(early post ahead of start of a new business trip to Europe. Posts will continue albeit irregularly) Swiss Franc The euro has appreciated by 0.19% to 1.1637 CHF. EUR/CHF and USD/CHF, November 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates This is it: The next 48 hours will be among the busiest of the year. The Bank of England meets tomorrow, and it not only gives a verdict on interest rates but also provides an update of its economic projections (Quarterly Inflation Report). And, among the innovations, the MPC minutes will be released. Ahead of the Federal Reserve meeting, the market will have the ADP private-sector job estimate. Initially indicated it would be seen

Topics:

Marc Chandler considers the following as important: China Caixin Manufacturing PMI, EUR, EUR/CHF, Featured, FX Trends, GBP, Japan Manufacturing PMI, JPY, newslettersent, NZD, TLT, U.K. Manufacturing PMI, U.S. Crude Oil Inventories, U.S. ISM Manufacturing Employment, U.S. Manufacturing PMI, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

(early post ahead of start of a new business trip to Europe. Posts will continue albeit irregularly)

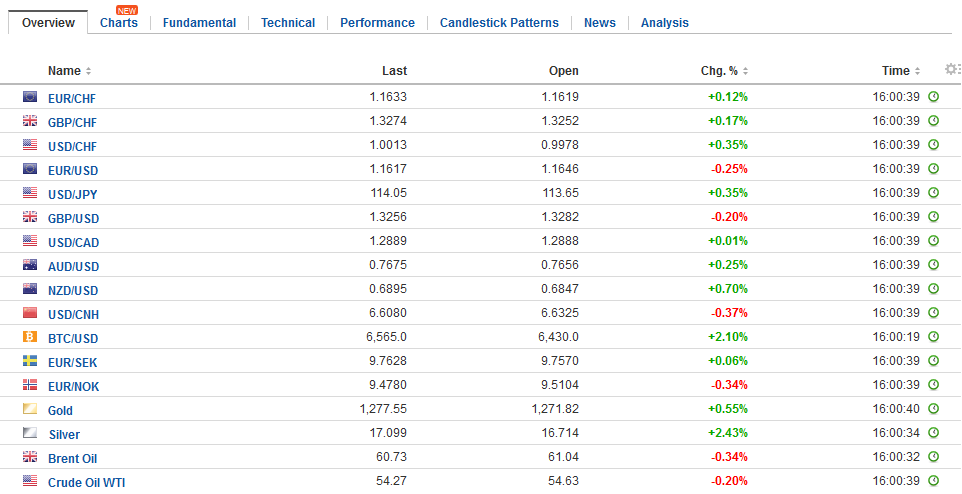

Swiss FrancThe euro has appreciated by 0.19% to 1.1637 CHF. |

EUR/CHF and USD/CHF, November 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

