Printing Money We have noticed that lately, numerous attempts have been made to explain the mechanics of quantitative easing. They range from the truly funny as in this by now ‘viral’ You Tube video with two robotic teddy-bears discussing the Fed chairman’s qualifications (‘my plumber has a beard too’), to outright obfuscation such as the propagation of this ‘Bernanke explains he’s not printing money, it’s just an asset swap‘ notion. This was apparently repeated by NY Fed president William Dudley on one occasion as well. However, ‘quantitative easing’ does amount to printing money, even if it does not involve the issuance of currency in the form of banknotes. Probably readers have heard the term ‘high-powered

Topics:

Pater Tenebrarum considers the following as important: Central Banks, Debt and the Fallacies of Paper Money, Featured, newslettersent, On Economy

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Printing MoneyWe have noticed that lately, numerous attempts have been made to explain the mechanics of quantitative easing. They range from the truly funny as in this by now ‘viral’ You Tube video with two robotic teddy-bears discussing the Fed chairman’s qualifications (‘my plumber has a beard too’), to outright obfuscation such as the propagation of this ‘Bernanke explains he’s not printing money, it’s just an asset swap‘ notion. This was apparently repeated by NY Fed president William Dudley on one occasion as well. However, ‘quantitative easing’ does amount to printing money, even if it does not involve the issuance of currency in the form of banknotes. Probably readers have heard the term ‘high-powered money’, which is often used as a description of the monetary base. Why is base money considered ‘high powered’? To explain this we must briefly consider how the central bank-led fractionally reserved banking cartel in a fiat money system actually works. Let us first take a step back and consider a free market. In a free market, a highly marketable good will be chosen as money. Historically, all sorts of goods have been used as money (from salt to cowry shells), but wherever gold and silver were available, the market eventually settled on these metals. It is obvious why: there was a preexisting strong demand for them, they are highly durable, divisible, fungible and scarce. In the case of gold, its scarcity furthermore ensures a high per unit value, making it feasible for large scale transactions. A bank in a free market would accept deposits in the form of gold. As we pointed out in a previous essay on fractional reserves banking, a deposit contract is essentially different from a loan contract. It is a warehousing contract, not a ‘loan to the bank’ (even though modern-day jurisprudence disagrees on this point, by ignoring both legal tradition and logic). Nonetheless, banks have throughout history succumbed to the temptation of embezzling the money of their depositors and using it for their own business ventures. Once a bank has built up a reputation of solidity, it will be fairly easy for it to just keep a fractional reserve at hand – this is to say, instead of actually warehousing the entire amount on deposit, it will only keep a certain percentage at hand that it estimates will suffice to satisfy withdrawal demands in the ‘normal course of business’. |

|

A Brief Look at HistoryIn times past there were two methods of engaging in this type of fraud, both of which can be illustrated by the practices of English goldsmiths in the 18th and early 19th centuries, the forerunners of modern-day banks. The first method came into being when the goldsmiths noticed that the deposit slips they issued for gold on deposit with them began to circulate as money substitutes. If a customer deposits 10 ounces of gold and then uses his warehouse receipt for ten ounces as a means of payment, nothing untoward has happened of course. The money supply is unaltered. The situation changed when the goldsmiths figured out that they could make use of this development by issuing more warehouse receipts for gold than they actually had on deposit. Instead of just using these deposit slips to buy goods or services, they would lend them out at interest. This however did alter the money supply, as now both the original receipts (‘bank notes’) circulated concurrently with the ‘unbacked’ receipts – money from thin air had been created. This method of increasing the money supply invariably led to economic booms that were just as invariably followed by economic busts. Just as the booms were inflationary in nature, the busts were deflationary, as the amount of money substitutes contracted during the bust phases. Usually the busts would quickly reveal that many bankers did not have enough specie to honor all the bank notes they had issued and so the number of banks usually contracted as well on these occasions. The second method of inflating the money supply with money from thin air came into full flower when the English finally decided in 1844 that they had had enough of this fraud. Under the influence of the ‘Currency School’, the Peel Act of 1844 was designed to stop the issuance of bank notes not backed by specie once and for all – this was thought to end the problem of the boom-bust cycle. The Bank of England – the forerunner of the modern central bank – itself had to suspend specie payment numerous times between the time of its founding in 1694 to the enactment of the Peel Act in 1844. On one occasion, following a war with France in the late 18th century, it suspended payment for 24 years. Funny enough, it was also around this time that its bank notes were finally granted ‘legal tender’ status. By the early 1830’s, the BoE had become a full-fledged central bank. The flaw of the Peel Act was that its proponents had not realized that sight deposit are in fact a perfect money substitute. While the act succeeded in limiting the issuance of bank notes, the BoE and the commercial banks simply proceeded to inflate by creating new deposits. Further boom-bust sequences were the result, and the Peel act had to be suspended several times until the gold standard was finally ended to enable inflationary war financing for World War I. In any event, the BoE became the model for a modern-day central bank. The commercial banks were deprived of the right to issue notes, which became a monopoly of the central bank. Thus the private banks had to keep deposits with the central bank (their reserves), which could be drawn down against note issuance. |

