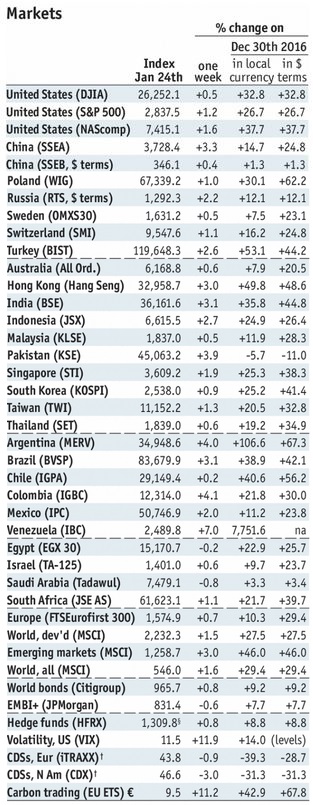

Stock Markets EM FX closed Friday on a mixed note, but still posted solid gains for the week as a whole. Best performers last week were ZAR, PLN, and CZK while the worst were ARS, PHP, and IDR. The bearish dollar environment remains intact and so we see further gains for EM FX this week. However, we continue to warn that divergences within EM are likely to assert themselves. Stock Markets Emerging Markets, January 27 Source: economist.com - Click to enlarge Brazil Brazil reports December central government budget data Monday. A deficit of -BRL25.0 bln is expected. If so, the 12-month total would narrow sharply to -BRL127 bln, the smallest since January 2016. It then reports consolidated budget data Wednesday.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX closed Friday on a mixed note, but still posted solid gains for the week as a whole. Best performers last week were ZAR, PLN, and CZK while the worst were ARS, PHP, and IDR. The bearish dollar environment remains intact and so we see further gains for EM FX this week. However, we continue to warn that divergences within EM are likely to assert themselves. |

Stock Markets Emerging Markets, January 27 Source: economist.com - Click to enlarge |

