe’s Dow Jones Stoxx 600 was marked sharply lower at the open and trended lower throughout the morning. The record high was reached on February 19 (~434) and is now approaching the year’s low set on January 10 (~410). It is off

Topics:

Marc Chandler considers the following as important: 4) FX Trends, 4.) Marc to Market, China, COVID-19, Currency Movement, Featured, FX Daily, Italy, Mexico, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

Swiss FrancThe Euro has fallen by 0.15% to 1.0588 |

EUR/CHF and USD/CHF, February 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

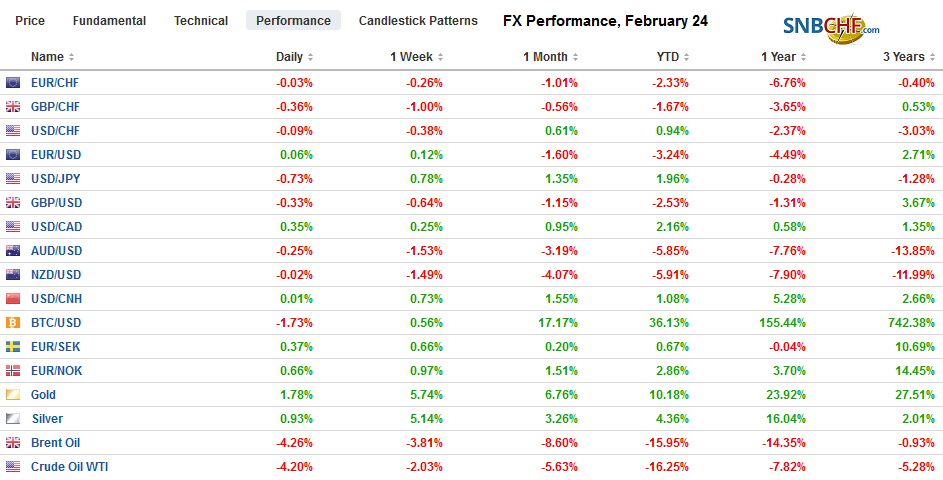

FX RatesOverview: The ring of containment of Covid-19 has grown from China. The new frontline is Japan, South Korea, Italy, and Iran. A lockdown of around 50k people near Milan and Austria blocking trains from Italy is scaring investors. Asian markets fell, but South Korea bore the brunt with a nearly 4% decline. The national holiday in Japan spared local equities. Europe’s Dow Jones Stoxx 600 was marked sharply lower at the open and trended lower throughout the morning. The record high was reached on February 19 (~434) and is now approaching the year’s low set on January 10 (~410). It is off about 3.7%. US shares are also selling off, and the early indication is for around 2.5% gap lower opening of the S&P 500. Bond yields are also falling. Asia-Pacific yields were off 2-4 bp, while core European bond yields are 5-7 bp lower, and the US 10-year yield is off around eight basis points to dip below 1.40%. The US 30-year yield is about seven basis points lower at a new record low near 1.84%. The major currencies fall into four buckets today. The yen, which some feared was losing its safe-haven status, is the only currency gaining against the dollar tody (~0.25%). The euro, Swiss franc, and Danish krone are off about 0.3%. The dollar-bloc and Swedish krona are off about 0.6%, and the Norwegian krone is off around 1%. Emerging market currencies are under pressure the JP Morgan Emerging Market Currency Index is 0.5% lower, with the Mexican peso and South Korean won leading with approximately 1% losses. Gold has soared more than 2% to $1680-$1690, and April WTI is off about 3.5% to $51.50. |

FX Performance, February 24 |

Asia Pacific

China added to the confusion by announcing the easing of the travel ban for Wuhan, where the virus initially emerged, only to rescinded it within hours. Apparently, it did not have senior leadership approval, and the lockdown of the 1l mln or so residents remains in place. Meanwhile, other reports suggest that Beijing is pushing to resume economic activity as soon as possible, and this is leading to other concerns that it may be premature. At the same time, the virus does not yet appear contained.

The IMF shaved its GDP projection for China to 5.6% this year, which seems wildly optimistic, but then China’s GDP is whatever it says it is. It is hard to see how China escapes a contraction in Q1, and even under the most optimistic scenarios, recoups it fully in Q2 (V-recovery) and grows near trend in H2. That would still put growth for the entire year closer to 3%.

Infections in South Korea have jumped from about 30 to over 750 in the past week. South Korea appears to be preparing for a fiscal and monetary response. A KRW10 trillion (~$8.2 bln) supplemental budget is being discussed. The central bank meets later this week (February 27) and is expected to deliver a 25 bp cut.

Last Thursday, the dollar rallied from about JPY111.10 to nearly JPY112.35. Before last weekend, the dollar pared its gains to around JPY111.50 and today to about JPY111.20, to meet the (38.2%) retracement of its recent run-up. The next target is just below JPY111 and the JPY110.65. The JPY111.60 area offers nearby resistance. The Australian dollar was trying to bottom at the end of last week, but the lack of containment of Covid-19 has sent it to a marginal new decade-low (~$0.6585). Resistance is seen in the $0.6640-$0.6660 area. The PBOC set the dollar’s reference rate at CNY7.0246, in line with the bank models. It rose to about CNY7.04 before stabilizing near CNY7.03.

