The SNB may soon start to normalise its monetary policy. We expect a first rate hike of 25bp in December 2018.There are several reasons to believe that the SNB may soon start to normalise its monetary policy. First, the Swiss macroeconomic outlook has improved: Swiss growth is picking up and becoming broader-based across a range of sectors, while inflation is also gradually rising. Second, the Swiss franc has weakened and the pressure on the currency has become somewhat softer. Third, other central banks (in particular the Fed and the ECB) are gradually removing some of their own stimulus. The key question is when and how the SNB will normalise?A change of communication regarding future monetary policy is likely during H2 2018 as the SNB will want to wait for sure signs that the European

Topics:

Nadia Gharbi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The SNB may soon start to normalise its monetary policy. We expect a first rate hike of 25bp in December 2018.

There are several reasons to believe that the SNB may soon start to normalise its monetary policy. First, the Swiss macroeconomic outlook has improved: Swiss growth is picking up and becoming broader-based across a range of sectors, while inflation is also gradually rising. Second, the Swiss franc has weakened and the pressure on the currency has become somewhat softer. Third, other central banks (in particular the Fed and the ECB) are gradually removing some of their own stimulus. The key question is when and how the SNB will normalise?

A change of communication regarding future monetary policy is likely during H2 2018 as the SNB will want to wait for sure signs that the European Central Bank (ECB) is ending its QE programme and that an ECB deposit rate hike is on the cards for Q3 2019, as we expect.

Our best guess is that there will be a first rate hike of 25bp in December 2018 (assuming that the ECB will have signalled the end of its QE programme). This would mean its policy rate would remain below the ECB’s current deposit rate of -0.40%. A second hike is then projected for Q3 2019, when we also expect the ECB to raise policy rates for the first time.

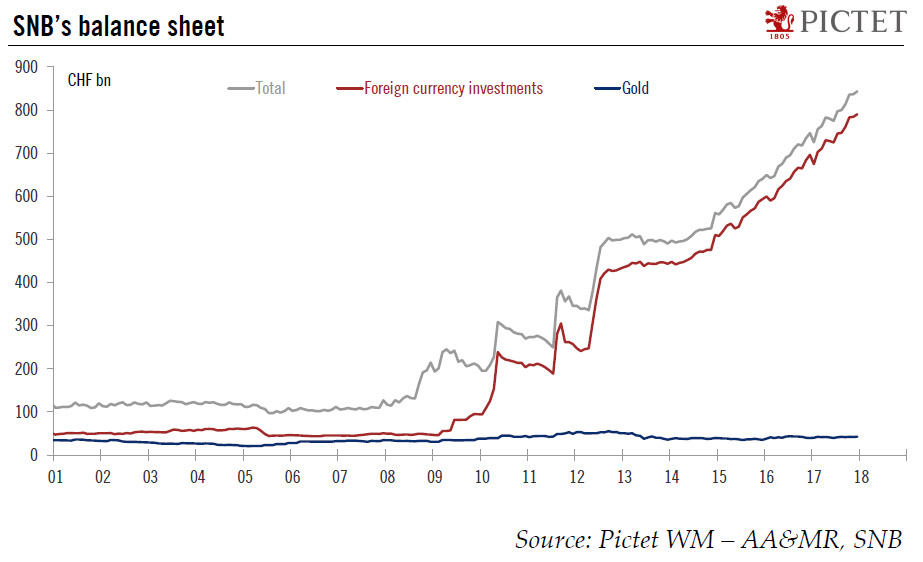

Regarding the SNB’s balance sheet, our impression is that the path of least resistance would be for the SNB to stop reinvesting the principal repayments, leading to a passive reduction of its balance sheet.