|

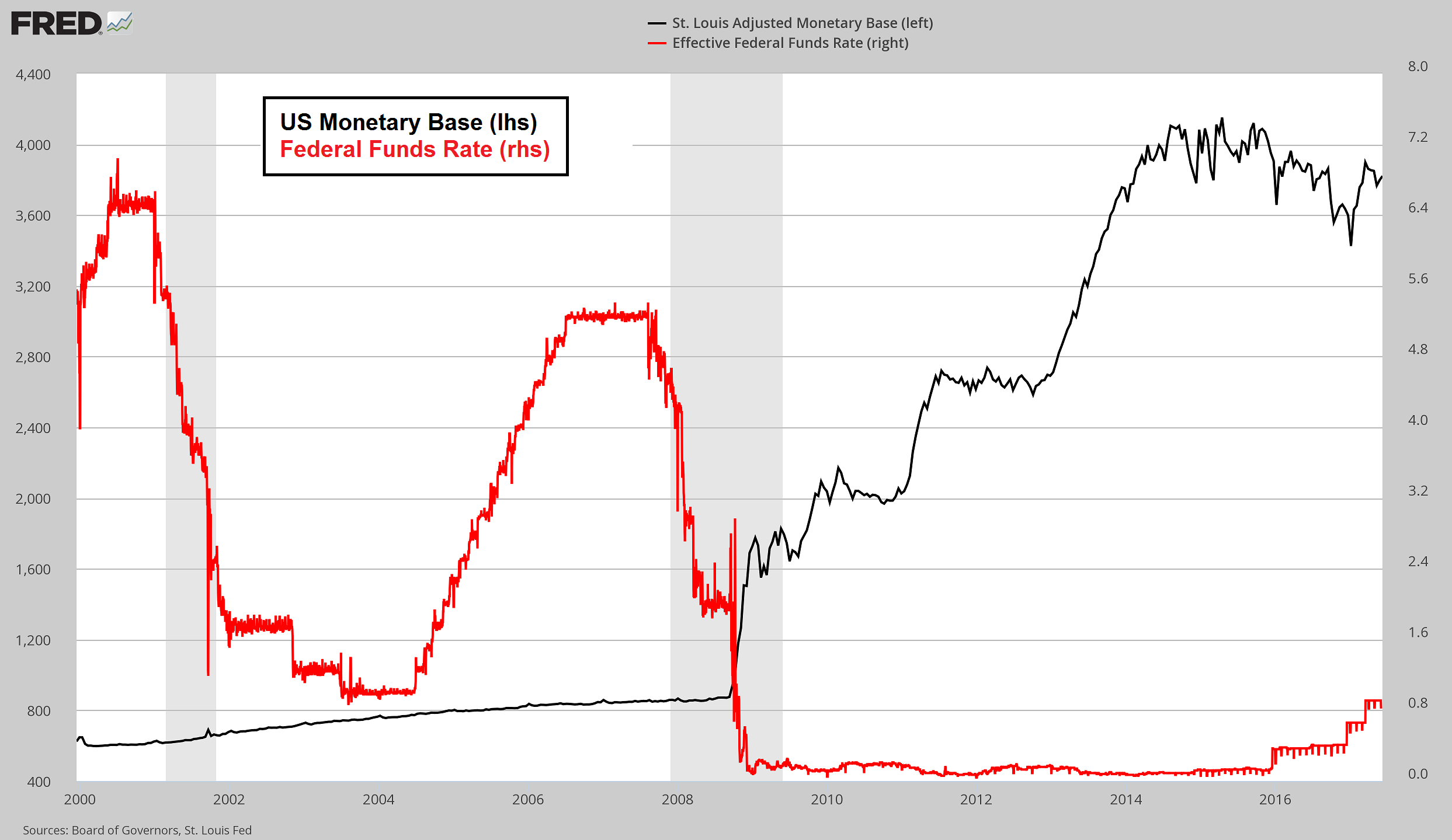

The Monetary BaseThe monetary base consists of currency in circulation and bank reserves (which in turn consists of ‘required’ and ‘excess reserves’). Bank reserves are in essence demand deposits of commercial banks at the Federal Reserve. Required reserves are those reserves that are legally required as ‘backing’ for the demand deposits customers of the commercial banks hold with the banks. In a fully ‘loaned up’ fractionally reserved banking system with e.g. a 10% legal reserve requirement, every $1 in reserves will support $10 in customer deposits. Thus the term ‘high-powered money’ for base money, as it serves as the means of pyramiding an enormous money supply on top of it. The central bank has the monopoly on issuing currency, so if a customer withdraws cash from a demand deposit, the bank in turn has to obtain the bank notes by drawing down its reserves account with the central bank (leaving aside that banks keep a certain amount of vault cash on hand). The bigger the amount of reserves (at a given reserve requirement), the bigger the amount of loans and deposits that can be supported, thus a withdrawal of cash has a ‘reverse leverage’ effect, while a cash deposit has the opposite effect. The Federal Reserve tends to keep an eye on the demand for cash however, and actively works against the deleveraging effect created by large withdrawal demands. The biggest factor in influencing the level of bank reserves are the Fed’s open market operations. Let us say the Fed buys an asset worth $1,000 from someone (the Fed can basically buy any asset it wants, but in practice it mostly buys treasury securities). This would create a deposit of $1,000 in favor of said someone, who deposits a check drawn on the Fed with his bank. The bank in turn deposits this check with the Fed. Considering the totality of this transaction we arrive at the following: the Fed has increased its assets by $1,000, a demand deposit of $1,000 was created at a commercial bank, but crucially, after the bank deposits the Fed’s check, bank reserves have also increased by $1,000. These reserves can once again be used to leverage the amount of outstanding loans and deposits according to reserve requirements. |

