See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Wrong-Way Event. Last week we said something that turned out to be prescient: This is not an environment for a Lift Off Event. An unfortunate technical mishap interrupted the latest moon-flight of the gold rocket. Fear not true believers, a few positive tracks were left behind. [PT] Fundamental Developments The price of gold didn’t move much Mon-Thu last week, though the price of silver did seem to be blasting off. Then on Friday, it reversed hard. We will provide a forensic look at the intraday action on Friday, and our usual picture of the gold and silver fundamentals. But first, here is the chart of the prices of

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, Chart Update, dollar price, Featured, Gold, Gold and its price, gold basis, Gold co-basis, gold price, gold silver ratio, newsletter, Precious Metals, silver, silver basis, Silver co-basis, silver price, Tags: Chart Update

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Wrong-Way Event.Last week we said something that turned out to be prescient:

|

|

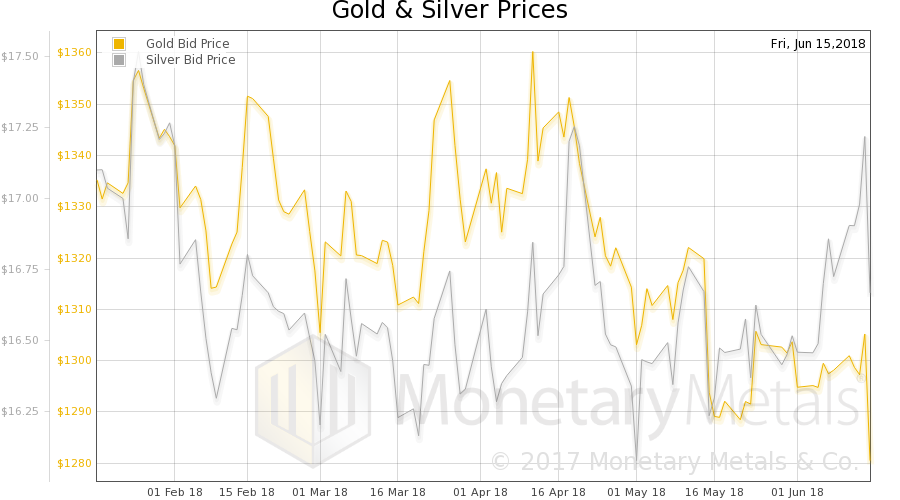

Fundamental DevelopmentsThe price of gold didn’t move much Mon-Thu last week, though the price of silver did seem to be blasting off. Then on Friday, it reversed hard. We will provide a forensic look at the intraday action on Friday, and our usual picture of the gold and silver fundamentals. But first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

Gold: Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It fell most of this week, recovering to unchanged by market close on Friday. |

Gold: Silver Ratio(see more posts on gold silver ratio, ) |

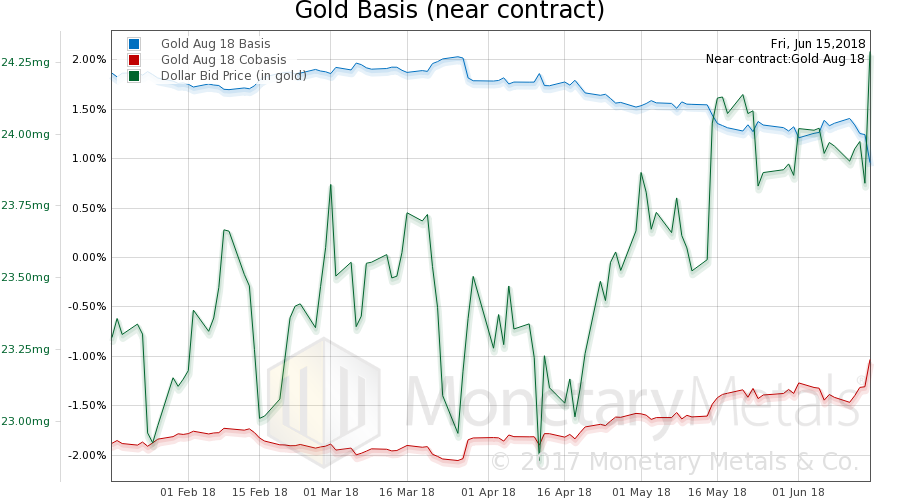

Gold Basis and Co-basis and Dollar PriceHere is the gold graph showing gold basis, co-basis and the price of the dollar in terms of gold price. |

