Fools and Rascals And it’s time, time, time And it’s time, time, time It’s time, time, time that you love And it’s time, time, time… – Tom Waits [embedded content] Tom Waits rasps about time POITOU, FRANCE – “So how much did you make last night?” “We made about $15,000,” came the reply from our eldest son, a keen cryptocurrency investor. “Bitcoin briefly pierced the $3,500 mark – an all-time high. The market cap of...

Read More »Views From the Top of the Skyscraper Index

Views From the Top of the Skyscraper Index On a warm Friday Los Angeles morning in spring of 2016, we found ourselves standing at the busy corner of Wilshire Boulevard and South Figueroa Street. We were walking back to our office following a client wire brushing for events beyond our control. But we had other thoughts on our mind. Standing amid a mob of pedestrians, we gazed up at the skeleton frame of what would...

Read More »Incrementum Advisory Board Meeting, Q3 2017

Global Monetary Architecture The quarterly Incrementum Advisory Board meeting was held last week (the full transcript is available for download below). Our regulars Dr. Frank Shostak and Jim Rickards were unable to attend this time, but we were joined by special guest Luke Gromen of research house “Forest for the Trees” (FFTT; readers will find free samples of the FFTT newsletter at the site and in case you want to...

Read More »The Myth of India’s Information Technology Industry

A Shift in Perception – Indians in Silicon Valley When I was studying in the UK in early 90s, I was often asked about cows, elephants and snake-charmers on the roads in India. A shift in public perception— not in the associated reality — was however starting to happen. India would soon become known for its vibran As more IT graduates from India moved to the US to work, they lobbied to change how India was viewed,...

Read More »The Student Loan Bubble and Economic Collapse

The Looming Last Gasp of Indoctrination? The inevitable collapse of the student loan “market” and with it the take-down of many higher educational institutions will be one of the happiest and much needed events to look forward to in the coming months/years. Whether the student loan bubble bursts on its own or implodes due to a general economic collapse, does not matter as long as higher education is dealt a death...

Read More »Congress’s Radical Plan to End Illegal Money

What Constitution? One of the many downfalls of being the United States Secretary of the Treasury is the requirement to place one’s autograph on the face of the Federal Reserve’s legal tender notes. There, on public display, is an overt record of a critical defect. A signature endorsement of a Federal Reserve note by the Treasury Secretary represents their personal ratification of unconstitutional money. If you...

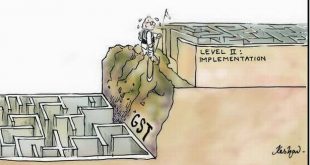

Read More »India: The Lunatics Have Taken Over the Asylum

Goods and Services Tax, and Gold (Part XV) Below is a scene from anti-GST protests by traders in the Indian city of Surat. On 1st July 2017, India changed the way it imposes indirect taxes. As a result, there has been massive chaos around the country. Many businesses are closed for they don’t know what taxes apply to them, or how to do the paperwork. Factories are shut, and businesses are protesting. [embedded...

Read More »Russell 2000: The Dangerous Season Begins Now

Old Truism Readers are surely aware of the saying “sell in May and go away”. It is one of the best-known and oldest stock market truisms. And the saying is justified. In my article “Sell in May and Go Away – in 9 out of 11 Countries it Makes Sense to Do So” in the May 01 2017 issue of Seasonal Insights I examined the so-called Halloween effect in great detail. The result: in just two out of eleven international stock...

Read More »Jayant Bhandari on Gold, Submerging Markets and Arbitrage

Maurice Jackson Interviews Jayant Bhandari We are happy to present another interview conducted by Maurice Jackson of Proven and Probable with our friend and frequent contributor Jayant Bhandari, a specialist on gold mining investment, the world’s most outspoken emerging market contrarian, host of the highly regarded annual Capitalism and Morality conference in London and consultant to institutional investors. As soon...

Read More »Quantitative Easing Explained

Printing Money We have noticed that lately, numerous attempts have been made to explain the mechanics of quantitative easing. They range from the truly funny as in this by now ‘viral’ You Tube video with two robotic teddy-bears discussing the Fed chairman’s qualifications (‘my plumber has a beard too’), to outright obfuscation such as the propagation of this ‘Bernanke explains he’s not printing money, it’s just an...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org