US Monetary Base And Federal Funds Rate, 2000 - 2017 |

|

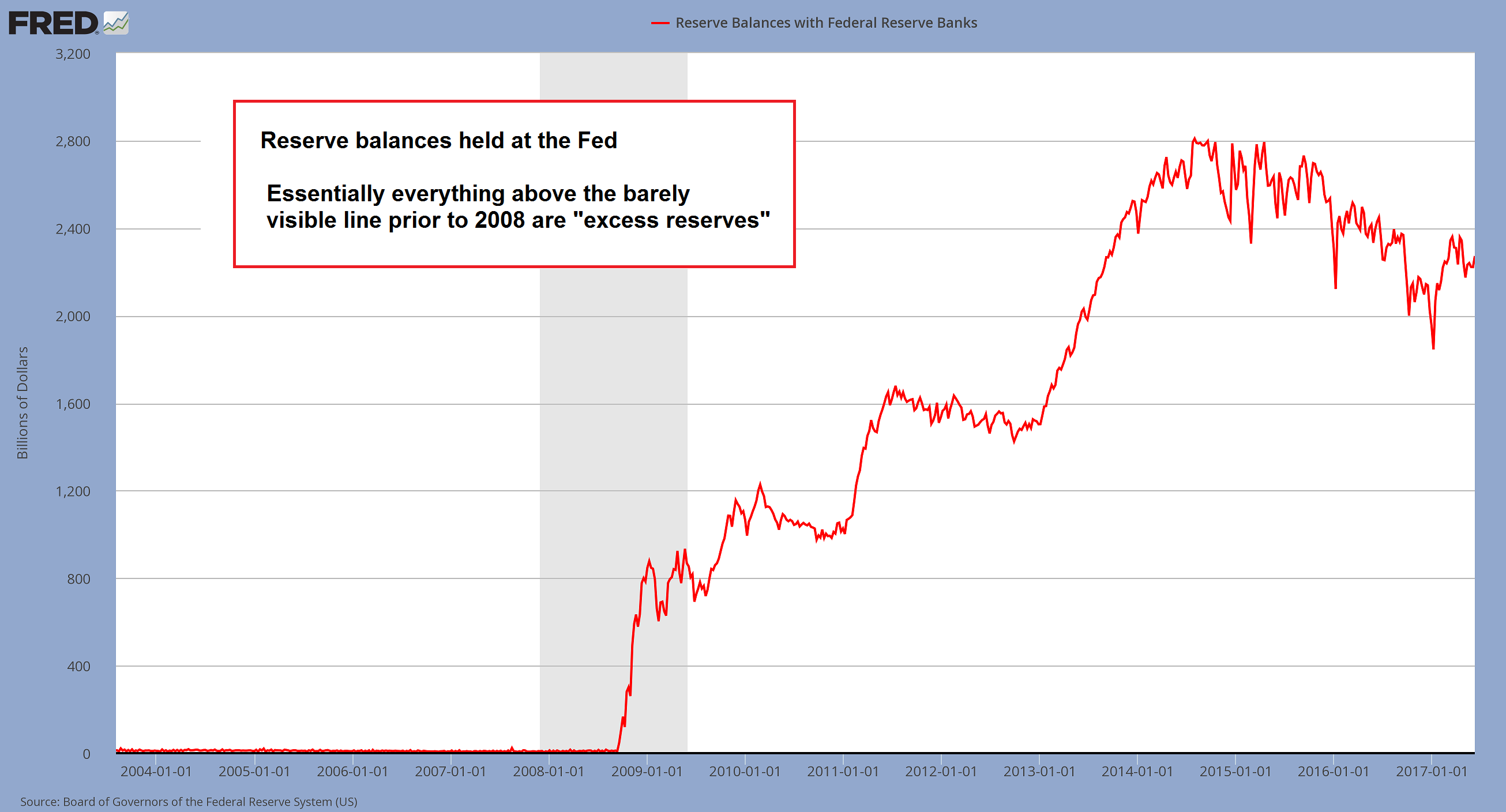

We have previously discussed how deposits tend to multiply in a fractionally reserved system via the so-called ‘multiplier’. A bank will not immediately lever up its reserves to the maximum allowed, but rather use the stock formula of 1-R (with R the required reserve). In this manner it can ensure that it won’t be put in a negative position vis-a-vis its reserves if the customer who receives the new deposit transfers his money to another bank (by e.g. paying someone who has an account somewhere else). So the initial additional money supply increase on a given increase in reserves will be 90% (with a 10% reserve requirement), a process that is then reiterated from bank to bank – it is this reiteration that can eventually lead to a ten-fold increase in deposits. However, at present the banks are not eager to lend a lot of money to the private sector – private sector credit demand has also decreased and in fact become negative (more loans are paid back than are taken out). As a result, excess reserves have been piling up at the Fed, for the first time since the Great Depression. Consider here what motivated the banks in the first place: a great amount of their assets turned out to be worthless (the famous ‘toxic’ assets) when the bust hit in 2008, and they found it difficult to maintain minimum capital ratios; their deposit liabilities of course remained the same, and initially the level of non-borrowed bank reserves went deeply into negative territory (this is to say, they were forced to borrow directly from the Fed’s discount window during this time). Also, banks fund themselves in the short term mainly in the Federal Funds market (essentially this is a market where banks with excess reserves lend to banks with a reserves shortfall), with the Fed supplying additional reserves (or draining reserves) with the aim of keeping the interest rate in the Federal Funds market on ‘target’. Nota bene, since the Fed’s balance sheet has continually grown in spite of lowering reserve requirements to next to nothing