Swiss Franc The Euro has fallen by 0.26% at 1.1287 EUR/CHF and USD/CHF, January 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Optimism on trade talks between the US and China coupled with the biggest rally in WTI in two years (11%+) have helped keep the equity market recovery intact.The MSCI Asia Pacific Index rose today, the eighth time in the past ten sessions, while the Dow Jones Stoxx 600 in Europe is closing in on its second consecutive weekly advance. The S&P 500 has a five-day rally in tow and is likely to extend its gains for a third consecutive week. Benchmark 10-year yields are mostly softer, though on the week, core bonds are little changed. In

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, newsletter, SPX

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

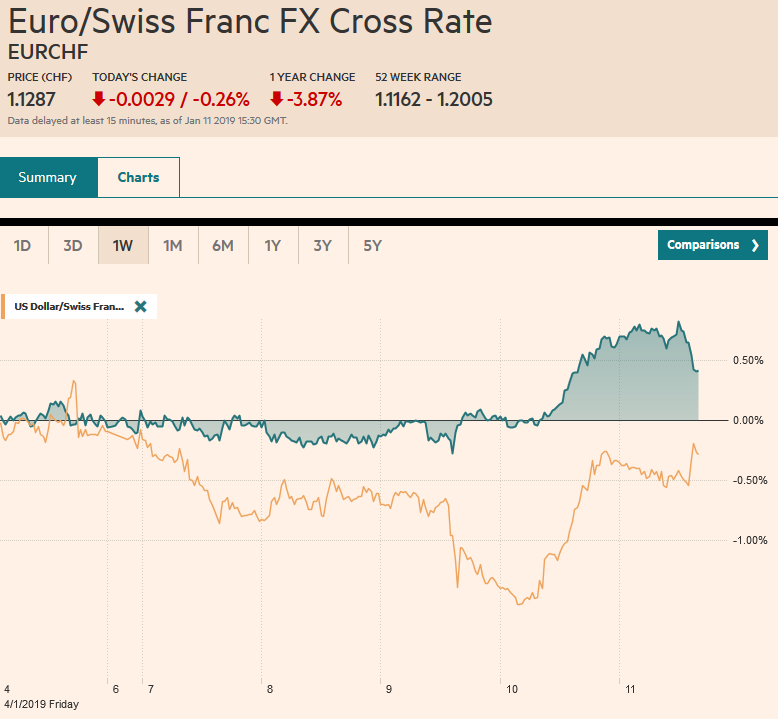

Swiss FrancThe Euro has fallen by 0.26% at 1.1287 |

EUR/CHF and USD/CHF, January 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

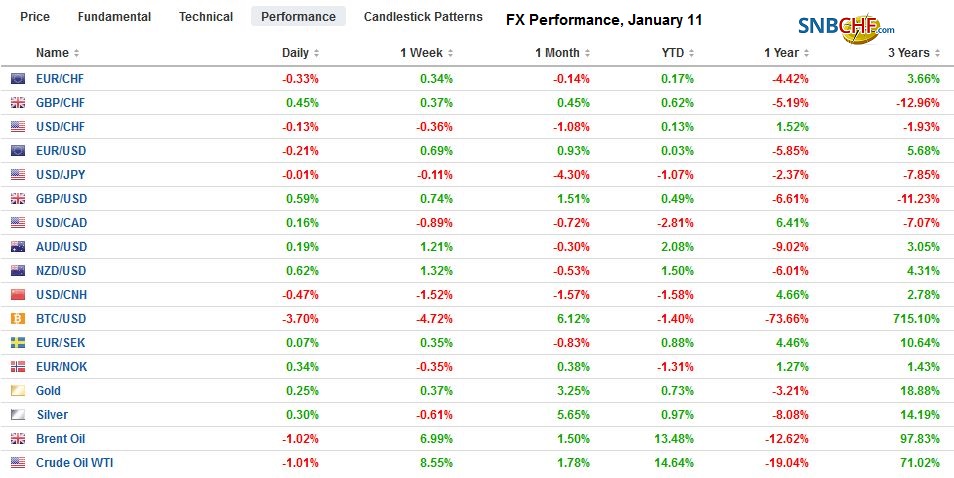

FX RatesOverview: Optimism on trade talks between the US and China coupled with the biggest rally in WTI in two years (11%+) have helped keep the equity market recovery intact.The MSCI Asia Pacific Index rose today, the eighth time in the past ten sessions, while the Dow Jones Stoxx 600 in Europe is closing in on its second consecutive weekly advance. The S&P 500 has a five-day rally in tow and is likely to extend its gains for a third consecutive week. Benchmark 10-year yields are mostly softer, though on the week, core bonds are little changed. In Europe, peripheral bonds and France saw premiums over Germany shrink. The dollar is heavier against all the majors but sterling. On the week, the greenback has slipped against all the majors, with sterling and the yen the laggards, while the dollar-bloc and the Norwegian krone leading the way higher. The Chinese yuan is the strongest currency on the day rising about 0.75%, and on the week, with its nearly 2% advance. |

FX Performance, January 11 |

Asia Pacific

China’s Vice Premier Liu He will travel to Washington at the end of the month and meet with US Trade Representative Lighthizer and Treasury Secretary Mnuchin for the next round of trade talks. It seemed easy for the mid-level team of negotiators to agree to buy more low value-added energy and agriculture goods from the US because China previously agreed before President Trump rejected the agreement. The non-tariff barriers, including technology transfers, require higher levels talks, but the underlying optimism stems from ideas that the blowback to the stock market has given the US Administration a greater sense of desire for a deal, even if the strategic competition for regional and global influence is not addressed.

