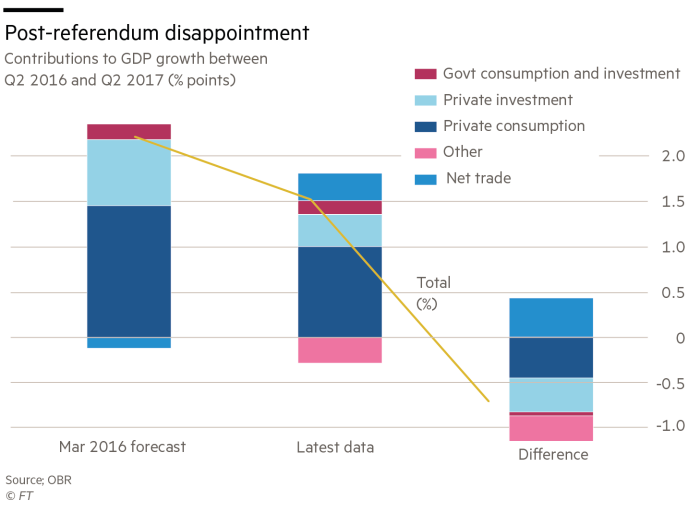

– Brexit budget – Grim outlook as UK economic forecasts downgrade – UK Chancellor uses housing market policy as smoke-screen for deteriorating economy – UK budget matters more than ever due to BREXIT risks – Policy on stamp duty will fail to aid worsening housing market – Real GDP expected to grow by just 1.5%, 40% less than projections 2 years ago – Households now face an unprecedented 17 years of stagnation in earnings – Critics claim Budget failed to calm Brexit uncertainty – UK and especially London property market at “breaking point” Contributions to GDP Growth, Q2 2016 - 2017Source: FT - Click to enlarge Yesterday UK Chancellor Philip Hammond’s long-awaited Autumn Budget was delivered to the Houses of

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

| – Brexit budget – Grim outlook as UK economic forecasts downgrade – UK Chancellor uses housing market policy as smoke-screen for deteriorating economy – UK budget matters more than ever due to BREXIT risks – Policy on stamp duty will fail to aid worsening housing market – Real GDP expected to grow by just 1.5%, 40% less than projections 2 years ago – Households now face an unprecedented 17 years of stagnation in earnings – Critics claim Budget failed to calm Brexit uncertainty – UK and especially London property market at “breaking point” |

Contributions to GDP Growth, Q2 2016 - 2017 |

|

Yesterday UK Chancellor Philip Hammond’s long-awaited Autumn Budget was delivered to the Houses of Parliament. He was praised for a ‘good budget in political terms’ and for talking up the UK economy, telling his contemporaries that that it is “confounding those who talk it down” and that “those who underestimated the UK, do so at their peril”. Hammond’s comments suggest the economy is doing better than its critics said it is. This isn’t the case. The Office of Budget Responsibility (OBR) delivered some depressing statistics yesterday which suggest the recovery post-crisis and post-referendum is still a long way off. Hammond was praised for his ‘cheery’ budget. His head had been very close to the block ahead of yesterday with many criticising his negative views on Brexit negotiations and general lack of optimism. In reality this really was a political budget. One designed for some quick-wins and support from the House and the media. It was hardly economic. Brexit was barely addressed, economic growth was referred to as ‘stubborn’ and the housing market was treated with a patronising cut in stamp duty. A band-aid on a haemorrhaging artery. Is the UK economy proving its critics wrong? The government statistics agency cut the UK’s projected growth forecast for 2017 from 2% to 1.5%. The OBR believes the economy can only now grow sustainably at a rate of 1.5 per cent, 40 per cent lower than it estimated as recently as two years ago. |