from the mid 90’s onward (when sweeps were introduced), we must conclude that the target rate was almost continually set below the level where it would have been in a free market – which is to say, the system always has an inflationary bias. Anyway, interbank lending dried up when the crisis hit, as banks would no longer trust each other (they sure were ‘fully loaned up’ at the height of the boom and it was not difficult to conclude for a bank at the time of the bust that all the other banks were in the same position of technical insolvency). So this increase in excess reserves, which as we noted above are the banks own demand deposits at the Fed and a substitute for cash, are akin to precautionary cash balances aimed at avoiding similar funding problems. The Mechanics of QEThe Fed asserts (see above), that its QE operations are not inflationary, since it merely ‘swaps assets’ – it is held that further asset purchases will merely increase the level of excess reserves, which by dint of not entering the money supply proper can not exert an effect on the economy. The purpose, according to Bernanke et al., of the asset purchases is merely to further depress interest rates across the maturity spectrum, as a lever against the so-called ‘zero-bound problem’. The idea is that once the Federal Funds rate has reached zero, the threat of deflation could lead to real interest rates rising above zero, which in the current economic situation is deemed bad. Furthermore, the Fed would like to adhere to the so-called ‘Taylor Rule’ (in spite of Professor Taylor’s protestations that it is misinterpreting and misusing his concept), a mathematical construct that purports to make monetary policy more ‘scientific’ by establishing an arithmetic rule for varying the administered interest rate according to the variance of ‘actual from target inflation’ (note that ‘inflation’ refers to the change in a price index in this case, not the phenomenon of inflation of the money supply as such), as well as the variance of economic output from ‘potential output’ (i.e, the so-called ‘output gap’ is incorporated in the formula as well). |

