While US oil production continues to grow, the increase in oil sales to China could help moderate Trump administration invectives against China.The ‘revolution’ in tight oil production means that US oil production is about to break the annual record of 9.6 million barrels per day (mb/d) reached in 1970. Under rising pressure from oil producers, the Obama administration significantly loosened rules on crude oil exports, which have boomed. But where is all this oil going?China has accounted for by far the largest increase in US crude oil exports so far this year. From an almost negligible amount – USD 238 million in 2016 – exports of crude oil to China ballooned to USD 2.2 billion in the first eight months of 2017, a year-on-year gain of 1,432%! Second place is the UK, with a gain of USD

Topics:

Thomas Costerg considers the following as important: Macroview, US crude oil exports, US oil exports, US oil production, US-China trade relations

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While US oil production continues to grow, the increase in oil sales to China could help moderate Trump administration invectives against China.

The ‘revolution’ in tight oil production means that US oil production is about to break the annual record of 9.6 million barrels per day (mb/d) reached in 1970. Under rising pressure from oil producers, the Obama administration significantly loosened rules on crude oil exports, which have boomed. But where is all this oil going?

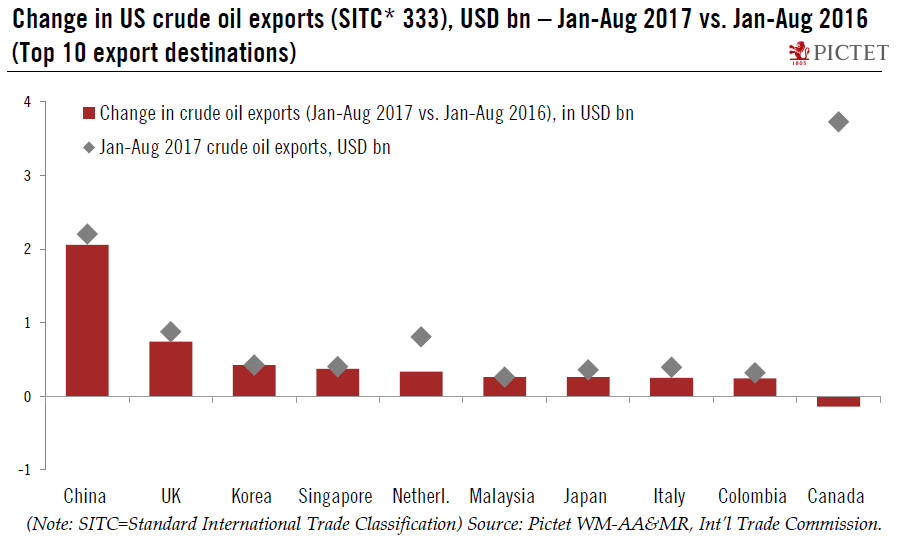

China has accounted for by far the largest increase in US crude oil exports so far this year. From an almost negligible amount – USD 238 million in 2016 – exports of crude oil to China ballooned to USD 2.2 billion in the first eight months of 2017, a year-on-year gain of 1,432%! Second place is the UK, with a gain of USD 1.5 billion, followed by South Korea (USD 423 million) and Singapore (USD 373 million). By contrast, there has been a decline in sales to Canada (down 3.7% so far this year), which had been exempt from the old restrictions on US oil exports. Canada is still the number one destination for US crude oil exports, but China is catching up fast. Total crude oil exports are up 85% so far this year, contributing to the 6.5% rise in overall US merchandise exports.

Two conclusions can be drawn from the increase in US oil exports. First, global oil prices are likely to be an important element in the growth outlook for the US in 2018-19. Second, rising oil sales to China, like the strength of Sino-American trade links in general, could help mitigate tensions between the Trump administration and China.