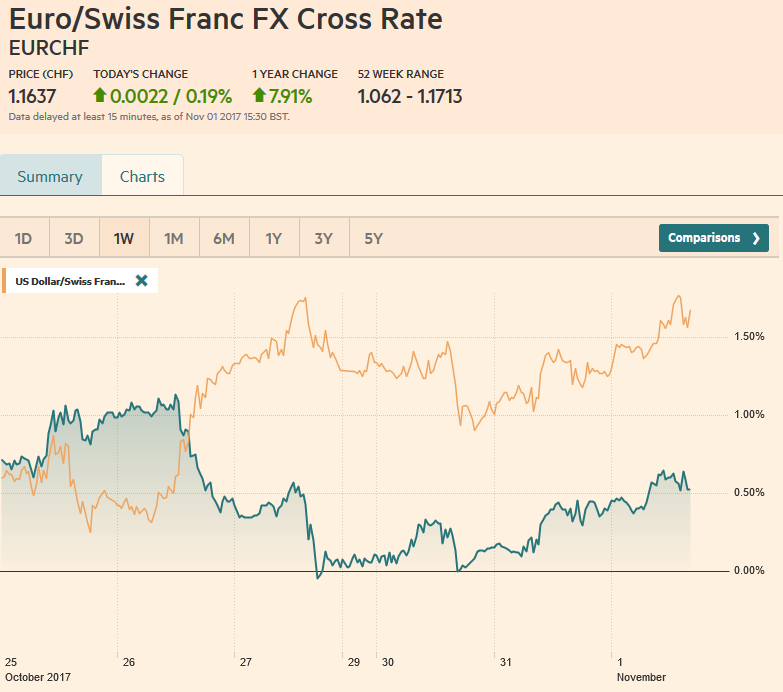

FX RatesThis is it: The next 48 hours will be among the busiest of the year. The Bank of England meets tomorrow, and it not only gives a verdict on interest rates but also provides an update of its economic projections (Quarterly Inflation Report). And, among the innovations, the MPC minutes will be released. Ahead of the Federal Reserve meeting, the market will have the ADP private-sector job estimate. Initially indicated it would be seen today, the House Ways and Means Committee now says it will reveal its draft bill on tax reform tomorrow. Tomorrow is also President Trump is expected to announce his Fed nomination(s). Meanwhile, Asian markets have begun the new month with aplomb. The MSCI Asia Pacific Index rose nearly 1%, the most since early June, and that follows a 4.25% gain in October, the most since January. The Nikkei led the region with a nearly a 1.9% gain, helped by a surge (~11%) surge in Sony as executives lifted the profit outlook. |

FX Daily Rates, November 01 |

| Talk has again surfaced that Prime Minister Abe is considering a supplemental budget. This does not strike us as new, or necessarily a commitment of fresh funds, but it was cited as another driver for Japanese shares as if it were needed after the 8%+ rally last month. US 10-year yields are about three basis points above yesterday’s low print, which corresponded to chart support, and this may have also helped the dollar to return to JPY114.00. There is a $910 mln option struck there that expires today. There is also another $580 mln struck at JPY113.75, and $515 mln struck at JPY113.50 that expire today.

Foreign investors were buyers of South Korean equities, despite the mostly disappointing economic data (October trade data were softer than expected and the manufacturing PMI slipped, while price pressures eased). The Kospi rose 1.3%. The won strengthened against the US dollar for the third consecutive session. The Kiwi is up more than 1% to trade at its best levels in a week near $0.6930. The bears may try to make a stand, but we anticipate an upside correction will continue and look for a move toward $0.7000-$0.7050, even if a modest pullback is seen first. At the same time, New Zealand shares were hit by profit-taking after a strong run, as the Kiwi fell. The 1.15% loss was the largest since March. The demand that lifted the euro from below $1.1600 has turned hesitant in front of the $1.1660 previous support and now resistance. Initial support is seen near $1.1620. The seems to be a lack of near-term conviction. Meanwhile, the Dow Jones Stoxx 600 is extending its gains for a fifth consecutive session, led by information technology and materials. Nickel and copper are powering the industrial metals. |