Reserve Balances Held At Fed, January 2004 - June 2017 |

If you think that this is nothing but a bunch of pseudo-scientific mumbo-jumbo, you are on the right track. This is an excellent example of the ‘pretense of knowledge’ as it were. This has of course not kept a Fed economist from concluding in mid 2009 that the Fed’s past policy stance as well as the ‘rules’ would theoretically require the Fed to cut the Fed Funds rate well below zero (pdf). The pertinent quote reads:

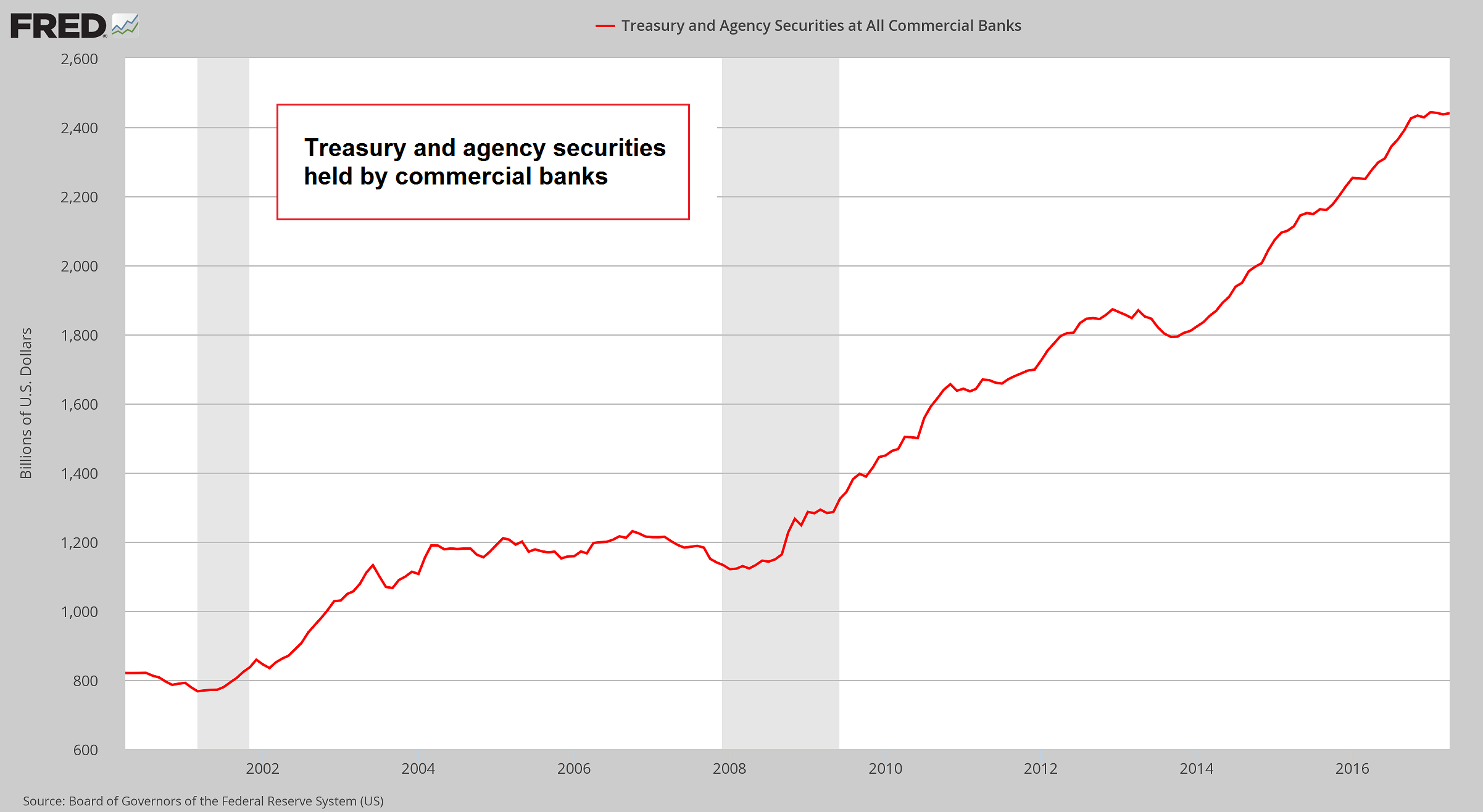

See? The ‘dashed line’ says so. We have previously commented on the sheer lunacy of negative interest rates when Gregory ‘Dream Team‘ Mankiw proposed their literal implementation and Willem Buiter followed suit , invoking the spirit of the monetary crank Silvio Gesell. Anyway, the asset purchases with money created from thin air are thought to be a second best solution to the ‘zero-bound’ problem, although the curious contradiction of how one can supposedly suppress interest rates and raise inflation expectations at the same time remains to this day unanswered by the proponents of this policy. You may safely count us as among those who are not in the least surprised that rates at the long end have been rising ever since QE2 began to be implemented. However, we want to return to the mechanics of QE, to show what actually happens in terms of immediate and potential money creation. First of all, it is important to note that the inflationary process does not require an additional fiscal deficit. When the Fed buys treasury debt to increase bank reserves, it buys already existing securities, i.e. the embodiment of past deficits. Even if the government ran a balanced budget or a budget surplus, the Fed would still be able to inflate the money supply (therefore, Mr. Hussman, with whom we agree on nearly everything else in his highly readable weekly comments, is in error on this particular point). Conversely, if the treasury ran a deficit, but financed it solely by selling securities to the private sector, all that would happen would be that existing deposits would be used to buy bonds, with the treasury then spending the money, after which it would become someone else’s deposit once again. During the entire operation the money supply would remain exactly the same, no matter how big the deficit (as long as someone is willing to lend the treasury money). Alas, what if the the treasury sells bonds to commercial banks? From the point of view of the banks, it does not matter how exactly they leverage their reserves. They can create new deposits for lending to the treasury just as easily as when they lend to the private sector. In this way new treasury debt can become inflationary – when the banking sector creates new demand deposits to finance the purchase. This is now where the Fed comes in. After all, what is required to create new demand deposits is an adequate level of reserves. |

Treasury And Agency Securities At All Commercial Banks, 2001 - 2017 |

| Let us say the Fed buys $10 billion of existing bonds in a POMO (permanent market operation) from a primary dealer that is a non-bank (all of them are in fact legally organized as non-banks, even though most of them are subsidiaries of banks these days). Now the primary dealer will have a demand deposit of $10 billion, assets on the Fed’s balance sheet will increase by $10 billion, and so will bank reserves after the Fed’s check is deposited by the commercial bank where the bond dealer has his account.