Gold Basis and Co-basis and the Dollar price(see more posts on dollar price, gold basis, Gold co-basis, ) |

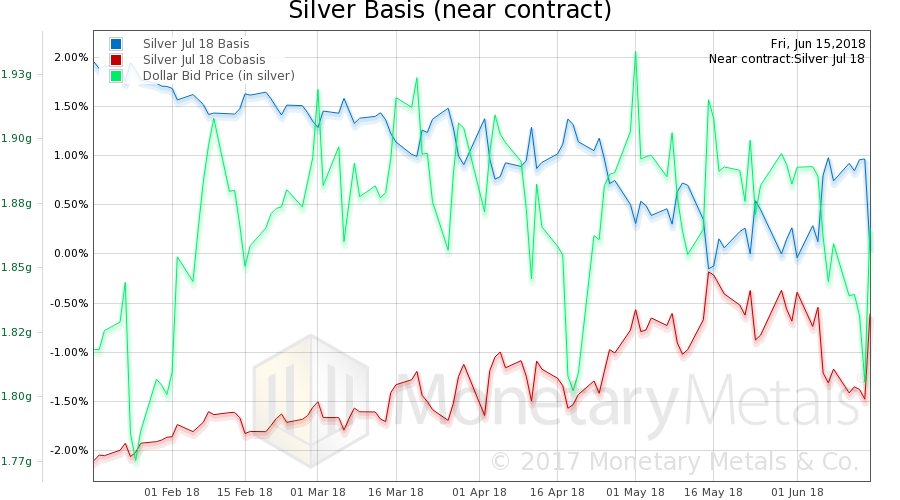

Silver Basis and Co-basis and the Dollar PriceOn Friday, there was a big rise in the dollar (i.e. drop in the price of gold). And a sizable increase in the scarcity of the metal to the market (i.e., the co-basis). Nothing unusual about this. The Monetary Metals Gold Fundamental Price fell another $16 this week to $1,335. The fundamental has now completed its round trip, first up out of the range it’s held since Q2 2017, and now back into that range. Now let’s look at silver. The price of silver was up all this week, until Friday. The drop on Friday more than reversed the move from Mon-Thu. And not surprisingly, the scarcity of silver fell in those four days, and rose sharply on Friday. The Monetary Metals Silver Fundamental Price rose 38 cents to $17.13, right back to where it was the previous week. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

A Closer Look at Market InnardsFriday was a big day in the market. Let us look at the price and basis action. First, here is the gold price overlaid with the August basis. In the wee hours of the morning (this is London time), the basis begins around 1.2%. By 2:00 PM, it is down to about 0.93%. This is a drop of 25 bps. In other words, 21% of the total basis was sucked out during the move. When basis falls, this means the price of futures is declining relative to spot. When it happens during a price drop, then we conclude that the selling was stronger in the futures than the spot market. However, do not take away from this that demand for physical metal was strong but someone pushed the market down $21 by selling futures. 25 bps means that the spread between the August future and spot dropped by about 41 cents. Let that sink in. The market price dropped from $1,301 to $1,280, or $21. The spread between futures and spot fell by around 50 cents. The selloff may have been stronger in futures, but make no mistake. The selling in spot was nearly as heavy. |