BrazilBrazil reports December central government budget data Monday. A deficit of -BRL25.0 bln is expected. If so, the 12-month total would narrow sharply to -BRL127 bln, the smallest since January 2016. It then reports consolidated budget data Wednesday. Tax revenues rose 8% y/y in December, suggesting a solid budget reading. December IP will be reported Thursday, which is expected to rise 3.3% y/y vs. 4.7% in November. ColombiaColombia central bank meets Monday. The market is almost evenly split. Of the 35 analysts polled by Bloomberg, 17 see steady rates and 18 see a 25 bp cut to 4.5%. We think a 25 bp cut is likely. CPI rose 4.1% y/y in December, which is above the 2-4% target range. However, that didn’t stop the bank from easing last year in order to help boost the sluggish economy. South AfricaSouth Africa reports December budget, money, and private sector credit Tuesday. Markets are likely to focus on the fiscal outlook ahead of next month’s budget statement. If the government cannot deliver a credible plan to limit the deficit, we think rating agencies will downgrade South Africa soon thereafter. December trade will be reported Wednesday. TurkeyCentral Bank of Turkey releases its quarterly inflation report Tuesday. CPI rose 11.9% y/y in December, which is well above the 3-7% target range. December trade will be reported Wednesday, with the deficit expected at -$9.6 bln. If so, this would raise the 12-month total to -$77.1 bln, the highest since July 2015. The external accounts are deteriorating, which is lira-negative. HungaryHungary central bank meets Tuesday and is likely to keep all rates steady. For now, the bank is focusing on unconventional measures to boost the economy. For instance, the central bank recently tweaked its interest rate swap facility in an effort to bring down long-term interest rates. CPI rose 2.1% y/y in December, right at the bottom of the 2-4% target range. MexicoMexico reports Q4 GDP Tuesday, which is expected to rise 1.6% y/y. Growth was only 1.5% y/y in Q3, the slowest since Q4 2013. Monthly indicators suggest Q4 growth near 1.5% y/y, yet price pressures remain high. The firmer peso may give the central bank leeway to stand pat for now. Next policy meeting is February 8. KoreaKorea reports December IP Wednesday, which is expected at -2.4% y/y vs. -1.6% in November. It then reports January CPI and tradeThursday. Inflation is expected at 1.3% y/y vs. 1.5% in December, while exports are seen rising 24.4% y/y and imports by 16.0% y/y. Inflation seems likely to remain below the 2% target for much of this year. As such, the BOK should be in no hurry to hike again after its 25 bp move in November. Next policy meeting is November 27, no change is expected. ChinaChina reports official January manufacturing PMI Wednesday, which is expected to drop a tick to 51.5. Caixin reports its manufacturing PMI Thursday, which is expected to remain steady at 51.5. These will be the first snapshots of the mainland economy for 2018, and are expected to show that the outlook remains solid. TaiwanTaiwan reports Q4 GDP Wednesday, which is expected to grow 2.5% y/y vs. 3.1% in Q3. CPI rose only 1.2% y/y in December. While the central bank does not have an explicit inflation target, low price pressures should allow it to remain on hold for much of this year. Next quarterly policy meeting is in March, and rates are likely to be kept steady at 1.375%. ChileChile reports December IP Wednesday, which is expected to rise 1.1% y/y vs. 2.3% in November. The central bank then meets Thursdayand is likely to keep rates steady at 2.5%. December retail sales will be reported Friday, which are expected to rise 4.0% y/y vs. 5.6% in November. ThailandThailand reports January CPI Thursday, which is expected to rise 0.74% y/y vs. 0.78% in December. If so, this would still be below the 1-4% target range. The BOT should be in no hurry to hike rates, especially with the baht so firm. Next policy meeting is February 14, rates are likely to be kept steady at 1.5%. IndonesiaIndonesia reports January CPI Thursday. CPI rose 3.6% y/y in December, which is in the bottom half of the 3-5% target range. Bank Indonesia next meets February 15, rates are likely to be kept steady at 4.25%. PeruPeru reports January CPI Thursday, which is expected to rise 1.32% y/y vs. 1.36% y/y in December. If so, inflation would remain in the bottom half of the 1-3% target range. The central bank next meets February 8, and rates are likely to be kept steady at 3.0%. This past year, it has been cutting rates every other month. Since it cut in January, the bank is likely to stand pat in February. Czech RepublicCzech National Bank meets Thursday and is expected to hike rates 25 bp to 0.75%. It last hiked November 2 by 25 bp, and it has hiked once every quarter since the tightening cycle began last August. Since November 2, the koruna has appreciated about 1.5% against the euro. While this may be equivalent to around 37.5 bp of tightening, we do not think it will preclude an actual rate hike this week. |

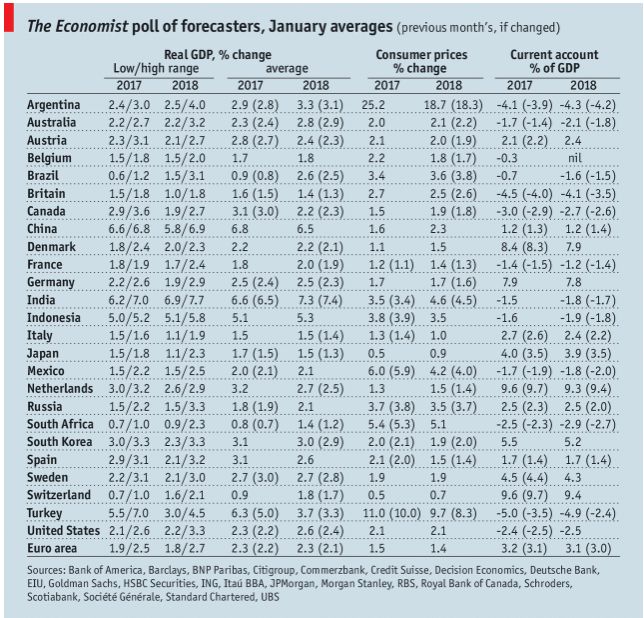

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, January 2018 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin