Summary: The dollar has been declining since the start of the year, but the causes have changed. The drag from US politics may be exaggerated, while European and Japanese politics are worrisome. The economic data may continue to be a drag on US yields, especially if core CPI slips again. The US dollar’s sell-off accelerated. It has been selling off since the start of the year. The first phase of the decline at the start of the year seemed similar to what happened at the start of 2016. Following the Fed’s first-rate hike at the end of 2015, the dollar weakened in the first several months of 2016. Disappointing economic growth, deferred expectations for another hike, and position adjustments were the key

Topics:

Marc Chandler considers the following as important: ECB, EUR, Featured, FX Trends, GBP, JPY, newsletter, Politics, USD

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Summary:

The dollar has been declining since the start of the year, but the causes have changed.

The drag from US politics may be exaggerated, while European and Japanese politics are worrisome.

The economic data may continue to be a drag on US yields, especially if core CPI slips again.

The US dollar’s sell-off accelerated. It has been selling off since the start of the year. The first phase of the decline at the start of the year seemed similar to what happened at the start of 2016. Following the Fed’s first-rate hike at the end of 2015, the dollar weakened in the first several months of 2016. Disappointing economic growth, deferred expectations for another hike, and position adjustments were the key drivers. Similarly, the dollar traded heavily at the start of 2017 after rallying strongly in H2 2016.

The second phase began in late April. Recall that the fear at the start of the year was that the populist-nationalist wave that was said to have been behind the UK decision to leave the EU and the Trump’s victory in the US was going to sweep across Europe. The dollar’s consolidation of the first part of the year ended abruptly when it became clear in late April that the National Front was going to be defeated. Indeed, the euro gapped higher in response and has not looked back.

The shortage of dollar that was evident in its rapid appreciation and the extreme premium for dollar’s in the cross-currency swaps eased dramatically. It appeared to partly be a function of the US Treasury Department drawing down its cash balances at the Federal Reserve as it maneuvered after the debt ceiling that had been hit.

The third phase was seemed to be a function of a mini-convergence wave. The eurozone experienced an inflation scare around the same time as it became clearer to investors that despite a Republican in the White House and a Republican majority in both houses of Congress, the legislative agenda tax reform, deregulation, and infrastructure that was to boost the growth potential of the world’s largest economy was unlikely to be delivered. The eurozone inflation spike sparked speculation that the ECB could hike the negative 40 bp deposit rate before the asset purchases were completed.

United StatesUS headline and core inflation trended lower starting in February. It did not prevent the Fed from hiking in March and June. However, the yield curve flattened as the long-term yields fell more than the short-end. Most recently, yields continued to fall as the business wing of the Trump’s coalition peeled away following Trump’s controversial response to White Supremacy incited violence. Cohn, the President’s chief economic adviser, was the odds-on favorite to succeed Yellen when her term as Chair of the Federal Reserve ends early next year. However, his mild and belated criticism of Trump appears to have been seen as a sign of disloyalty, and appears to have taken him out contention. Meanwhile, Cohn, whose chief task apparently was to draft a bold tax reform program fell out of favor. By late August it was clear that this was not going to happen. The White House retreated and returned the initiative, outside of some broad principles, including the jettisoning of the controversial Border Adjustment Tax. The fractured nature of Congress does not make investors particularly confident in the process or outcome. The weak price impulses, and the soon changing composition of the Federal Reserve has prompted the market be skeptical that rates will rise again this year or next. There are two anomalies about the dollar’s accelerated decline. First, even though the market does not expect the Fed to hike rates, it is convinced that the Fed will begin allowing its balance sheet to shrink starting in Q4. It begins slowly to be sure, and it will take place with the sales of a single instrument. It simply won’t reinvest the full amount that is maturing. The ECB made it clear last week that it is no hurry to exit its extraordinary policies. It is not convinced that inflation has yet to enter a sustainable and durable path. This suggests that the ECB’s balance sheet is likely to expand by more and for longer than may be appreciated by market participants, many of whom are concerned that the ECB will run out of assets it can buy under the current self-imposed rules. Lastly, the US has reportedly notified the respective parties that it will seek new sanctions against North Korea by the UN at the start of the week. In addition to a ban on oil exports, reports suggest the US will also seek an embargo on textile trade, accepting guest workers from North Korea, and freezing Kim’s assets. The cost of the such proposal would likely weigh heaviest on China, but the US does not appear to be offering China anything to offset this cost. |

