In recent years, there has been a major debate about the respective merits of gold versus Bitcoin, even though many, not all, gold bulls are also supporters of the latter. Gold advocates generally view favourably Bitcoin’s inherent characteristics of decentralisation, finite supply and ability to operate (so far) outside of the usual interference by western central banks. Having said that, the launch of Bitcoin futures on the CME in the coming weeks could lead to naked shorting of “paper Bitcoin” by any parties, including central banks and large commercial banks, who deem capping of the Bitcoin price necessary. As we discussed last week in “Financial Times: Sell Bitcoin Because The Market Is About To Become

Topics:

Tyler Durden considers the following as important: Alternative currencies, Bitcoin, Business, Central Banks, Cryptocurrencies, currency, Digital currency, E-commerce, Economics of bitcoin, Featured, Finance, Financial cryptography, Financial technology, Global news on Switzerland, goldman sachs, Goldman Sachs Asset Management, Lloyds, Money, NED, newsletter, NTrust, Online wallet, Precious Metals, Switzerland, World Gold Council

This could be interesting, too:

investrends.ch writes Bitcoin nach Kurseinbruch mit fulminantem Comeback

investrends.ch writes Hedgefonds-Branche erlebt Gründungsboom – Kapital erreicht Rekordhöhe

investrends.ch writes Welche Rolle spielen gehebelte Produkte beim jüngsten Einbruch der Krypto-Währungen?

investrends.ch writes «Die Nerven liegen derzeit blank»

In recent years, there has been a major debate about the respective merits of gold versus Bitcoin, even though many, not all, gold bulls are also supporters of the latter. Gold advocates generally view favourably Bitcoin’s inherent characteristics of decentralisation, finite supply and ability to operate (so far) outside of the usual interference by western central banks. Having said that, the launch of Bitcoin futures on the CME in the coming weeks could lead to naked shorting of “paper Bitcoin” by any parties, including central banks and large commercial banks, who deem capping of the Bitcoin price necessary. As we discussed last week in “Financial Times: Sell Bitcoin Because The Market Is About To Become “Civilized”, this could align Bitcoin with one of the major issues which has held the gold market hostage for years, time will tell.

While many gold investors remain entrenched in the view that gold will (eventually) prove to be the better store of value, one thing many would acknowledge is that Bitcoin is likely to evolve into a superior means of payment. However, that could be in the process of changing.

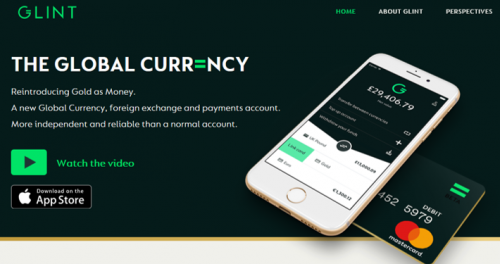

A fintech start up is partnering with some financial heavyweights to create a payments system backed by physical – not paper – gold. According to the Financial Times.

|

|

If you’ve been watching carefully Glint (website is glintpay.com) has been working towards this moment for some time. The Crunch reported a capital raising in August this year, noting the impressive list of backers.

Other supporters of the new app include the Tokyo Commodity Exchange, and NEC Capital Solutions, a technology integration company. The co-founder and COO of Glint, Ben Davies (right in the photo below), is well known to us for his media appearances – often lambasting manipulation of the gold price – and for running the precious metals investment fund, Hinde Capital. The CEO and co-founder, Jason Cozens, also has gold market experience, having set up “GoldMadeSimple.com, a website that allows investors to buy and store physical gold. Additionally, he set up two ecommerce and online marketing businesses. |

|

In terms of how the service works, the FT reports.

We doubt that we’ll have to wait two decades before the vast majority of people will need to protect the value of their money. It could be a matter of months, so Glint’s new service might prove timely. Here are some further thoughts from Davies in the FT article.

So, is the question gold, Bitcoin or both? |

Tags: Alternative currencies,Bitcoin,Business,central banks,Cryptocurrencies,Currency,Digital currency,E-commerce,Economics of bitcoin,Featured,Finance,Financial cryptography,Financial technology,Goldman Sachs,Goldman Sachs Asset Management,Lloyds,money,NED,newsletter,NTrust,Online wallet,Precious Metals,Switzerland,World Gold Council