What Constitution? One of the many downfalls of being the United States Secretary of the Treasury is the requirement to place one’s autograph on the face of the Federal Reserve’s legal tender notes. There, on public display, is an overt record of a critical defect. A signature endorsement of a Federal Reserve note by the Treasury Secretary represents their personal ratification of unconstitutional money. If you recall, Article I, Section 8, of the U.S. Constitution empowers Congress – not the Federal Reserve – to coin money and regulate its value. What’s more, Article I, Section 10, specifies that money be coined of gold and silver and cannot consist of bills of credit – such as paper legal tender notes. As far as

Topics:

MN Gordon considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, On Economy, On Politics, U.S. money supply

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

What Constitution?One of the many downfalls of being the United States Secretary of the Treasury is the requirement to place one’s autograph on the face of the Federal Reserve’s legal tender notes. There, on public display, is an overt record of a critical defect. A signature endorsement of a Federal Reserve note by the Treasury Secretary represents their personal ratification of unconstitutional money. If you recall, Article I, Section 8, of the U.S. Constitution empowers Congress – not the Federal Reserve – to coin money and regulate its value. What’s more, Article I, Section 10, specifies that money be coined of gold and silver and cannot consist of bills of credit – such as paper legal tender notes. As far as we can tell, paper dollars are illegal money on two counts. First, they’re issued by the Federal Reserve. Second, they’re bills of credit with no ties to gold or silver. What gives? Isn’t the U.S. Constitution supposed to be the supreme law of the land? Don’t be silly. Anyone with half their wits about them knows the U.S. Constitution has been reduced to a mere artifact of history. Does this bother you? It bothers us. To be clear, we don’t take the recline and flail of the U.S. Constitution lightly. But we also can’t ignore the pervasive truth of its sad state. Of course, the dollar has other problems besides the major technicality of being illegal. For example, its qualities as a medium of exchange are suspect. |

|

Illegal Restrictions on Illegal MoneySeveral years ago JP Morgan Chase stopped accepting cash as payment for credit cards and mortgages. Now Visa is dangling carrots in front of merchants with hungry stomachs. Visa will upgrade a merchant’s payment system and in return the merchant will no longer accept cash payments from customers. Aren’t these actions by JP Morgan Chase and the merchants that take up Visa on their offer also illegal? The last we checked, the fine print on cash, as in paper dollars, says: This note is legal tender for all debts, public and private. We don’t see anything that exempts certain parties from accepting cash payments. Thus, illegal restrictions are being placed on illegal money. At least, that’s how we see it. But what do we know? We still cut our own grass and pay our utility bills with hand written checks. The point is, illegal money results in a whole host of problems. Moreover, the man who now autographs the illegal money, Treasury Secretary Steven Mnuchin, has these problems – and many more – bearing down upon him. |

Banks and credit card companies are at the forefront of the propaganda war against cash, and certainly not for altruistic reasons. Essentially they want governments to bring about a situation that will be tantamount to a highly profitable privilege for them – a bit like a letter of marque almost, a kind of highway robbery license. Governments eager to destroy even the last vestiges of financial privacy are no doubt happy to see their war on cash bankrolled by such well-endowed allies. Alas, individual liberty will be dealt a major blow if they succeed. For the time being, there is still massive resistance against the notion of abolishing cash. Most people instinctively understand that it would represent a tyrannical measure, even if they use cash only sparingly. Hence all sorts of things are tried to make the cashless society a fait accompli through the backdoor, which may eventually reduce an outright cash ban to a mere formality. [PT] |

| In short, today’s money is created from debt; it is borrowed into existence. Over time, the economy has adjusted to this debt based money. Business transactions are made with it. Private and public buying and selling is conducted with it. All commerce is now settled with debt payments. Even debt is paid with debt.