This increase in reserves by $10 billion will enable the banking system (via the previously mentioned multiplier function) to buy an additional $90 billion worth (with an assumed 10% reserve requirement) of new treasury bonds by creating demand deposits in favor of the treasury. Why only $90 billion and not $100 billion? This is due to the fact that the dealer’s demand deposit also needs to be backed by 10% reserves, so only $9 billion of the new reserves are available for monetary expansion. The total increase in money supply will of course be $100 billion ($ 10 billion in demand deposits to the dealer, $90 billion to the treasury, from whence it is distributed back into the economy at large). In short, it is mainly the desire of commercial banks to load up on treasury debt that determines how big a money supply expansion will eventually be generated by such asset purchases. Some people have accused Ben Bernanke of lying when he denied that the ‘Fed will monetize the government’s deficit’ in testimony. The chairman may actually be relying on a technicality here. As mentioned above, the Fed buys already existing bonds, so technically it is merely buying assets that represent deficits of the past, not current ones. Furthermore, the above calculations would look a great deal more inflationary if the Fed were to buy bonds from the treasury directly in the same amount that the commercial banks potentially will in the above example. If the Fed were to hand the treasury a $90 billion check drawn on the Fed in exchange for $90 billion in new treasury bonds, then obviously bank reserves would increase by $90 billion instead of $10 billion, with the attendant possibility of pyramiding that amount again via the multiplier function. Lastly, there is of course nothing that forces the banks to buy treasury securities to this extent. Alas, if you look closely at the chart of excess reserves above, you will notice that they are already burning a hole in their pockets, so to speak (they are paid a measly 0.25% on these excess reserves). The temptation to ‘ride the yield curve’ must be great, and there is indeed evidence that banks have begun to load up on treasury debt (they must do something after all, and the private sector is out at the moment). |