Europe

The number of cases in Italy, especially northern Italy, has risen sharply. The Venice Carnival has been canceled, and schools have been shuttered. The restricted movement has impacted about 50k people around Milan, according to reports. This will likely qualify as sufficient of an emergency to permit a fiscal response. Reports suggest Austria has halted a few trains from Italy.

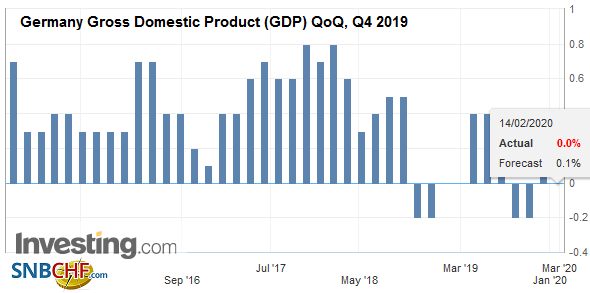

| Germany’s February IFO survey was mixed. The current assessment slipped to 98.9 from 99.1, but the expectations component edged up to 93.4 from 92.9. The combination saw the overall climate measure tick up to 96.1 from a revised 96.0 in January. It sparked a short-lived bounce in the euro to about $1.0840. Separately, in the Germany city/state of Hamburg, the SPD held on to win a plurality, and the Greens also did well. The CDU saw its support fall to a new record low (~11.2%), and both the FDP and AfD both barely squeaked past the threshold for the local parliament. The CDU is without a party leader, and it was decided earlier today to hold a convention in late April to choose a successor to AKK, and likely Merkel herself. |

Germany Gross Domestic Product (GDP) QoQ, Q4 2019(see more posts on Germany Gross Domestic Product, ) Source: investing.com - Click to enlarge |

The UK Parliament returns from its recess today. The new points-based immigration proposals and anti-terror legislation are on the top of the agenda. Formal talks with the EU on the post-Brexit trade relationship are to start on March 2, and the UK budget is to be presented on March 11.

The euro is consolidating in its pre-weekend range (~$1.0785-$1.0865). It needs to resurface, and ideally close above $1.0820 to keep the correction intact. The intraday technicals suggest a reasonable chance for this. Still, with last Friday an exception, the North American participants have often been more bearish toward the euro than the other centers. Sterling is also confined to the previous session’s range (~$1.2880-$1.2980). A break lower would immediately target $1.2840. A close above $1.2930 would point to more consolidation.

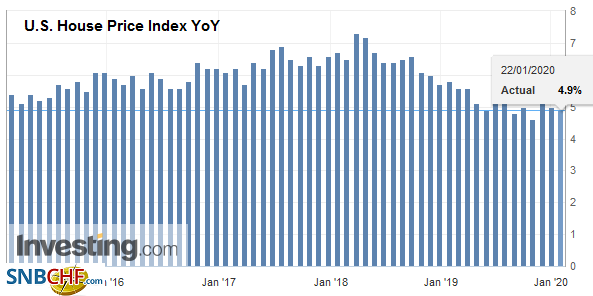

AmericaThe Chicago Fed’s National Activity (January) report and the Dallas Fed’s (February) manufacturing survey are hardly the data that drives the capital markets even in the best of times, and today, it is an even greater stretch. Investors have been given two warnings–one from Apple and one from last week’ preliminary PMI–that they may be a larger impact from Boeing and the disruption from Covid-19 than officials and many (equity) investors seem to recognize. The implied yield of the December funds futures has fallen nine basis points today to 1.06%. The current average effective fed funds rate is 1.59%, which means that the market has now discounted a little more than 50 bp of easing. The Fed’s Mester (voting member) speaks today, but the chorus of officials have shown little sign of softening their stance, though next month’s FOMC meeting is likely to be a different story (spoiler: dovish hold). |

U.S. House Price Index YoY, December 2019(see more posts on U.S. House Price Index, ) Source: investing.com - Click to enlarge |

The sharp drop in oil prices and risk-appetites have sent the Canadian dollar sharply lower. The US dollar has surged to briefly poke above CAD1.3300 after finishing last week flirting with the 200-day moving average (~CAD1.3215). The high set two weeks ago, near CAD1.3330, is the next key chart point. The intraday technicals suggest the extreme may be passed, and a test on CAD1.3260 would boost the confidence of this view. The dollar closed below MXN19.00 ahead of the weekend despite intraday penetration. However, the greenback’s rally has continued today, and the peso, being a liquid and freely accessible currency, is bearing the brunt of the EM sell-off today. The greenback is approaching MXN19.20 and the 200-day moving average, which has not been violated since early December is found just above MXN19.21 today. Increased volatility is forcing an unwind to the popular carry trade.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,COVID-19,Currency Movement,Featured,FX Daily,Italy,Mexico,newsletter