FX Performance, November 01 |

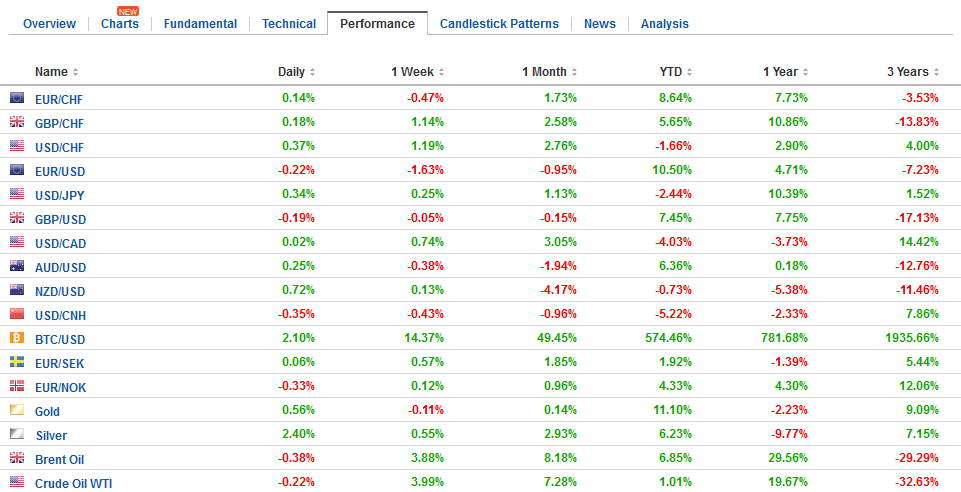

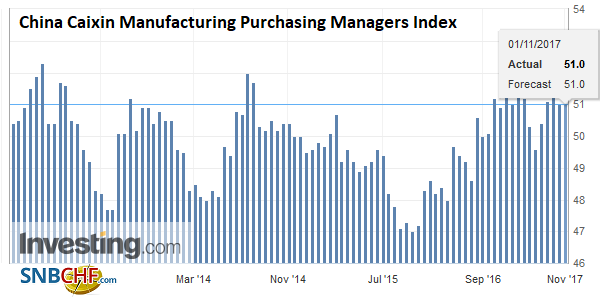

ChinaChina’s Caixin manufacturing PMI came in unchanged at 51.0. This was a pleasant surprise after the official measure that was reported earlier this week showed a decline (51.6 vs. 52.4). There are concerns among investors that 1) negative news before and during the 19th Party Congress may have been held back and 2) that attempts to facilitate deleveraging will continue. Chinese shares continue to underperform and posted gains of less than 0.1% today. That said, the Chinese shares that trade in Hong Kong (Hong Kong Enterprise Index) rose an impressive 1.1%. Those shares are up almost 24% year-to-date, while the Shanghai Composite has advanced almost 9.5%. |

China Caixin Manufacturing Purchasing Managers Index (PMI), Oct 2017(see more posts on China Caixin Manufacturing Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

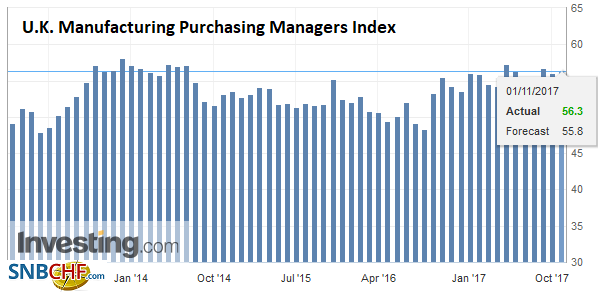

United KingdomAhead of the Bank of England meeting tomorrow, sterling is edging higher. The manufacturing PMI posted an unexpected gain. The market had expected a flat report, but instead, it rose to 56.3 from an upwardly revised 56.0 (was 55.9). While expectations of a rate hike tomorrow may be protecting sterling’s downside, signals that the UK government may be preparing to compromise to help reinvigorate Brexit negotiations may also help. Sterling is approaching the upper end of its recent trading range near $1.3340. A convincing move above there would suggest potential toward $1.3400-$1.3420. |

U.K. Manufacturing Purchasing Managers Index (PMI), Oct 2017(see more posts on U.K. Manufacturing Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

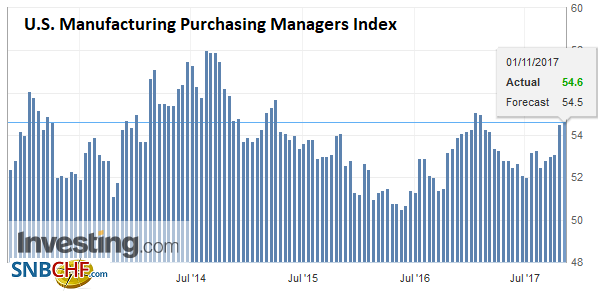

United StatesThe ADP jobs estimate and US auto sales may provide some insight into the economy, but there seems to be an asymmetrical risk. Strong data may spur less of a reaction than weak data because of the response to the storms. ADP showed a 135k increase in jobs in September while the national figure showed a 33k loss. The median Bloomberg survey forecast is for the 200k increase. To put it in some contest, this year’s average through August was 221k and last year’s average was around 180k. |

U.S. Manufacturing Purchasing Managers Index (PMI), Oct 2017(see more posts on U.S. Manufacturing Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

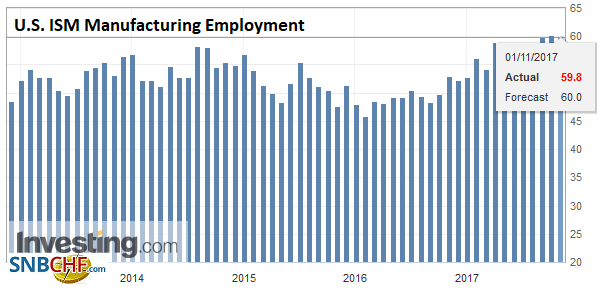

| The key focus for investors is not the number of jobs being created. It is on earnings and wage growth. We will write more about it in the weeks ahead, but we suspect that the Phillip’s Curve has been prematurely buried and will, over the next few quarters, make itself more visible. Suffice for the time being to note the importance of wage pressures as a new Fed takes shape early next year, and that the employment cost index (0.8% increase in wages in Q3 2.5% year-over-year) has begun accelerating. |