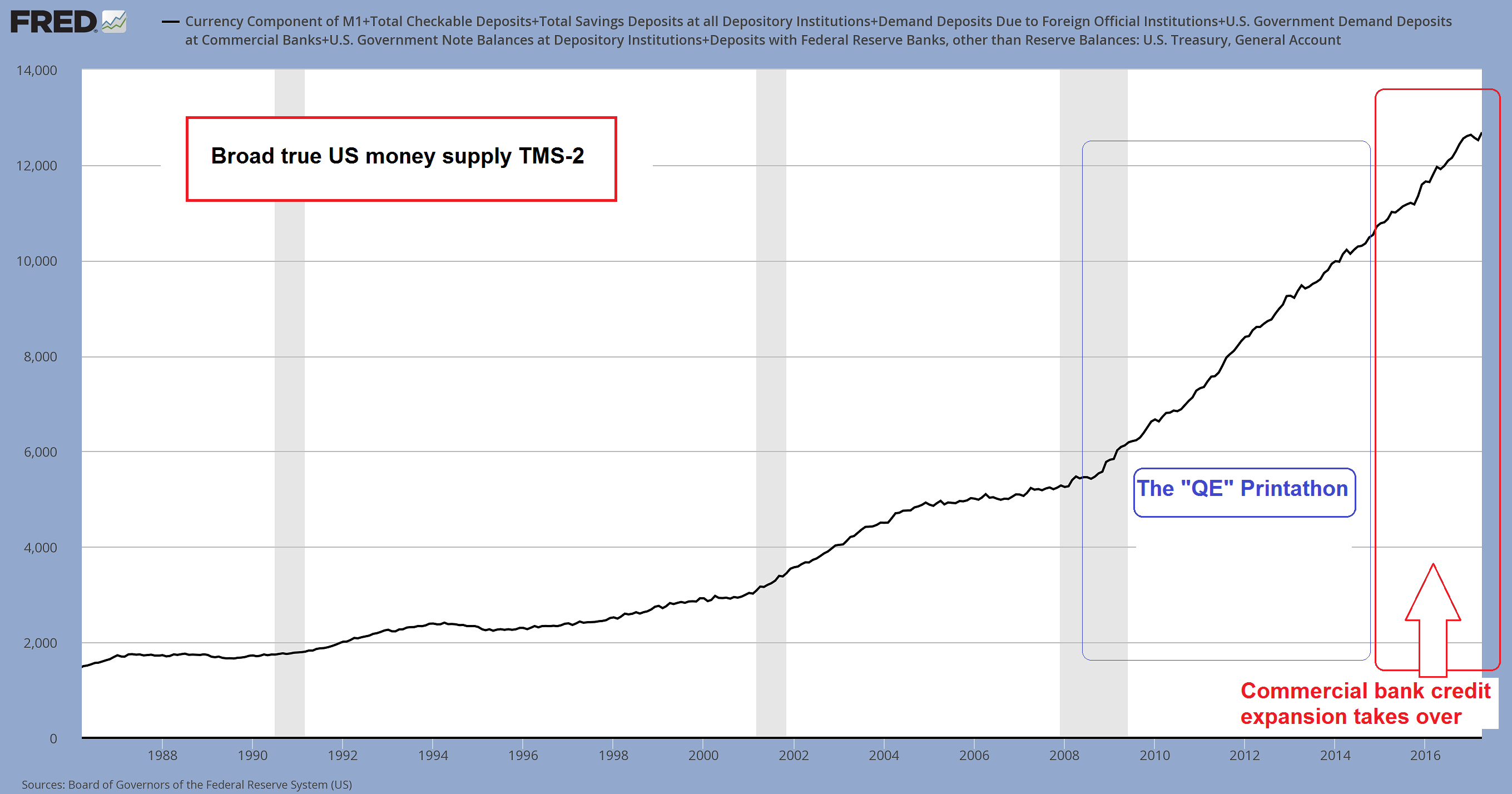

U.S. Broad True Money Supply, 1987 - 2017 |

Concluding Remarks

Lastly, we have read elsewhere that there is allegedly ‘no economic difference between money and t-bills or t-notes, as all are liabilities of the US government’.

That is incorrect from a theoretical as well as a practical standpoint. Money is the medium of exchange – a present good, that is immediately exchangeable for other goods and services. T-bills, t-notes and so forth are debt securities, i.e. they represent credit transactions that are not equivalent to money – in order to obtain money, one must first sell them to someone holding money (or creating it from thin air, whichever the case may be…).

T-bills are sometimes considered safer than deposit money by market participants during panics (since the counter-party is the US treasury instead of a mere commercial bank), alas, it would still not be possible to go shopping with them (try explaining that you want to pay with one to a Wal-Mart cashier. You’d likely stand a better chance with a gold coin). However, the high marketability of t-bills makes them probably what Mises called ‘secondary media of exchange’.

From the point of view of the individual actor, currency in one’s wallet and the deposit money in one’s account that is available on demand (including, these days, savings deposits) are one’s cash holdings, i.e. , they are ‘money’.

One’s t-bills and t-notes are investments in interest bearing securities; even though certain investments may be regarded as secondary media of exchange, one must still convert them to money proper or a perfect money substitute in order to make payments or increase one’s cash holdings.

