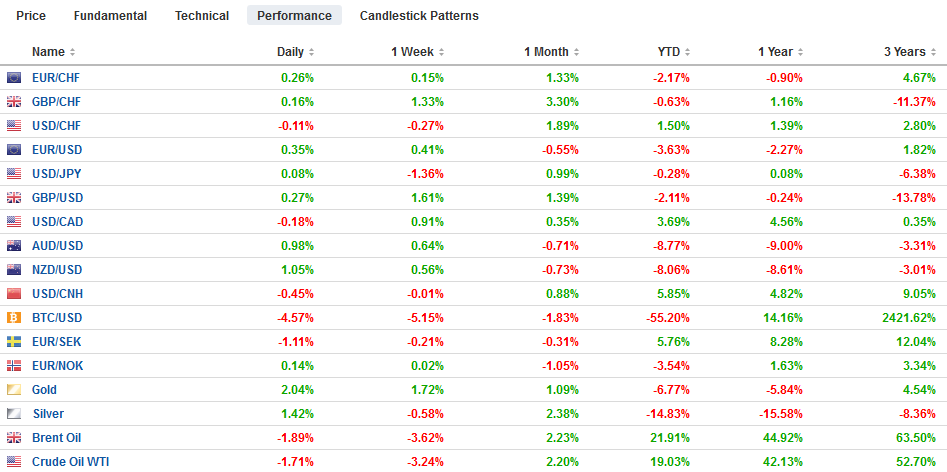

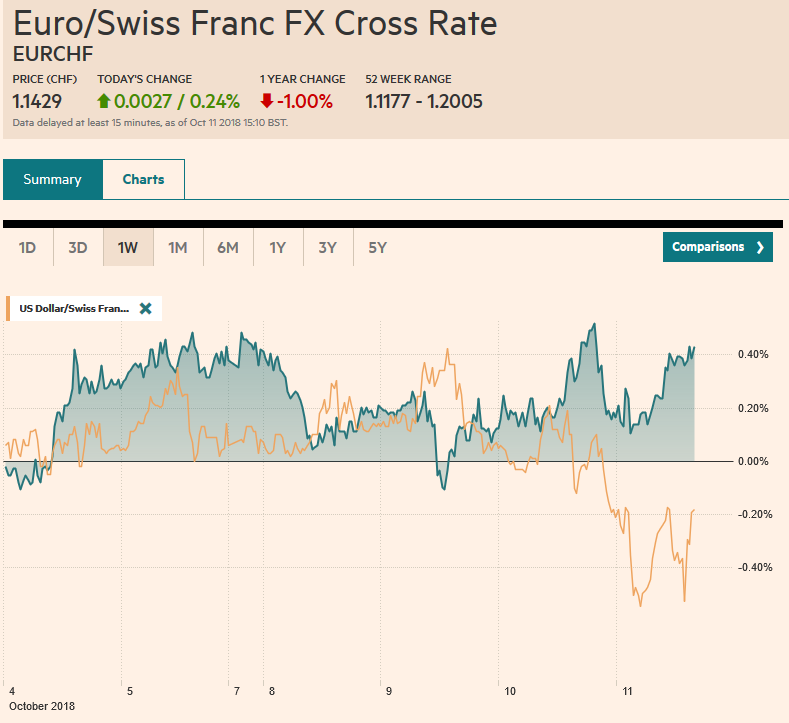

Swiss Franc The Euro has risen by 0.24% at 1.1429 EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is one story today, and that is the sell-off in global equities. Although the narratives put the US at the center, the fact of the matter is that US equities have been among the best performers this year, despite the rise of interest rates and a President that is not above criticizing the central bank. Other benchmarks, like the MSCI Emerging Markets and its Asia Pacific Index and the Dow Jones Stoxx 600 in Europe were all well below 200-day moving averages. It has taken today’s follow-through decline in the S&P 500 to test

Topics:

Marc Chandler considers the following as important: $CNY, $TRY, 4) FX Trends, AUD, CAD, EUR, Featured, JPY, newsletter, Oil, SPX

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.24% at 1.1429 |

EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: There is one story today, and that is the sell-off in global equities. Although the narratives put the US at the center, the fact of the matter is that US equities have been among the best performers this year, despite the rise of interest rates and a President that is not above criticizing the central bank. Other benchmarks, like the MSCI Emerging Markets and its Asia Pacific Index and the Dow Jones Stoxx 600 in Europe were all well below 200-day moving averages. It has taken today’s follow-through decline in the S&P 500 to test its 200-day moving average (~2765) for the first time in five months. The rout in Asia took markets down 3.5%-6.5%, with the tech-heavy Taiwan hit among the hardest (-6.3%). European bourses are around 1.5% lower in late-morning activity, matching yesterday’s loss and bring the Dow Jones Stoxx 600 loss to date to about 7.25%. The equity slide is giving bonds a bond and yields are lower in Asia and core Europe. Yields in the periphery are higher, led by a five basis point increase in Italy, which is trying to raise 6.5 bln euros in bond sales. In the foreign exchange markets, the dollar is softer and ironically the yen, which often strengthens during risk-off periods, is underperforming, while the dollar-bloc is firm, and in emerging markets, the typically volatile Turkish lira and South African rand are leading, the advance. The usually lower volatile Asian currencies like the Korean won (~-0.9%) and Taiwanese dollar (~-0.45%) are among the poorest performers today. |

FX Performance, October 11 |

Causes and Effects: There does not seem to be an obvious trigger for equity rout. Most narratives link it to US rates, trade tensions, and/or positioning around earnings. While any of these could be the spark, many investors also realize that none is needed. Moreover, none seem compelling, and it is precisely because of this that the market’s fever may burn itself out. We note that the markets open the latest in Asia have done suffered as deep of losses and that European equities are down less than Asia, (which also speaks to technology’s leadership). At the risk of being naive, a test on 200-moving average in the S&P 500 has proven itself a good buying opportunity over the last couple of years. Penetration has occurred, but it has been mostly brief and shallow.