Real GDP Growth, March - Nov 2017 |

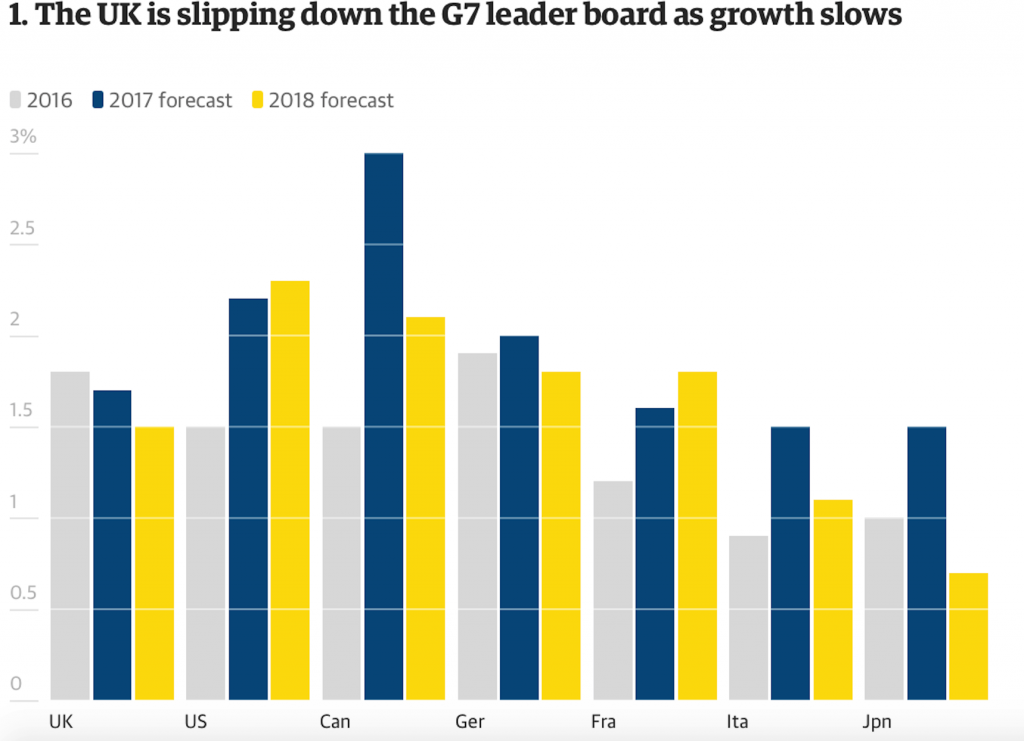

| On an international level we are expected to fall down the leaderboard of G7 countries in 2017 and into 2018. Just last year we were second only to Germany in terms of growth. Data from both the OBR and the IMF suggest lower forecasts for the UK’s GDP and output.

This does not bode well for workers who have not only failed to see their wage levels increase for nearly a decade but are also worried about the impact of Brexit. |

G7 Countries Growth, 2016 - 2018 |

| Brexit boost?

Hammond was praised for drawing attention away from the ongoing Brexit-saga. He mentioned the allocation of a further £3bn to help any outcome of the talks. For London May Sadiq Khan this was not enough:

Khan’s right. Businesses will be looking at yesterday’s budget feeling as much in the dark as they were beforehand. There has been little guidance as to how the UK will work to make the capital city attractive post-Brexit and the incentives there will be to keep people employed here. It isn’t just infuriating from a business perspective, but also for the London housing market which is nearly impossible for new entrants to join. “At a time when Londoners can’t afford to rent in London, let alone buy, no new rule news in relation to building affordable homes in London.” Hammond couldn’t even figure out that this wasn’t an area that could be a quick policy announcement. The smoke-screen of stamp duty The media jumped on Hammond’s pièce de résistance – removal of stamp duty for first time buyers. Which in reality is just a massive smokescreen designed to make us believe there is hope for the UK economy and housing market. The main headline-grabbing announcement from Hammond in his Brexit budget was the removal of stamp-duty for first-time buyers purchasing houses under £300k. This is unlikely to make any difference to either first-time buyers or the overall property market. As the OBR concluded from the Chancellor’s announcement, the tax break was likely to push property prices up by about 0.3%, with most of the increase coming in 2018. “The main gainers from the policy,” said the forecasting group, “are people who already own property, not the FTBs [first-time buyers] themselves.” It explained that whilst some potential FTBs, with smaller deposits, would now be able to borrow a little more “allowing them to buy properties that they otherwise could not afford” this would now be “more expensive”. So who is helping who out here, Chancellor? Is the government yet again encouraging citizens to go up and buy things they can’t afford, thus pushing themselves further into debt?