We close with a quote from Ludwig von Mises that seems apropos considering the various justifications for QE we have seen emanating from the Fed (from Human Action, ch. 17/2, ‘Observations on Some Widespread Errors’):

“Instead of starting from the actions of individuals, as catallactics must do without exception, formulas were constructed, designed to comprehend the whole of the market economy. Elements of these formulas were: the total supply of money available in the Volkswirtschaft; the volume of trade – i.e., the money equivalent of all transfers of commodities and services as effected in the Volkswirtschaft; the average velocity of circulation of the monetary units: the level of prices. These formulas seemingly provided evidence of the correctness of the price level doctrine. In fact, however, this whole mode of reasoning is a typical case of arguing in a circle. For the equation of exchange already involves the level doctrines which it tries to prove. It is essentially nothing but a mathematical expression of the – untenable – doctrine that there is proportionality in the movements of the quantity of money and of prices.

In analyzing the equation of exchange one assumes that one of its elements – total supply of money, volume of trade, velocity of circulation – changes, without asking how such changes occur. It is not recognized that changes in these magnitudes do not emerge in the Volkswirtschaft as such, but in the individual actors’ conditions, and that it is the interplay of the reactions of these actors that results in alterations of the price structure. The mathematical economists refuse to start from the various individuals’ demand for and supply of money. They introduce instead the spurious notion of velocity of circulation fashioned according to the patterns of mechanics.”

Tags: central banks,Featured,newslettersent,On Economy