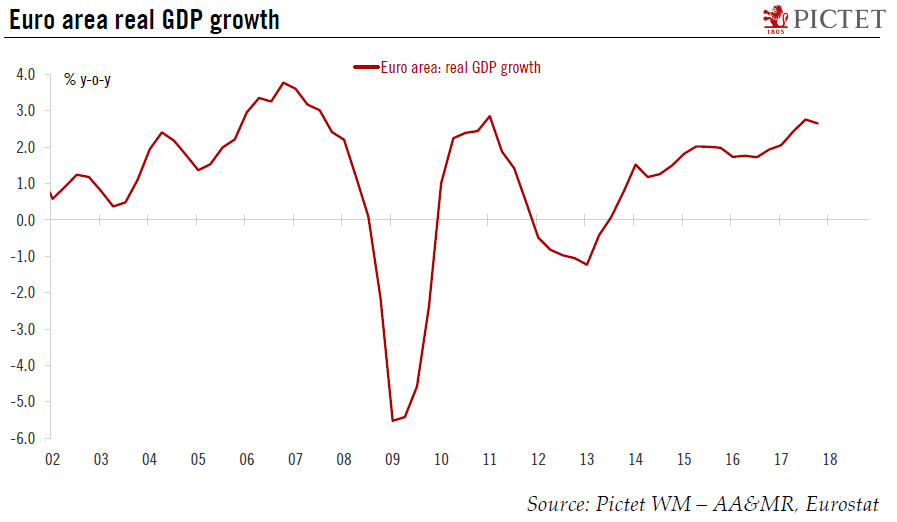

Euro area real GDP expanded in Q4, in line with expectations but marginally less than in Q3. We forecast GDP growth of 2.3% in 2018, with near-term upside risks.According to Eurostat’s preliminary estimate, euro area real GDP rose by 0.6% q-o-q in Q4 (2.3% q-o-q annualised; 2.7% y-o-y), in line with consensus expectations but slightly less than its upwardly-revised 0.7% q-o-q increase in Q3.The euro area economy expanded by 2.5% in 2017 overall, its fastest annual growth since 2007. The flash Q4 estimate is based on figures published by six countries (including Spain and France), as well as some confidential inputs from five others. German and Italian flash GDP readings are due on 14 February, while the euro area breakdown by expenditure components will be published on 7 March.The French

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Euro area real GDP expanded in Q4, in line with expectations but marginally less than in Q3. We forecast GDP growth of 2.3% in 2018, with near-term upside risks.

According to Eurostat’s preliminary estimate, euro area real GDP rose by 0.6% q-o-q in Q4 (2.3% q-o-q annualised; 2.7% y-o-y), in line with consensus expectations but slightly less than its upwardly-revised 0.7% q-o-q increase in Q3.

The euro area economy expanded by 2.5% in 2017 overall, its fastest annual growth since 2007. The flash Q4 estimate is based on figures published by six countries (including Spain and France), as well as some confidential inputs from five others. German and Italian flash GDP readings are due on 14 February, while the euro area breakdown by expenditure components will be published on 7 March.

The French economy grew by 0.6% q-o-q in Q4 and the Spanish economy by 0.7% q-o-q.

As for 2018, the first set of euro area sentiment indicators suggests that the euro area started the year on a very strong note and confirmed that growth is improving, in quantity as well as quality, with rising job creation and investment. That said, some forward-leading indicators (in particular IFO expectations and manufacturing new export orders) have dropped modestly in January, consistent with our forecast of a gradual slowdown in the pace of growth in the second half of 2018. We forecast euro area GDP growth of 2.3% in 2018, with near-term upside risks.