Despite a 2% year-over-year rise in November labor cash earnings in Japan, the most in five months, household spending slumped 0.6%. Economists had expected recovery from a 0.3% decline in October. Japan is on track to raise the retail sales tax from 8% to 10% in October. The data also suggest a weak recovery from the natural disaster-induced contraction in Q3. Separately, Japan reported a larger than expected current account surplus, driven by a smaller trade deficit. Japan’s current account surplus is a function of investment income (from portfolio and direct investment abroad) not from the trade balance. Through November, Japan’s average monthly trade balance in 2018 was about JPY88 bln.

Australia reported slightly better than expected November retail sales (0.4% rather than 0.3%) but does little to ease concern about the headwind from housing, where investors learned earlier in the week that permits fell by more than a third from year-ago levels. Today’s news that construction index fell to five-year lows reinforces troubled outlook. The swaps market appears to be discounting a roughly 25% chance of a rate cut later this year.

The dollar is sidelined against the yen today, stuck in less than a quarter of a yen range (~JPY108.25-JPY108.50). There is an expiring option for $425 mln at JPY108.50, and one for about $435 mln struck at JPY108.20 that will also be cut. Unless the dollar closes above the high for the day thus far, it will be the fourth consecutive weekly decline. The domestic headwinds have not prevented the Australian dollar from extending its gains as it pushes to its best level since mid-December, near $0.7230, which is two standard deviations from the 20-day moving average. Above $0.7240, there is little technical resistance until closer to $0.7400.

Europe

The UK reported disappointing November trade and industrial production figures, but the stronger than expected service sector lifted the monthly GDP reading more than anticipated. The trade deficit narrowed by GBP100 mln from October but it was still about GBP100 mln more than economists forecast. Industrial output was expected to have risen by 0.2% but instead fell by 0.4% and the small upward revision (to -0.5% from -0.6%) makes little difference. The index of services, on the other hand, rose by 0.3% instead of 0.1% as had been expected. This offset much of the negativity to lift the monthly GDP to 0.2% in November from 0.1% in October. The vote next week in the House of Commons on the Withdrawal Bill, which by most accounts, faces the prospect of a stunning defeat overwhelms the economic data on sentiment.

Italy rounded out the miserable EMU industrial output performance in November. Recall last week investors learned German industrial production crashed by 1.9% (for a -4.7% year-over-year pace) and earlier this week, France reported a 1.3% drop (-2.1% year-over-year). Today investors learned that Italian industrial output slumped 1.6% (-2.6% year-over-year). We suspect that besides toying with its forward guidance, the ECB will move toward a new round of Targeted Long-Term Refinance Operations (TLTRO) in Q2.

After breaking above $1.15 in the middle of the week, it has found good demand below there on pullbacks. It is interesting to note that Turkey has swapped the $2 bln it raised in a bond auction into euros, but it hardly accounts for the persistence of the euro’s upticks. It is up for the fifth time in the past seven sessions. There is a 2.5 bln euro option struck at $1.15 that expires today. Half a cent higher is another expiring option for about 785 mln euro. With little exception, sterling has been confined to a $1.27-handle this week. The euro is posting an outside down day against sterling after running out of steam near GBP0.9025. The lower end of the range is seen near GBP0.8950.

North America

More than half of the FOMC spoke in recent days and although many pundits seem confused, with the exception of St. Louis’s Bullard, it seemed like they sung from a common songbook. The new chorus line is “patience and flexibility.” In Fed-speak this means that there will be no rate hike in March (patience) and it is not committed to any rate path (flexibility). The continued reduction of the balance sheet, which was not much of a focus when the S&P 500 was racing to record highs at the end of Q3, has now become the favorite whipping boy. In practice, while the Fed can be more patient with the rate hikes, it has not altered its balance sheet operations. Although the Fed does not know the final target size of the balance sheet, we suspect it will be reached either at the end of this year or the middle of next year at the latest.

Fed officials by and large seem more constructive on the economic outlook than many investors and economists. Plain-spoken Powell was among the clearest: there is no sign of elevated risks of a recession. His biggest worry was the slowing of the world economy and China in particular. Given the plethora of measures China is taking to lift the economy, including structural reforms, assuming the government re-opens, the trade tensions with China are resolved, even if the longer-term competitive challenges remain, and the US economy performs like the Fed expects, a rate hike around the middle of the year is very much play. Part of the challenge is policymakers and investors will not have much data during the government shutdown.

Today’s CPI report, like last week’s employment data, comes from the Department of Labor, which has already secured its funding. Softer energy prices will likely weigh on the headline, which will be pulled lower from 2.2% in November. It would be the first monthly decline since March. The core rate, though, likely remained firm, and a 0.2% increase on the month will keep the year-over-year rate at 2.2%.

The cautionary tone by the Bank of Canada earlier this week has failed to dent the Canadian dollar, which has risen every day for the past two weeks, except yesterday. The dramatic rise in oil prices and rising equities (risk-on) appear to be the main drivers. A break of the CAD1.3180 area, the week’s low would bring the next technical target near CAD1.3120 into view. The technical indicators are stretched, but there is no sign of a turn yet or divergences. Still, momentum and trend-followers need to be on guard for a reversal pattern.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,$AUD,$CAD,$CNY,$EUR,$JPY,Featured,newsletter,SPX