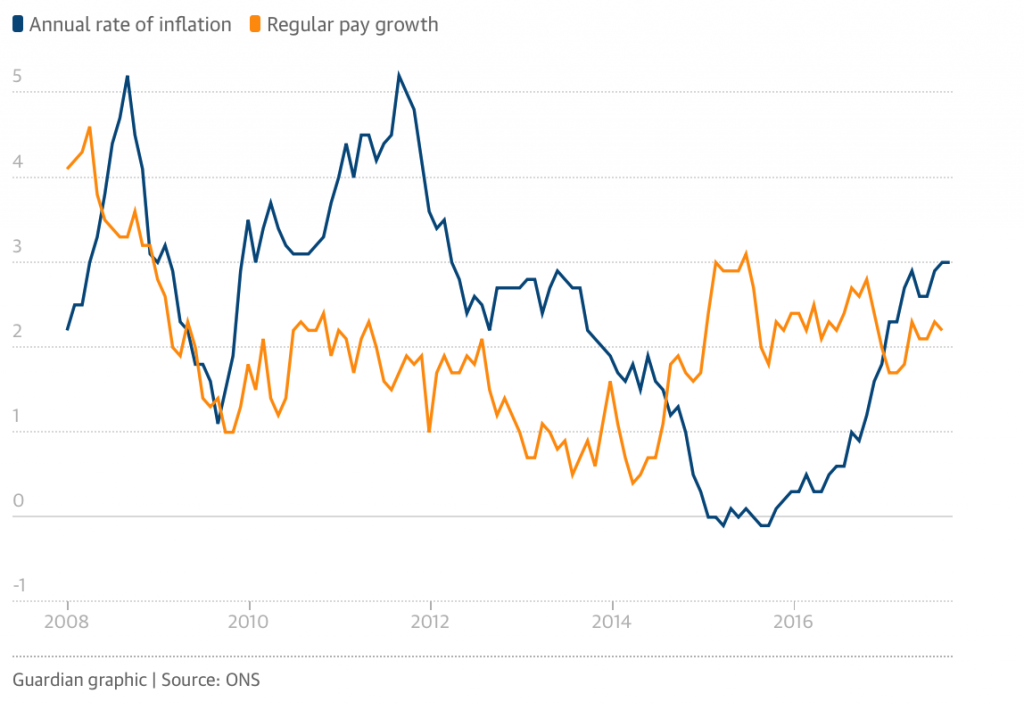

The fact is people cannot afford to buy houses right how, not because of stamp duty but because house prices are far beyond the reach of those who have not seen wages and therefore their savings increase in nearly ten years. This is not set to change. Households now face an unprecedented 17 years of stagnation in earnings. |

Annual Rate of Inflation and Regular Pay Growth, 2008 - 2017 |

| A misunderstood market used as a political puppet

The barrier to entry for first-time buyers is not the prospect of a few thousand pounds extra in tax. It is the near impossibleness of being able to save enough for the initial deposit. This is the main barrier as found in a recent Halifax bank survey. For those who can manage a deposit, that small amount of tax wasn’t particularly prohibitive to them in the first place. The government seems to be on yet another false-path to trying to prop up the ailing housing market, strong in the belief that it is the elixir of life for the UK economy. Why the constant encouragement to get on a housing ladder that is neither affordable, nor stable? How can a housing market solve all of the problems when the demand side just cannot afford to get involved? The new figures from the OBR suggest that the downward revisions mean pay will not reach its 2008 level until the mid 2020s. So with rising inflation, plus expected rising interest rates and now further stagnation in wages it’s not looking as though Hammond’s solution is going to do much at all. The housing market is long past a quick fix in the Autumn budget. A recent Halifax bank survey recorded the weakest reading for consumer expectations since October 2012. The bank told the Guardian:

This is what terrifies Hammond and the UK government. A housing market is seen as a measure for the health of an economy. With growth and productivity ‘stubbornly’ refusing to budge, the Chancellor has had to turn his attention to an area he can have a slightly more direct impact on – the housing market. However there is little evidence that such policies play out well in the long-term. For decades the UK government has worked to try bubble up the UK housing market. It has arguably worked very well. But a financial crisis, wage stagflation and stealth inflation means that it is at breaking point. This was being seen even before the UK voted for the biggest economic upset (Brexit) seen in modern history. |

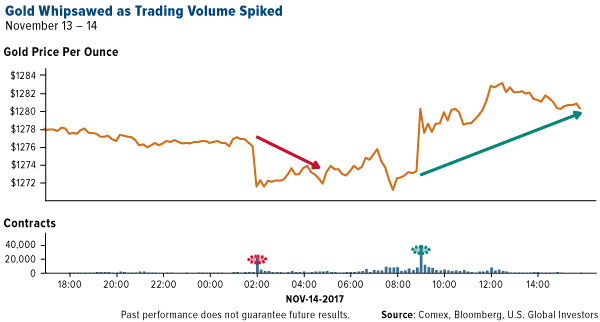

Gold Price , 14 Nov 2017(see more posts on Gold prices, ) |

A depressing yet timely reminder

Yesterday’s Brexit budget was a depressing yet timely reminder of the way politicians can manipulate economies and policies to suit their targets and save their jobs.

It was a reminder for savers and investors everywhere, not just in the UK.

Hammond’s distraction technique using the stamp-duty announcement, as well as the allocation of funds to Brexit, may have worked for the mainstream media but anyone hoping to protect the value of their portfolios should stay alert.

As we explained recently:

The government needs to stop being so irresponsible and no longer constantly peddle arguments for home ownership. However it is difficult politically to sell that story. Especially when all parties have realised the youth vote has major housing concerns and believes they have the right to own property.

For those who are not susceptible to the war-cry to the youth vote they would be wise to remember that there are other real assets out there, ones that cannot be manipulated by policy announcements and are less vulnerable to the machinations of career politicians.

Physical gold coins and bars are like housing. If owned as a diversification, in the safest ways, precious metals are tangible, safe stores of value.

However, they do not come with a massive debt burden, owners do not have to live in fear of rising interest rates and unprecedented uncertainties in both political and economic spheres as we alluded to yesterday.

Tags: Daily Market Update,Featured,newsletter