Bad Reputation Years ending in 7, such as the current year 2017, have a bad reputation among stock market participants. Large price declines tend to occur quite frequently in these years. Just think of 1987, the year in which the largest one-day decline in the US stock market in history took place: the Dow Jones Industrial Average plunged by 22.61 percent in a single trading day. Or recall the year 2007, which marked...

Read More »1987, 1997, 2007… Just How Crash-Prone are Years Ending in 7?

Bad Reputation Years ending in 7, such as the current year 2017, have a bad reputation among stock market participants. Large price declines tend to occur quite frequently in these years. Just think of 1987, the year in which the largest one-day decline in the US stock market in history took place: the Dow Jones Industrial Average plunged by 22.61 percent in a single trading day. Or recall the year 2007, which marked...

Read More »Donald Trump: Warmonger-in-Chief

Cryptic Pronouncements If a world conflagration, God forbid, should break out during the Trump Administration, its genesis will not be too hard to discover: the thin-skinned, immature, shallow, doofus who currently resides in the Oval Office! The commander-in-chief – a potential source of radiation? - Click to enlarge This past week, the Donald has continued his bellicose talk with both veiled and explicit threats...

Read More »India: The Genie of Lawlessness is out of the Bottle

Recapitulation (Part XVI, the Last) Since the announcement of demonetization of Indian currency on 8th November 2016, I have written a large number of articles. The issue is not so much that the Indian Prime Minister, Narendra Modi, is a tyrant and extremely simplistic in his thinking (which he is), or that demonetization and the new sales tax system were horribly ill-conceived (which they were). Time erases all...

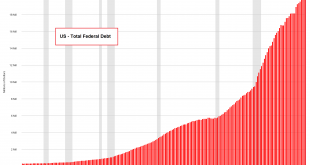

Read More »US Debt: To Hell In A Bucket

No-one Cares… “No one really cares about the U.S. federal debt,” remarked a colleague and Economic Prism reader earlier in the week. “You keep writing about it as if anyone gives a lick.” We could tell he was just warming up. So, we settled back into our chair and made ourselves comfortable. “The voters certainly don’t care about the federal debt,” he continued. “They keep electing the same spendthrifts to office. And...

Read More »The Government Debt Paradox: Pick Your Poison

Lasting Debt “Rule one: Never allow a crisis to go to waste,” said President Obama’s Chief of Staff Rahm Emanuel in November of 2008. “They are opportunities to do big things.” At the time of his remark, Emanuel was eager to exploit the 2008 financial crisis to raid the public treasury. With the passage of the American Recovery and Reinvestment Act in February 2009, Emanuel’s wish was granted. The Obama administration...

Read More »How to Make the Financial System Radically Safer

Preventing the Last Crisis Clear thinking and discerning rigor when it comes to the twisted state of present economic policy matters brings with it many physical ailments. A permanent state of disbelief, for instance, manifests in dry eyes and droopy shoulders. So, too, a curious skepticism produces etched forehead lines and nighttime bruxism. The terrible scourge of bruxism and its potentially terrifying...

Read More »Hidden Forces of Economics

Waiting for the Flood We have noticed a proliferation of pundits, newsletter hawkers, and even mainstream market analysts focusing on one aspect of the bitcoin market. Big money, institutional money, public markets money, is soon to flood into bitcoin. Or so they say. We will not offer our guess as to whether this is true. Instead, we want to point out something that should be self-evident. If big money is soon to come...

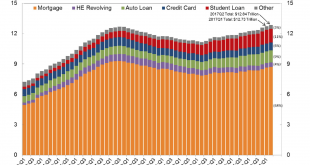

Read More »Why There Will Be No 11th Hour Debt Ceiling Deal

Milestones in the Pursuit of Insolvency A new milestone on the American populaces’ collective pursuit of insolvency was reached this week. According to a report published on Tuesday by the Federal Reserve Bank of New York, total U.S. household debt jumped to a new record high of $12.84 trillion during the second quarter. This included an increase of $552 billion from a year ago. United States Consumer DebtUS consumer...

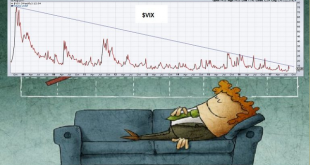

Read More »Is Historically Low Volatility About to Expand?

Suspicion Asleep You have probably noticed it already: stock market volatility has recently all but disappeared. This raises an important question for every investor: Has the market established a permanent plateau of low volatility, or is the current period of low volatility just the calm before the storm? When such questions regarding future market trends arise, it is often worthwhile to examine market history. For...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org