U.S. ISM Manufacturing Employment, Oct 2017(see more posts on U.S. ISM Manufacturing Employment, ) Source: Investing.com - Click to enlarge |

| Auto sales are expected to have slowed from the storm-inspired pace of 18.47 mln vehicles in September. Estimates suggest between the two storms that struck as many as 700k vehicles were destroyed. They all are not going to be immediately replaced, though clearly some are being replaced. In the eight months before the storm, the US sold an average (SAAR) of nearly 16.8 mln vehicles a month. This jumped to nearly 18.5 mln in September. It is expected to slow to 17.5 mln, but the risk seems to be on the upside. Note that in October 2016, 17.8 mln vehicles were sold, which was the most last year until December. |

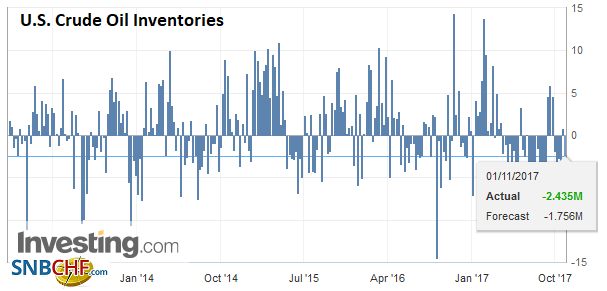

U.S. Crude Oil Inventories, Sep 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

Japan |

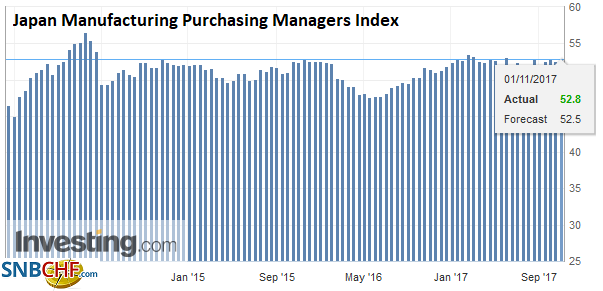

Japan Manufacturing Purchasing Managers Index (PMI), Oct 2017(see more posts on Japan Manufacturing Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

Federal Reserve

The FOMC meeting is a low-key event. Four hikes into the cycle and the Fed has not managed to hike rates outside of a meeting in which there is a press conference and updated economic projections. It is a shame because that it cuts in half the number of “live” meetings, and denies it greater flexibility. There is not going to be a change of rates today, and there cannot be much of a commitment to hike in December. If it were a done deal, as the vernacular would have it, then the Fed would hike rates now.

We suspect Fed officials have been pleasantly surprised by the continued strength of the economy, and could, in its economic assessment, recognize it. We would not push this point too hard though on the grounds that final domestic sales were rose by an uninspiring 1.8%.

The Fed has finished its first month of allowing its balance sheet to shrink. It may adjust the technical section to reflect this. Otherwise, we expect the FOMC statement to be little changed. We note that this will be Governor Quarles first meeting. The market will wait for December’s meeting to try to tease out his dot on the plot. For the record, assuming no chance of a rate hike today, and making some allowances for year-end behavior, we estimate that fair value for the December Fed fund futures contract would imply a 1.295% yield. It has been fairly steady at 1.275%.

New Zealand

We have been looking for a bottom in the New Zealand dollar, suspecting the market was overreacting to the new Labour-New Zealand First government. We expect the pro-growth orientation will be rewarded over time. In recent days, the downside momentum faded as the Kiwi approached the lows for the year, set in May near $0.6800. However, the bias was still to sell into rallies. Until today, when the stronger than expected Q3 employment figures spurred a powerful short squeeze.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,$EUR,$JPY,$TLT,China Caixin Manufacturing PMI,EUR/CHF,Featured,Japan Manufacturing PMI,newslettersent,NZD,U.K. Manufacturing PMI,U.S. Crude Oil Inventories,U.S. ISM Manufacturing Employment,U.S. Manufacturing PMI,USD/CHF