President Trump was quick to blame the Fed for what he later recognized may have been a long-overdue correction. However, some of the Fed’s critics were sympathetic to the idea that Fed tightening was at least part of the problem. By most measures, Fed policy is still accommodative. The US reports September CPI figures today. The headline may ease to 2.4% (from 2.7%) while the core may edge up to 2.3% from 2.2%. The fed funds target is 2.00%-2.25% meaning that despite an economy growing well above trend, unemployment at the lowest level in a generation, adjusted for inflation, the real fed rates target is still negative. Around 2.8%, the two-year note yield is a little below when the Fed sees the long-term equilibrium rate for fed funds.

Powell Put: The fact that the US President could openly criticize the Fed and even suggest it is “crazy” and that the market generally accepted that the criticism won’t impact the course of monetary policy speaks to the institutional strength of the US and the difference between it and many developing countries. Investors often punish a country by demanding higher interest rates or depreciating a currency when a government appears to encroach on the independence of the central bank. Consider that implied yield of the December 2019 fed funds futures contract eased two basis points in the face of the equity swoon. The slightly lower rate, which is a few basis points lower today, is the recognition that continued equity market volatility could influence the Fed. The Fed meets early next month, but as the meeting is not followed by a press conference, and the Fed just hiked in September, there was understood that the next hike would be in December. Moreover, from comments by Powell in the past, we think that in the market’s vernacular, there is Powell Put, but with elevated valuations (which the IMF noted in its update of the world economic outlook) the strike price may be lower than suspected in the past.

Currency Manipulation: A couple of months before the 1987 equity market crash, the Baker, the Treasury Secretary at the time, threaten Germany with a weaker dollar if it did not do more to stimulate its economy. The buzz this week is that for the first time since 1994 the US may cite China as a currency manipulator in next week’s Treasury report. Most observers would agree that it does not meet the Congressional three-prong definition having to do with the size of the overall trade balance, the bilateral balance, and intervention. China meets only the criteria of a large trade surplus with the US. It ran a current account deficit in H1, and some expected it to be more chronic situation going forward. To the extent that the PBOC has intervened, it appears to have done so to prevent or slow the yuan’s decline. In fact, we, like some others, think that if the PBOC stood back, a floating yuan would sink.

While the US Treasury Secretary has discretion, the risk with devising a new definition is that it may catch up with other countries which the US may not wish to cite. If China is indeed cited, the implications are more symbolic than real. China would be forced to have bilateral talks with the US. China is open to these now. It is the US that does not want to talk, seemingly intent on trying to use the tariffs and threats of more to soften up China for a negotiated settlement.

The G20 meeting at the end of November offers a window of opportunity for Trump and Xi to talk, but if China does not make concessions, and there is no reason to think it will, the US may conclude there is not much to discuss. The 10% tariff the US recently levied on $200 bln of Chinese goods increases to 25% at the start of next year. The symbolic importance, however, should not be underestimated. It would likely be seen as an escalation of tensions, which as the recent developments in the South China Sea, and the denial by Hong Kong of a port call illustrate, the confrontation is multi-faceted.

Amid the sea of gloom, there has been a positive development to note. The sharp devaluation of he Turkish lira has sparked a dramatic recovery of its external imbalance. Earlier today, Turkey reported its first monthly current account surplus since September 2015. The $2.59 bln surplus is a little larger than economists had expected. A sustained surplus would remove a weight from the curency, but there are other concerns for investors. Also, the surplus may be a reflection not simply of a more competitive lira, but the compression of domestic demand and the high interest rates and inflation choke the local economy.

Oil prices are extending their decline. The November light sweet crude oil futures contract is off another 1.8% after yesterday’s 2.3% drop. There are few demand concerns. Some stem from the weakening of equities and the trade tensions that may slow global growth. The storm hitting the US may not impact the supply of oil as much as keep drivers off the road. After the markets closed yesterday, API estimated that US crude inventories jumped 9.75 mln barrels last week. It would be the biggest jump in 18 months if confirmed by the EIA today. Yesterday the EIA lifted its forecast of US oil production next year to 11.76 mln barrels a day from 11.5 mln. Technical support for the November contract is seen in the $70.80-$71.00 area (trendline retracement objective, previous consolidation).

We had been looking for the dollar to correct lower this week and we now suspect the pullback is over or nearly so. Look for the expiring $1.16 option 1.6 bln euros to be sufficient to cap the euro’s upside. The greenback was pushed briefly below JPY112.00 but quickly grabbed, and session highs near JPY112.40 were seen in the European morning. There are JPY112.60-JPY112.80 options for $1.3 bln that may come into play. Sterling made to almost $1.3250 after bottoming last week near $1.2920 apparently on US dollar weakness and less pessimism over an EU agreement on Brexit in the coming days. Although it was sold back toward $1.3080, it looks set to take another run at the upside. A two-month high set in September is near $1.3320 and is the next technical target. The US dollar recorded an outside up day against the Canadian dollar yesterday, but there has been no follow-through today. We suspect the greenback’s rally was exaggerated and look for a return to CAD1.30 and possibly below ahead of the weekend.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: $AUD,$CAD,$CNY,$EUR,$JPY,$TRY,Featured,newsletter,OIL,SPX