Macronomics could well accelerate the closing of the growth gap with Germany and improve the outlook for French equities.The first major piece of President Emmanuel Macron’s agenda, the business- friendly labour market reform, was signed into law last month. Some Macron measures may have adverse effects in the short term and some others are not fully financed and difficult to quantify, but overall they should boost purchasing power, investment and productivity. The government has been successful in limiting trade unions’ opposition, which bodes well for future reforms.The labour market reform was articulated around two key principles: decentralisation of labour negotiations and enhanced flexibility of the hiring and firing process, with a special focus on small and medium-sized companies.

Topics:

Frederik Ducrozet considers the following as important: French economy, French reforms, French tax, Macronomics, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Macronomics could well accelerate the closing of the growth gap with Germany and improve the outlook for French equities.

The first major piece of President Emmanuel Macron’s agenda, the business- friendly labour market reform, was signed into law last month. Some Macron measures may have adverse effects in the short term and some others are not fully financed and difficult to quantify, but overall they should boost purchasing power, investment and productivity. The government has been successful in limiting trade unions’ opposition, which bodes well for future reforms.

The labour market reform was articulated around two key principles: decentralisation of labour negotiations and enhanced flexibility of the hiring and firing process, with a special focus on small and medium-sized companies. The second major announcement concerns tax cuts, with a first objective to lower the corporate tax rate from 33.3% to a rate of 25% by 2022.

The phased introduction of tax cuts for larger companies will lift the CAC 40’s underlying earnings growth outlook, from a current 2019 estimate of +8.6% to +12.5% and from a 2020 estimate of +7% to +8.9%, according to our calculations. While the effect is not massive, it would be enough to ensure that the outlook for underlying profit growth for the CAC 40 is the highest of any European market.

The next key structural reforms involve unemployment benefits and the pension system (unifying dozens of existing systems). Whether the government can address such explosive issues comprehensively will depend on how much political capital it has left, with reform of the unemployment benefits system at most risk of being watered down.

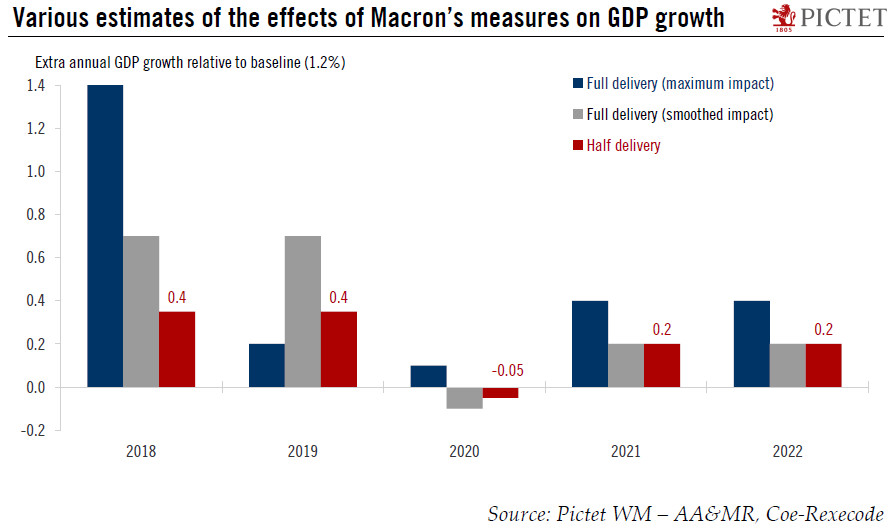

Our broad assessment of the French economy remains cautiously optimistic. If the corporate tax cuts are implemented in full, they be a game changer, pushing up GDP growth by at least 0.5% over the longer-term. In its latest forecasts, the European Commission put France’s potential growth rate at 1.2% in 2018 compared with 1.5% for Germany. Structural factors, including demographics, suggest that France is likely to outperform Germany eventually, and Macronomics may well accelerate the catch-up process.

Maintaining reform momentum will be important for rebuilding trust and confidence with France’s European partners. We see more common ground between Macron and Merkel that is generally acknowledged. A fully-fledged fiscal union may not be feasible (nor desirable), but any concrete steps towards greater integration should be welcomed by markets, including a roadmap to a euro area fiscal capacity and finance minister.