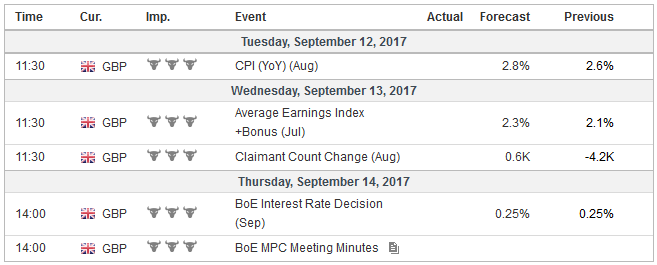

Economic Events: United States, Week September 11 |

EurozoneIf the ECB were to cut its purchases in half to 30 bln euros in the first half of next year, the balance sheet would expand by another 180 bln euro by the end of June 2018, after expanding by 180 bln euros in Q4 17. If the Fed begins its balance sheet operations in October, by the end of June 2018, its balance sheet would shrink by $180 blns. The ECB also reiterated that it will not raise rate (deposit rate at minus 40 bp and refi rate is at zero) until after its asset purchases are complete. NY Fed President Dudley suggested before the weekend that the two hurricane’s that have ravaged parts of Texas and Florida may impact the timing of the Fed’s next rate hike. He had recently suggested could take place before the end of the year, provided the economy evolved as the Fed expected. However, the market had already reduced the chances of a December rate hike to about a 25% chance, down from a little more than 40% the previous week. While the tighter financial conditions in the EMU are thought to make for a cautious ECB, investors are not nearly as convinced that the easing of US financial conditions will spur the Fed into action. We suggest that this is partly because many participants do not think the Fed places the same amount of weight to the financial stability mandate as they do to the short-hand talk of a dual mandate. We think this is a mistake. Also, the cautiousness expressed by several Fed presidents and Governor Brainard, in light of the coming personnel changes, many expected easy money to prevail. The second anomaly is politics. Much has been made about the erosion of public support for Trump, who did not win the majority of the popular vote, but, carried the electoral college, which is where the election is decided. We have expressed concerns that the business-wing of his coalition and the Republican Establishment that had joined him are peeling away. Too often charts claiming to show that the dollar is tracking the president’s popularity show the two variables on the same chart with two scales. With that methodology one can prove nearly anything. Ironically, since mid-May, the same methodology could show that the dollar is tracking the decline in support for Macron. Although the new elected French President enjoyed a large parliamentary majority, his public support is more or less at the same level as Trump’s. Some labor unions are staging protests early next week, but Macron can rule by decree. What economists call labor market rigidities are part of the social contract whose unilateral abridgment is likely to have longer-term consequence on cohesion and trust, even if the direct economic impact is minimal. |

