Italian elections are the next big political challenge facing the euro area. While near-term risks seem contained, medium-term ones remain.The Italian government confirmed 4 March as the date for the next parliamentary elections. The lower and upper houses will be elected under a new electoral law, but a hung parliament is the likely initial outcome of the elections given the fragmented political landscape in Italy.However, we do not think that, as things stand, political uncertainty will lead to systemic crisis. The Italian economy has gained momentum since Q4 2016. Domestic household demand has led the pick-up in growth, whereas corporate investment has improved only very recently. The cyclical recovery is expected to continue in the near term: we forecast that Italian real GDP will

Topics:

Nadia Gharbi considers the following as important: euro area, Italian economy, Italian elections, Italian real GDP, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Italian elections are the next big political challenge facing the euro area. While near-term risks seem contained, medium-term ones remain.

The Italian government confirmed 4 March as the date for the next parliamentary elections. The lower and upper houses will be elected under a new electoral law, but a hung parliament is the likely initial outcome of the elections given the fragmented political landscape in Italy.

However, we do not think that, as things stand, political uncertainty will lead to systemic crisis. The Italian economy has gained momentum since Q4 2016. Domestic household demand has led the pick-up in growth, whereas corporate investment has improved only very recently. The cyclical recovery is expected to continue in the near term: we forecast that Italian real GDP will expand by 1.5% in 2017 and 1.4% in 2018.

A number of near-term vulnerabilities have faded. In particular, bank non-performing loans are declining and Italy is running a current account surplus. Foreign holdings of government bonds have fallen. This suggests that there would be contained macroeconomic consequences from an episode of higher interest rates.

However, while the risk that Italy will exit the euro area has significantly diminished, volatility is expected to increase in Italian bond markets in response to the uncertainty generated by strong political fragmentation — but we do not think that political uncertainty will lead to a systemic crisis for Europe.

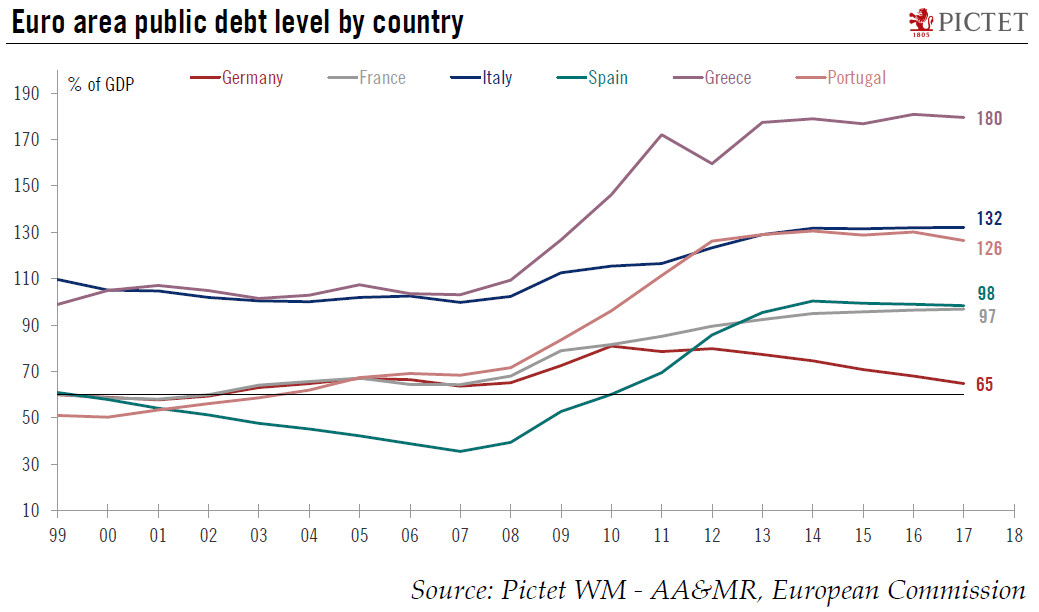

Nonetheless, while near-term risks seem contained, medium-term challenges remain. Compared with its euro area partners, Italy’s potential growth is low, and youth unemployment is at about 35%, among the highest in Europe. Over the past few years, Italy has endeavoured to address certain structural issues, but more steps need to be taken to lift the Italian growth rate to a sustainably higher level. The Italian debt level is also a source of concern. The country has the second-highest debt load in the euro area, at 132% of GDP.

All in all, the current economic momentum and environment should carry Italy through the March election without major turbulence. The risk that a sudden negative event will have systemic consequences is limited, but debt sustainability remains a challenge for Italy in the medium term.