With Fed officials becoming more optimistic about the US outlook, there is a risk of additional rate hikes this year. Meanwhile, strategy brainstorming about tweaking inflation targeting continues.A number of Fed officials have given speeches since the beginning of the year, sending mixed messages to markets in the process. Complicating matters, the discussion about the short-term cyclical outlook has become mixed up with an open debate about whether the Fed’s current flexible inflation targeting strategy is still the most appropriate, or whether it needs an update. The debate comes ahead of the Fed’s annual end-January meeting when it spells out its strategy for the year ahead.Core PCE inflation has averaged only 1.6% over the past five years, and was only 1.5% y-o-y in November, despite

Topics:

Thomas Costerg considers the following as important: Macroview, US Fed hikes, US Fed policy, US Fed Update, US monetary policy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

With Fed officials becoming more optimistic about the US outlook, there is a risk of additional rate hikes this year. Meanwhile, strategy brainstorming about tweaking inflation targeting continues.

A number of Fed officials have given speeches since the beginning of the year, sending mixed messages to markets in the process. Complicating matters, the discussion about the short-term cyclical outlook has become mixed up with an open debate about whether the Fed’s current flexible inflation targeting strategy is still the most appropriate, or whether it needs an update. The debate comes ahead of the Fed’s annual end-January meeting when it spells out its strategy for the year ahead.

Core PCE inflation has averaged only 1.6% over the past five years, and was only 1.5% y-o-y in November, despite a decline in the unemployment rate to just over 4%. The dichotomy of low inflation, a tight labour market and low interest rates forms part of the backdrop to the discussion about changing the flexible inflation targeting strategy.

For now, we think that the debate remains theoretical and that it is highly unlikely that the Fed’s policy framework will change in the near term. With Jerome Powell about to succeed Janet Yellen as Chair, the Fed has more immediate concerns.

Of all the recent Fed officials’ comments about the US outlook, those by New York Fed president Bill Dudley are of special note, because this influential voice has indicated increased optimism about the US outlook due to the tax cuts and still-loose financial conditions. His views could be an early sign of a broader hawkish shift at the Fed.

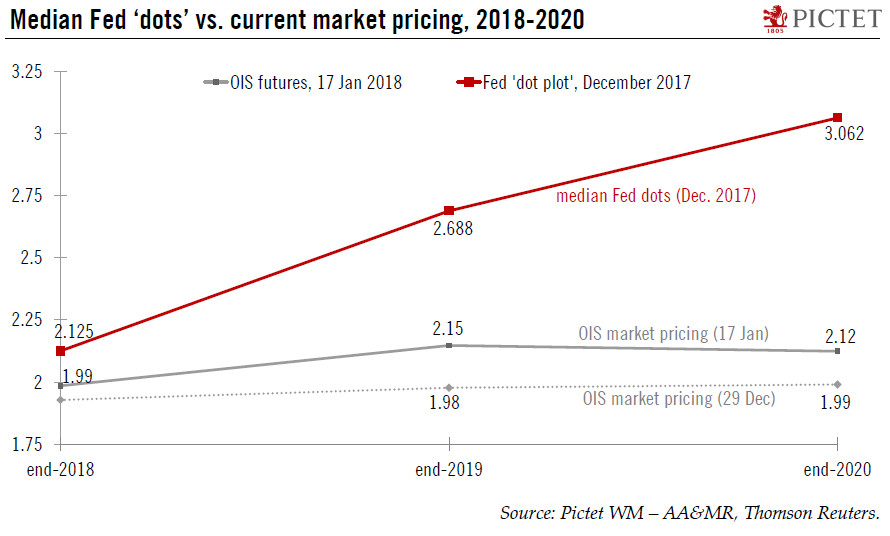

Indeed, while we had been expecting two rate hikes this year (in March and June), we now think there is a risk of additional rate hikes in the second half of the year in light of the upside risks to US growth and inflation.