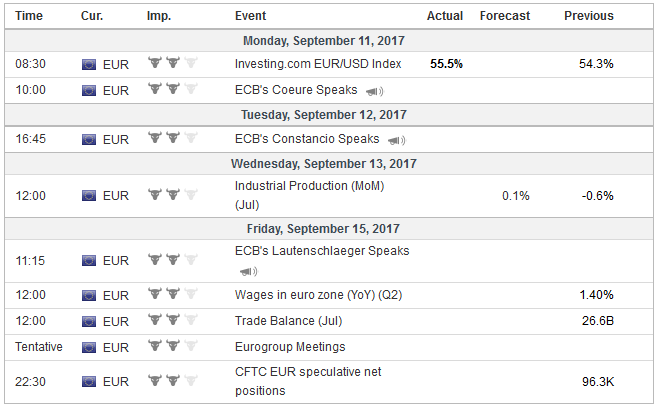

Economic Events: Eurozone, Week September 11 |

United KingdomIn the UK, Prime Minister May lost the Tories majority in the snap election earlier this year. She is trying to govern as if the majority was preserved. The second reading of the Great Repeal on Monday at it appears the government is going to have to compromise, even not with Labour or LibDems, but with Tory MPs. The Dutch have not been able to forge a government for six months (and the economy is poised to grow its fastest this year since the start of EMU). The Bank of England and the Swiss National Bank hold policy making meetings in the days ahead, and Norway goes to the polls. Neither central bank is likely to alter policy and Norway’s election will likely confirm the status quo. Before the Bank of England meets, it will see the August inflation report. It is likely to have risen, largely as a result of depreciation of sterling after the June 2016 referendum. Still, there is good reason to expect the peak in inflation in the coming months, even if CPI gets closer to 3% first. The UK’s labor market continues to absorb slack and the risk to the unemployment rate is on the downside, even though it has already fallen to 4.4% from 4.8% at the end of last year. However, earnings growth is slipping further behind the inflation, and this is likely to squeeze discretionary consumption over time. Sir Ramsden has assumed his role as the new Deputy Governor for the Bank of England. It is now fully staffed with nine members. Two of whom are likely to continue to dissent in favor of a hike, but they have been unable to convince their colleagues. |

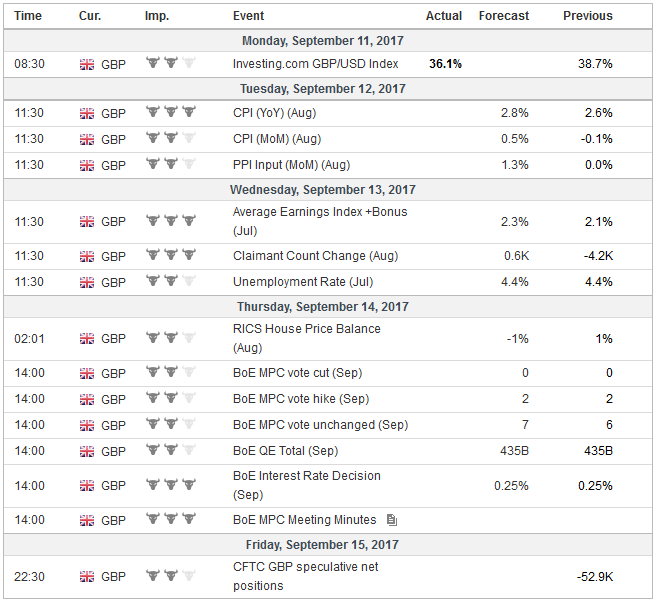

Economic Events: United Kingdom, Week September 11 |

ItalyItaly is on its fourth un-elected Prime Minister with the same parliament. Elections must be held by next spring. The rules of the electoral process have not been agreed upon after the old rules were ruled unconstitutional. Berlusconi and a far-right party (or two) may shortly announce so joint effort. While many have noted the recent easing of talk of leaving the EU or EMU, perhaps helped by the better economic performance, there remains cause for concern with the talk of a parallel currency, which, when asked, Draghi, reiterated the obvious: there is only one currency for EMU members. Italy addressed some it urgent banking challenges earlier this year, but the political risk remains. While Italy’s political risk will not come to a head until well into next year, Spain’s challenge is around the corner. Despite Spain’s high court ruling against them, Catalonia is pushing ahead with its referendum for independence on October 1. With no minimum turnout requirement, Catalonian leaders seem confident of their victory, though opinion polls show a close contest. The leaders claim that within 48 hours of the referendum they are prepared to declare their independence. |

