Renewed political risks are leading to very limited repricing of the sovereign risk premiums.A Catalan crisis, a Dutch eurosceptic-leaning government coalition, the return of Austrian populists, difficult German coalition talks… Eurosceptics have had plenty of opportunities to make a comeback, and yet the market continues to trade each event as largely idiosyncratic in nature.Explanations abound for the resilience of peripheral markets to political risks, including a stronger and broad-based economic recovery, the ECB’s “prudent and persistent” approach to rescaling QE, prospects of further euro area governance reforms, etc. We believe that the Brexit vote and the current difficult state of negotiations are also playing an important role, as populist parties have reviewed their positions,

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Euro political risk, Euro risk premiums, European politics, Euroscepticism, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Renewed political risks are leading to very limited repricing of the sovereign risk premiums.

A Catalan crisis, a Dutch eurosceptic-leaning government coalition, the return of Austrian populists, difficult German coalition talks… Eurosceptics have had plenty of opportunities to make a comeback, and yet the market continues to trade each event as largely idiosyncratic in nature.

Explanations abound for the resilience of peripheral markets to political risks, including a stronger and broad-based economic recovery, the ECB’s “prudent and persistent” approach to rescaling QE, prospects of further euro area governance reforms, etc. We believe that the Brexit vote and the current difficult state of negotiations are also playing an important role, as populist parties have reviewed their positions, dropping calls for EU referendums.

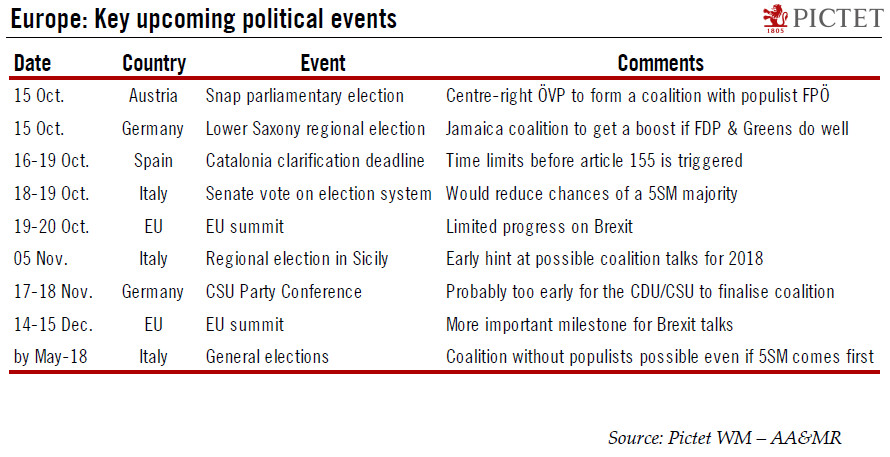

Still, risk appetite is likely to remain contained ahead of upcoming events. Political fragmentation looks to be here to stay, which is making it more difficult to anticipate the composition of future governments. In Austria, the populist right-wing FPÖ is likely to join a government coalition with the centre-right ÖVP, which is expected to win the election on Sunday. In Germany, the regional election in Lower Saxony on the same day looks equally important, as the outcome could shift the debate at the national level in favour of a ‘Jamaica’ coalition if the FDP and the Greens do well.

Looking ahead, Italy remains arguably the elephant in the European room, but there, too, risks have started to diminish. If the latest agreement on a new voting system is approved by both Houses, it will reduce the uncertainty ahead of the next general elections. An absolute majority for any single party is unlikely, but the new rules would significantly reduce the chances of an anti-establishment party winning a majority.