In an NBER working paper, Matthias Fleckenstein and Francis Longstaff argue that Treasuries do not trade at a premium: It is widely believed that Treasuries trade at premium prices because of their safety and money-like properties. In reality, this is only true on a relative basis when compared to other bonds, but is often not true on an absolute basis. Many Treasuries have repeatedly traded at substantial discounts to their intrinsic fair values for extended periods during the past...

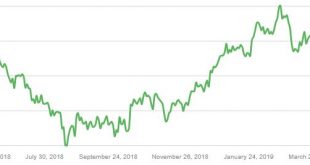

Read More »Gold Tops $1,300/oz As Trade Wars Escalate and Increased Risk of U.S. War With Iran

* Gold sees safe haven demand push it to highest in one month as it breaches key $1,300/oz and £1,000/oz levels * U.S. China trade wars escalates as China retaliates and imposes tariffs on $60 billion of U.S. goods * Increased risk of war in Middle East after U.S. alleges Iran bombed Saudi oil vessels destined for the U.S. Gold prices held steady near one-month highs today as an escalation in Sino-U.S. trade war saw...

Read More »Is Lending the Root of All Evil? Report 24 Feb

Ayn Rand famously defended money. In Atlas Shrugged, Francisco D’Anconia says: “So you think that money is the root of all evil? . . . Have you ever asked what is the root of money? Money is a tool of exchange, which can’t exist unless there are goods produced and men able to produce them. Money is the material shape of the principle that men who wish to deal with one another must deal by trade and give value for value....

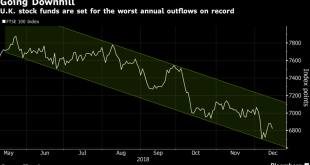

Read More »Gold Prices In Pounds and Euros Gain More as Economic Growth Falters in the UK and EU

Gold prices in pounds and euros as economic growth falters in UK and EU Euro & pound gold tests multi year resistance; likely to surpass due to strong demand Improved risk appetite sees stocks rise which may be hampering stronger gains for gold Investors concerns regarding trade wars, Brexit, Italexit, the economic outlook and looser monetary policies is seeing robust demand for gold bullion Gold prices broke...

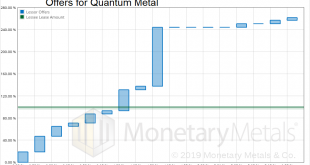

Read More »Quantum Metal Lease #1 (gold)

Monetary Metals leased gold to Quantum Metal, to support the growth of its gold distribution business through retail bank branches. The metal is held in the form of retail Perth Mint bars. For more information see Monetary Metals’ press release. Metal: Gold Commencement Date: January 31, 2019 Term: 1 year Lease Rate: 4.5% net to investors Offers for Quantum Metal - Click to enlarge...

Read More »Gold Consolidates Above $1,300 After 1.2 percent Gain Last Week

via Marketwatch: Gold futures settled above $1,300 an ounce on Friday, with prices for the yellow metal at their highest since June as the U.S. dollar pulled back and investors eyed geopolitical turmoil and global growth worries. Rising gold prices reflect “political uncertainty” in the U.S., Eurozone, Venezuela and pockets of South America, as well as China-U.S. trade talks, said George Gero, managing director in RBC....

Read More »Rising Interest and Prices, Report 13 Jan 2019

For years, people blamed the global financial crisis on greed. Doesn’t this make you want to scream out, “what, were people not greedy in 2007 or 1997??” Greed utterly fails to explain the phenomenon. It merely serves to reinforce a previously-held belief. Far be it from us to challenge previously-held beliefs (OK, OK, we may engage in some sacred-ox-goring from time to time), but this is not a scientific approach to...

Read More »Surest Way to Overthrow Capitalism, Report 6 Jan 2019

One of the most important problems in economics is: How do we know if an enterprise is creating or destroying wealth? The line between the two is objective, black and white. It should be clear that if business managers can’t tell the difference between a wealth-creating or wealth-destroying activity, then our whole society will be miserably poor. Any manager will tell you that it’s easy. Just look at the profit and loss...

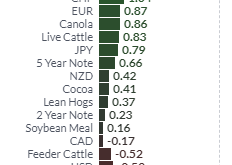

Read More »Change is in the Air – Precious Metals Supply and Demand

Fundamental Developments: Physical Gold Scarcity Increases Last week, the price of gold rose $25, and that of silver $0.60. Is it our turn? Is now when gold begins to go up? To outperform stocks? Something has changed in the supply and demand picture. Let’s look at that picture. But, first, here is the chart of the prices of gold and silver. Gold and Silver Price(see more posts on gold price, silver price, )Gold and...

Read More »Gold and Silver Gained 2 percents and 3 percents Last Week While Stocks Dropped Nearly 5 percents

Close Gain/Loss On Week Gold $1248.40 +$10.10 +2.19% Silver $14.63 +$0.25 +3.25% XAU 67.94 +2.40% +5.40% HUI 153.93 +2.58% +6.13% GDM 560.05 +2.34% +5.32% JSE Gold 1201.13 -0.09 +9.31% USD 96.60 -0.14 -0.61% Euro 114.10 +0.24 +0.80% Yen 88.80 +0.01 +0.67% Oil $52.61 +$1.12 +3.30% 10-Year 2.856% -0.031 -4.86% Bond 143.90625 +0.34375 +2.27% Dow 24388.95 -2.24% -4.50% Nasdaq 6969.25 -3.05% -4.93% S&P 2633.08 -2.33%...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org