Stock Markets EM FX ended the week on a mixed note, but still capped off a strong week overall. US data this week could challenge the market’s dovish take on the Fed. For now, though, the global liquidity outlook still seems to favor further gains in EM. Stock Markets Emerging Markets, September 11 Source: economist.com - Click to enlarge China China should report August new loan and money supply data this week, but no date is set. New loans are expected at CNY950 bln vs. CNY826 bln in July. China reports August retail sales and IP Thursday. The former is expected to rise 10.5% y/y and the latter by 6.6% y/y. Czech Republic Czech Republic reports August CPI Monday, which is expected to rise 2.6% y/y vs. 2.5%

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended the week on a mixed note, but still capped off a strong week overall. US data this week could challenge the market’s dovish take on the Fed. For now, though, the global liquidity outlook still seems to favor further gains in EM. |

Stock Markets Emerging Markets, September 11 Source: economist.com - Click to enlarge |

ChinaChina should report August new loan and money supply data this week, but no date is set. New loans are expected at CNY950 bln vs. CNY826 bln in July. China reports August retail sales and IP Thursday. The former is expected to rise 10.5% y/y and the latter by 6.6% y/y. Czech RepublicCzech Republic reports August CPI Monday, which is expected to rise 2.6% y/y vs. 2.5% in July. Central bank Governor Rusnok said recently that he would prefer to wait for the next staff forecasts due at the November 2 meeting before deciding on further tightening. Next policy meeting is September 27, so a hike then seems highly unlikely. TurkeyTurkey reports Q2 GDP Monday, which is expected to grow 5.3% y/y vs. 5.0% in Q1. It also reports August budget data Monday. The central bank then meets Thursday and is expected to keep rates steady. July current account will be reported Friday, and is expected at -$5.2 bln vs. -$3.8 bln in June. August budget data will also be reported Friday. MexicoMexico reports July IP Monday, which is expected to rise 0.1% y/y vs. -0.3% in June. The economy remains weak but still-rising inflation should prevent any near-term easing. Indeed, we see no rate cuts until around mid-2018. Next Banxico meeting is September 28, no change is expected then. RussiaRussia reports July trade Monday. The central bank meets Friday and is expected to cut rates 50 bp to 8.5%. However, the market is split. Of the 16 analysts polled by Bloomberg, 7 see a 25 bp cut and 9 see a 50 bp cut. August CPI rose 3.3% y/y, lower than expected and below the 4% target. As such, we lean towards a 50 bp cut. IndiaIndia reports August CPI and July IP Tuesday. Inflation is seen at 3.23% y/y vs. 2.36% in July, while IP is seen rising 1.7% y/y vs. -0.1% in June. India then reports August WPI Thursday, which is expected to rise 3.15% y/y vs. 1.88% in July. The RBI cut rates last month, but warned that inflation had bottomed and would move higher in H2. We see steady rates at the next policy meeting October 4. BrazilBrazil reports July retail sales Tuesday, which are expected to rise 4% y/y vs. 3% in June. July GDP proxy will be reported Thursday. The recovery should pick up steam due to the aggressive easing cycle. However, COPOM signaled a slower pace and a nearing end. Next policy meeting is October 25, and we think a 75 bp cut to 7.5% is likely then. South AfricaSouth Africa reports July retail sales Wednesday, which are expected to rise 2.6% y/y vs. 2.9% in June. It then reports Q2 current account data Thursday, with the deficit expected at -1.9% of GDP vs. -2.1% in Q1. The sluggish economy should allow SARB to continue cutting rates after it started in July. Next policy meeting is September 21. Consensus is no change but we see a good chance of another 25 bp cut to 6.5%. ChileChile central bank meets Thursday and is expected to keep rates steady at 2.5%. August CPI rose 1.9% y/y, which is still below the 2-4% target range. The recent copper rally should help boost growth, and so we believe the central bank when it says that the easing cycle is over, at least for now. PeruPeru central bank meets Thursday and is expected to keep rates steady at 3.75%. August CPI rose 3.17% y/y, which is still above the 1-3% target range. While accelerating inflation should keep the central bank cautious, we see a small chance that it continues the easing cycle with another 25 bp cut. IsraelIsrael reports August CPI Friday, which is expected at -0.1% y/y vs. -0.7% in July. If so, this would still be well below the 1-3% target range. Next central bank policy meeting is October 19, no change expected then. Near-term, politics will likely trump economics in Israel as a widening corruption probe keeps investors on edge. ColombiaColombia reports July IP and retail sales Friday. The former is expected to rise 0.7% y/y and the latter by 2.8% y/y. The central bank will also release minutes Friday. CPI rose 3.9% y/y in August vs. 3.4% in July, and was the first acceleration since July 2016. Next policy meeting is September 29, and we believe another 25 bp cut to 5.0% is likely. |

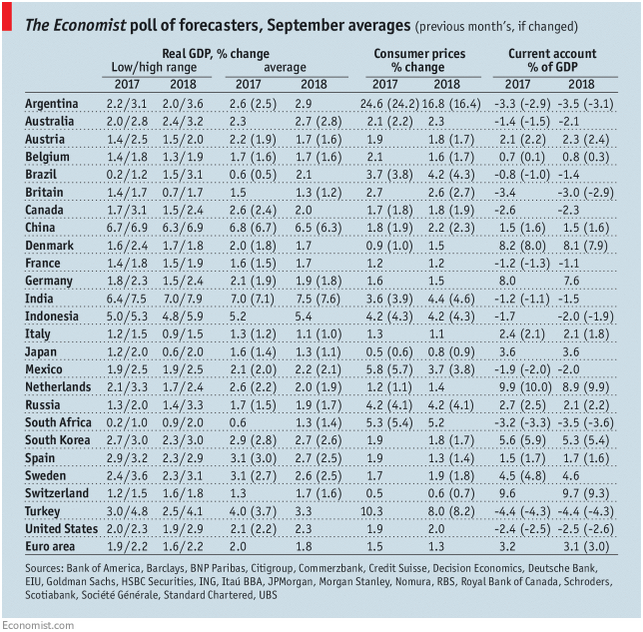

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, September 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin