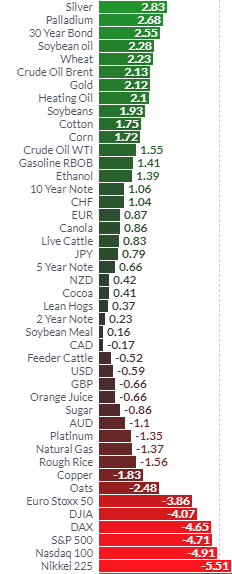

Close Gain/Loss On Week Gold 48.40 +.10 +2.19% Silver .63 +%excerpt%.25 +3.25% XAU 67.94 +2.40% +5.40% HUI 153.93 +2.58% +6.13% GDM 560.05 +2.34% +5.32% JSE Gold 1201.13 -0.09 +9.31% USD 96.60 -0.14 -0.61% Euro 114.10 +0.24 +0.80% Yen 88.80 +0.01 +0.67% Oil .61 +.12 +3.30% 10-Year 2.856% -0.031 -4.86% Bond 143.90625 +0.34375 +2.27% Dow 24388.95 -2.24% -4.50% Nasdaq 6969.25 -3.05% -4.93% S&P 2633.08 -2.33% -4.60% Weekly Performance (Source: GoldSeek) Gold acted as a safe haven last week and is again acting as a safe haven in December. It has performed well despite the rout in stocks in Ireland and globally. U.S. stocks including the S&P500 and Nasdaq were down nearly 5% last week, while gold was 2% higher

Topics:

Mark O'Byrne considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Daily Market Update, Featured, Gold and its price, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

| Close | Gain/Loss | On Week | |

| Gold | $1248.40 | +$10.10 | +2.19% |

| Silver | $14.63 | +$0.25 | +3.25% |

| XAU | 67.94 | +2.40% | +5.40% |

| HUI | 153.93 | +2.58% | +6.13% |

| GDM | 560.05 | +2.34% | +5.32% |

| JSE Gold | 1201.13 | -0.09 | +9.31% |

| USD | 96.60 | -0.14 | -0.61% |

| Euro | 114.10 | +0.24 | +0.80% |

| Yen | 88.80 | +0.01 | +0.67% |

| Oil | $52.61 | +$1.12 | +3.30% |

| 10-Year | 2.856% | -0.031 | -4.86% |

| Bond | 143.90625 | +0.34375 | +2.27% |

| Dow | 24388.95 | -2.24% | -4.50% |

| Nasdaq | 6969.25 | -3.05% | -4.93% |

| S&P | 2633.08 | -2.33% | -4.60% |

Weekly Performance (Source: GoldSeek)

|

Gold acted as a safe haven last week and is again acting as a safe haven in December. It has performed well despite the rout in stocks in Ireland and globally. U.S. stocks including the S&P500 and Nasdaq were down nearly 5% last week, while gold was 2% higher and silver over 3% higher. Gold and silver saw even larger gains in euros, pounds and most other fiat currencies and are seeing gains in most fiat currencies in 2018. With the risk of a U.S. recession increasing and U.S. stock indices near record highs, it is a good time to rebalance portfolios. As is frequently the case, gold can suffer in the initial market sell off and be correlated with risk assets. However, it tends to bottom quicker and bounce and display an inverse correlation to risk assets. |

Gold Silver Stocks |

| This is especially the case over the long term – on a monthly, quarterly or annual basis.

Gold has consolidated after its recent sell off. Gold ETF and physical demand globally and especially in China remains robust and this should push gold higher in the New Year. Markets being sentiment and momentum driven this could mean the recent correction in gold is over. Technical driven traders are likely to take signal from the recent price gains, in the face of stock market sell offs, and many will be seeking to reverse short positions and go long gold. Gold appears to have bottomed and looks set to have a strong 2019 given the increasingly positive fundamentals. |

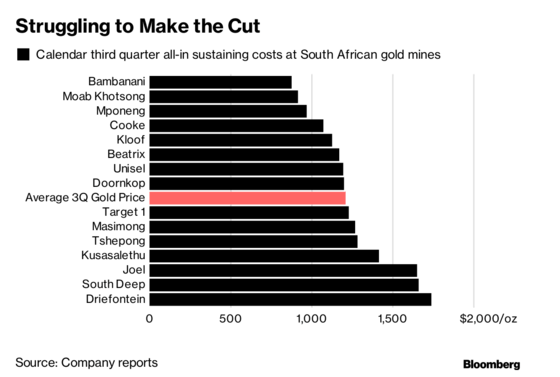

South African Gold Mines |

| Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below |  |

Tags: Daily Market Update,Featured,newsletter