Gold price action late last week vs. August basis |

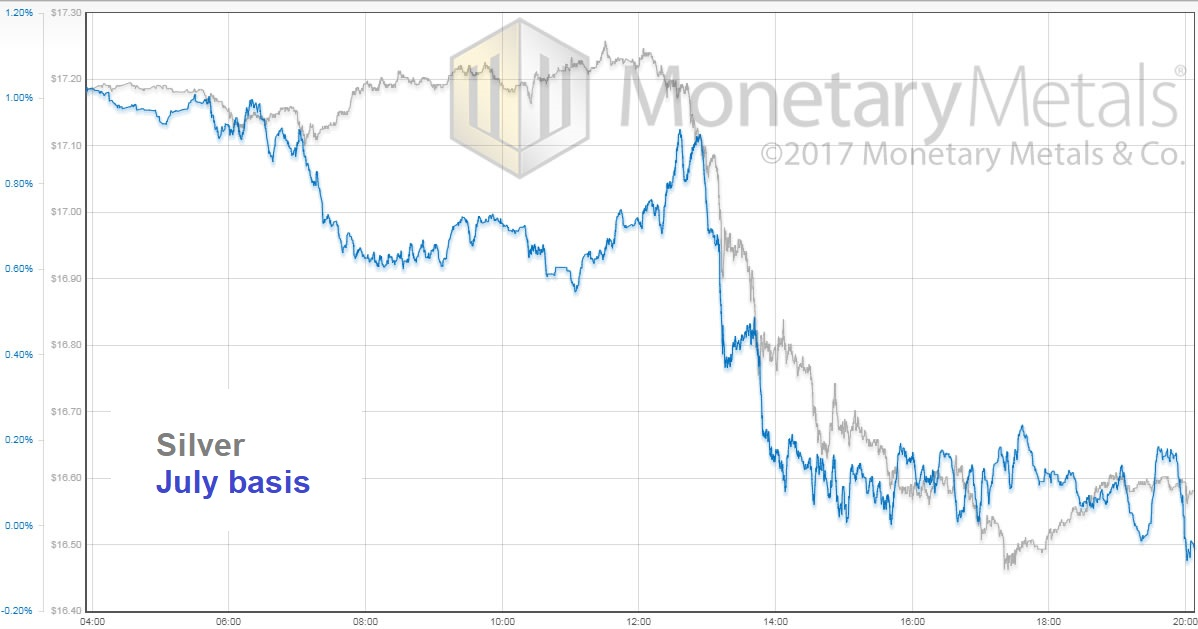

| Here is the silver price overlaid with the July basis.

There are some interesting differences. In gold, the price holds steady until just past noon, while the basis is clearly dropping. This means there was steady, but light, selling pressure in futures offset by steady demand for physical. The selling leads the price down, which only converges with the basis around 3 PM. But in silver, the basis is falling with a rising price from around 7:00 AM. This means robust buying of physical metal. Then the basis begins rising around 11:00 AM, with a steady price, indicating speculators buying in the futures market, just as buyers backed off in the spot market. The basis continues to rise through about 13:00, by which time the price has already dropped 15 cents. Rising basis and falling price means selling of physical metal. Sorry, but that is the mechanics behind this observation. Finally, the price and basis go over the edge just as in gold. The basis drops from around 1% to around 0.1% (this is the July contract, already under heavy pressure due to the roll, so take the magnitude with a grain of salt). This amounts to about a 1.5-cent drop in the spread between July futures and spot. The gold fundamental price fell $10 on Friday, but the silver fundamental price rose 9 cents the same day. And this is why we watch the fundamentals. Looking only at prices, one would have to think that on Friday the market changed, and people wanted less silver. Yet the price at which the metal would clear, absent speculators in the futures market, was up slightly. This means that the fundamental price of gold continued its slide from late April. And silver’s fundamental price increased this week. The market price action might suggest only the former. |

Silver price late last week vs. July basis(see more posts on silver price, ) |

© 2018 Monetary Metals

Charts by Monetary Metals

Chart and image captions by PT

Tags: Chart Update,dollar price,Featured,Gold,gold basis,Gold co-basis,gold price,gold silver ratio,newsletter,Precious Metals,silver,silver basis,Silver co-basis,silver price,Tags: Chart Update