The economy has also adjusted to an ever-increasing money supply that’s contingent upon ever-increasing levels of debt. Just a brief pause in the expansion of the money supply and the whole thing falls apart. Debts quickly fall into arrears and businesses and individuals go bankrupt, as they run out of new debt to pay their old debts. |

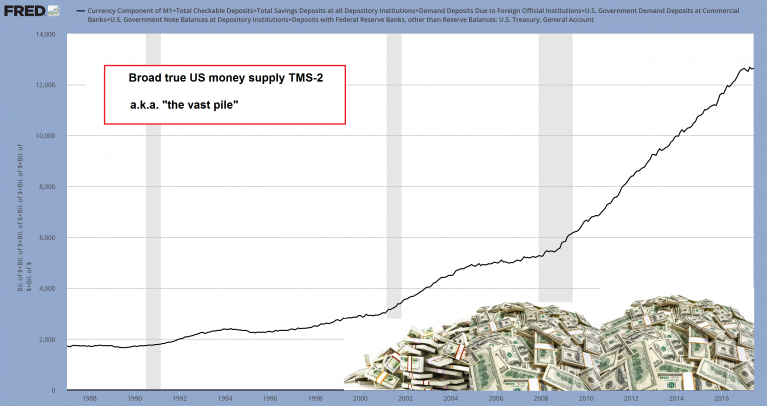

U.S. Money Supply TMS 2 1988 - 2017(see more posts on U.S. Money Supply, )People usually instinctively think “more is better” – but that is definitely not the case with the money supply. The willy-nilly expansion of the money supply cannot make us richer on a society-wide basis, although it can and does surreptitiously redistribute already existing wealth – mainly to those who need it least. Moreover, pumping up the money supply is an obstacle to economic progress. |

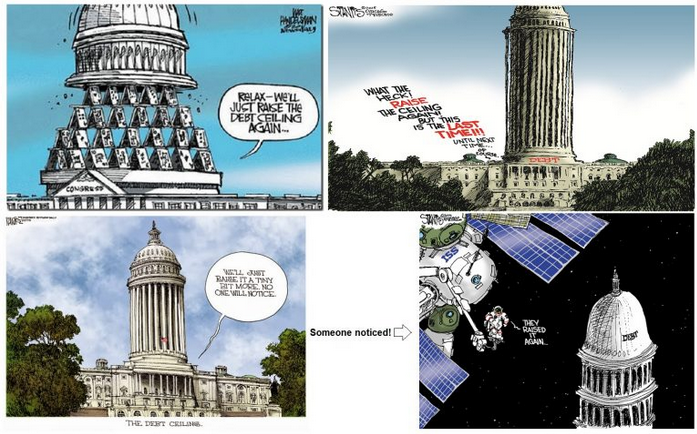

Congress’s Radical Plan to End Illegal MoneyAlong the way, debt based money has also given way to ever expanding government debt. Likewise, large components of the welfare-warfare state have become dependent upon it. Small reductions in deficit spending lead to large consequences for the economy. No doubt, Treasury Secretary Mnunchin has an intolerable job. He must keep the economy humming by paying out the government’s illegal money. However, to do so, he must also continue to run up the national debt. But the national debt is closing in on its current debt ceiling. Mnuchin will run out of the new debt he needs to pay the government’s obligations sometime in September if Congress doesn’t raise the debt ceiling. |

|

| So what’s the big deal? Congress has raised the debt ceiling 78 times over the last 57 years. Can’t they just raise it again? Yes, and until recently raising the debt ceiling was practically a consent item.

However, because the national debt has increased from under $6 trillion at the turn of the new millennium to nearly $20 trillion today, the debt ceiling has become highly politicized in Congress. Agreements to increase the debt ceiling must be met with other budget changes, including faux spending cuts, so that representatives can look good to their constituents. |

|

| Obviously, no one really believes that the Treasury will default on its debt. After much jabbering and kvetching a deal will be reached at the 11th hour, right? That’s what has happened in the recent past.

Yet given the quagmire Congress has made of its Obamacare repeal and replace efforts, you never know. They just can’t seem to get anything done. Perhaps they may unwittingly do us all a favor and fail to raise the debt ceiling. Could the dopes in Congress hatch a more radical plan to put an end to the government’s illegal money? Only by accident. |

Chart by: St. Louis Fed

Chart and image captions by PT

Tags: Featured,newsletter,On Economy,On Politics,U.S. Money Supply