Euro area core inflation rebounded in December. We expect a more sustained adjustment in core prices to start in H2 2018, and to continue in 2019.Euro area core inflation rebounded to 1.0% in January, from 0.9% in the previous month, in line with expectations. There is no escaping the fact that the ECB remains “some distance” from meeting its inflation criteria, as Peter Praet said this week.Our inflation forecasts are consistent with a delayed normalisation in the ECB’s stance as core inflation looks unlikely to rebound on a sustained basis before the second half of this year. We expect services inflation to edge gradually higher, although a stronger EUR would cap any further rebound in core goods inflation.The ECB’s three inflation criteria are likely to be fully met by September, when

Topics:

Frederik Ducrozet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Euro area core inflation rebounded in December. We expect a more sustained adjustment in core prices to start in H2 2018, and to continue in 2019.

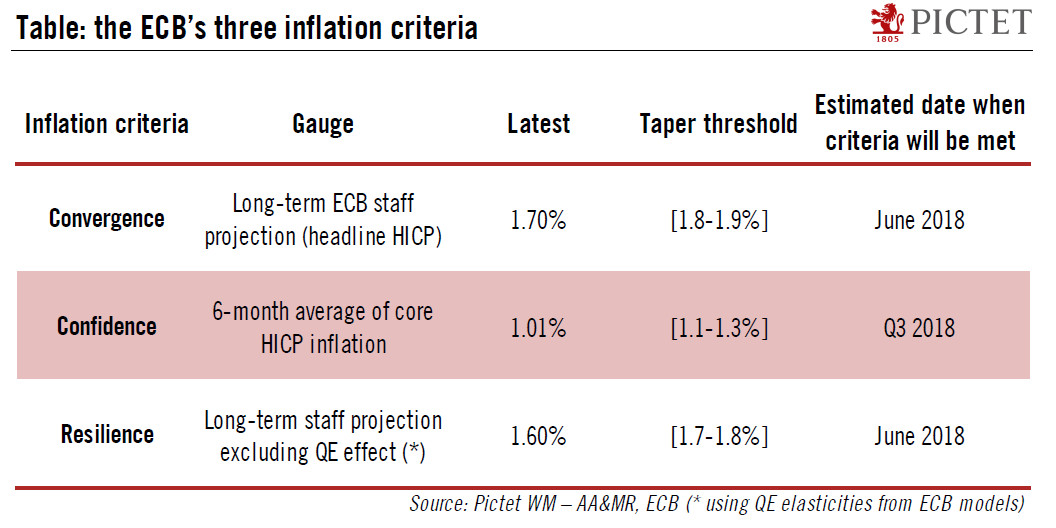

Euro area core inflation rebounded to 1.0% in January, from 0.9% in the previous month, in line with expectations. There is no escaping the fact that the ECB remains “some distance” from meeting its inflation criteria, as Peter Praet said this week.

Our inflation forecasts are consistent with a delayed normalisation in the ECB’s stance as core inflation looks unlikely to rebound on a sustained basis before the second half of this year. We expect services inflation to edge gradually higher, although a stronger EUR would cap any further rebound in core goods inflation.

The ECB’s three inflation criteria are likely to be fully met by September, when we expect a gradual tapering of asset purchases to start. The timing and pace of rate hikes will be driven by future developments in core inflation, which we expect to rise more rapidly going into 2019.

In the end, our ECB scenario remains unchanged, including in terms of communication, tapering and rate hikes, but the balance of risks is moving – in our view, in opposite direction for 2018 compared with 2019. The combination of above-potential growth and rising inflation expectations from surveys (PMI price pressures; Survey of Professional Forecasters) should strengthen the ECB’s confidence and lead to hawkish changes in its communication over the course of the year (see “Guide me if you can!”). We expect a transition in forward guidance from QE to policy rates in March, followed by a tapering announcement in June or in July.

But, ultimately, it is actual core inflation that will drive policy decisions. We expect a more sustained adjustment in core prices to start in H2 2018, and to continue in 2019. In short, we see the risks as tilted towards a more dovish ECB in the next six months, but once the normalisation process starts, we expect the ECB to tighten faster than markets expect, at least initially.