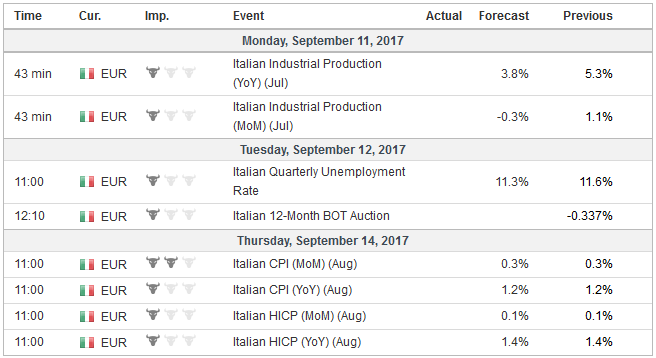

Economic Events: Italy, Week September 11 |

SpainMadrid is in an awkward position. If it seeks to enforce an injunction, which requires its police powers, it may alienate more Catalonians. If it allows the vote but declares it illegal, it may still have to enforce its decision. Spanish bonds have under-performed Italian bonds (by six basis points last week and 15 basis points over the past month). Spanish stocks have also lagged behind Italian stocks, with over half this year’s under-performance taking place over the past month. A year ago, as the LDP altered their rules to allow Abe a third term, he seemed unassailable. Now wracked by scandals and a stunning loss in the local Tokyo elections, and forced to reshuffle his cabinet, apparently giving room to rivals, Abe looks vulnerable. Unlike, Trump, Macron, or May who have a few years before having to face voters, Japan’s lower house election must be held by the end of next year. Surely, with Kuroda’s term ending next April, and no precedent in the past 50 years of a BOJ Governor given a second term, policy uncertainty looms large. Meanwhile, leaving rhetoric aside and focusing on real actions, the limited achievements of the Trump Administration’s first few quarters is well within the US liberal tradition. As he signed the executive order that pulled out of the TPP, he noted that both Clinton and Sanders were also opposed to it. Clinton too had been critical of the DACA program. His nominee to the Supreme Court is also within American tradition. Trump’s first Fed nominee, Quarles, was approved in committee last week and now faces a vote in the whole Senate. He could be easily approved as early as next week. In other areas, as we have argued before, the system has proved resilient. The judicial branch has limited his efforts to bar immigrants from certain countries and extended families of people already in the US. The legislative branch passed sanctions on Russia, Iran, and North Korea, which although Trump signed reluctantly, they curb the power of the “imperial presidency.” |

Economic Events: Spain, Week September 11 |

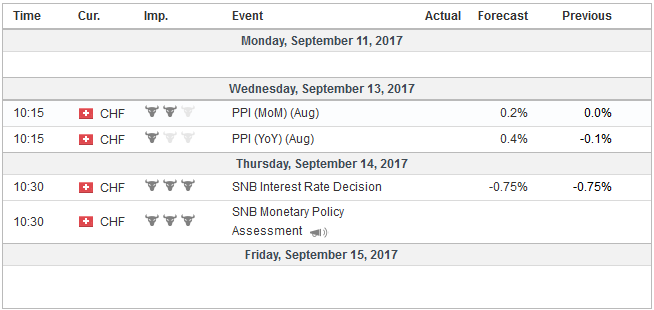

SwitzerlandThe Swiss deposit rate will remain unchanged at minus 75 bp. The OECD still regards the Swiss franc as the most over-valued currency in its universe (~23.5%). The SNB seems content to lag well behind the ECB and Fed in the monetary cycle. It may repeat it warning that it is prepared to intervene in the foreign exchange market if needed. We argue that one of the key drags on the dollar is coming from the drop in interest rates. Data due out in the coming days are unlikely to change sentiment. Specifically, there is risk that the core measure of CPI continued to decline last month. It peaked this year in January at 2.3%. It has been stuck at 1.7% for three months through July. The risk is that it slipped to 1.6% in August, which would be the lowest since January 2015. Retail sales are unlikely to have repeated July’s 0.6% rise. Auto sales will be a major drag on the headline. The components that feed into GDP are likely to have risen around 0.3%, which is about the average so far, this year. Similarly, industrial output growth likely slowed in August after a meager 0.2% increase in July which matches this year’s average. The jobs growth in manufacturing suggest that output in that sector likely fared better than over all industrial output. However, there is nothing in these data points that suggests the US economy has accelerating. |

Economic Events: Switzerland, Week September 11 |

ChinaChina cannot accept precipitating a crisis that would lead to regime change and the risk that US interests dominate the peninsula. At the same, time, China seems to recognize that North Korea’s six nuclear bomb tests, and even more missile tests, encourage the further deployment of missile defense systems in South Korea and Japan immediately, which could also ostensibly be used against it. A friendly vote from China would be to abstain, while the US course risks a veto unless it can be amenable to compromise. The failure of the UN to agree on more sanctions could further encourage North Korea and discourage risk taking. |

Economic Events: China, Week September 11 |

Tags: #GBP,#USD,$EUR,$JPY,ECB,Featured,newsletter,Politics