[unable to retrieve full-text content]Reserve Bank of India will introduce a new monetary policy tool. Moody’s raised the outlook on Russia’s Ba1 rating from stable to positive. Fitch cut Saudi Arabia’s rating a notch to A+. Moody’s cut the outlook on Turkey’s Ba1 rating from stable to negative. China has temporarily suspended beef imports from Brazil.

Read More »March to Default

Style Over Substance “May you live in interesting times,” says the ancient Chinese curse. No doubt about it, we live in interesting times. Hardly a day goes by that we’re not aghast and astounded by a series of grotesque caricatures of the world as at devolves towards vulgarity. Just this week, for instance, U.S. Representative Maxine Waters tweeted, “Get ready for impeachment.” [embedded content] Well, Maxine...

Read More »The Inverse of Keynes

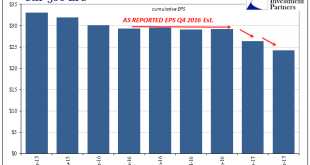

With nearly all of the S&P 500 companies having reported their Q4 numbers, we can safely claim that it was a very bad earnings season. It may seem incredulous to categorize the quarter that way given that EPS growth (as reported) was +29%, but even that rate tells us something significant about how there is, actually, a relationship between economy and at least corporate profits. Keynes famously said that we should...

Read More »The real reason Swiss drugs are so expensive

24 Heures. In Switzerland, a 16-pack of 500mg Dafalgan Odis (Paracetamol) costs CHF 8.60. A comparable French product, Doliprane, costs 1.12 euros for a box of 12 tablets the same size. 12 tablets of 500 mg of Algifor (Ibuprofen) costs CHF 9.90 compared to 2.50 euros for a similar box of Advil in France. © Ginasanders | Dreamstime.com - Click to enlarge Another product, Nivea Baby Serum physiologique (24 x 5 ml), an...

Read More »Results of the new pensions statistics 2015: Large differences between genders and age groups in pillar 2 and 3a old-age benefits

Neuchâtel, 24.03.2017 (FSO) – In 2015 approximately 33,000 persons obtained an old-age pension for the first time from the occupational pension fund (2nd pillar), while some 41,000 persons received a lump-sum withdrawal from their 2nd pillar retirement savings. Men received far higher benefits from the 2nd pillar than women. Pensions obtained before the legal retirement age were on average the highest. These are some of...

Read More »FX Daily, March 24: Dollar Trying to Stabilize Ahead of the Weekend

Swiss Franc EUR/CHF - Euro Swiss Franc, March 24(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF With just a few days to go before Article 50 is triggered the currency markets are waiting with baited breath for what may happen to the value of the Pound against all major currencies including against the Swiss Franc. Yesterday we saw a brief respite for the Pound vs the Swiss Franc with the release of...

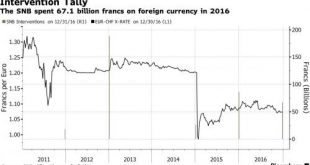

Read More »SNB Spent $68 Billion On Currency Manipulation In 2016

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China. But while everyone knows that the biggest currency manipulation in the world, and perhaps the Milky...

Read More »Vollgeld? Geht schon!

Der Bundesrat, Economiesuisse und die die Schweizerische Nationalbank haben die Vollgeldinitiative salopp (oder populistisch?) als Hochrisikoexperiment zur Ablehnung empfohlen. In ihrer Überheblichkeit gehen sie davon aus, dass dies auch so geschehen wird. Dazu brauche es nicht einmal einen Gegenvorschlag. Sie haben die Rechnung damit möglicherweise ohne den Schweizer Wirt gemacht. Den meisten Bürgern ist (noch?) nicht...

Read More »The Deep State’s Dominant Narratives and Authority Are Crumbling

This is why the Deep State is fracturing: its narratives no longer align with the evidence. As this chart from Google Trends illustrates, interest in the Deep State has increased dramatically in 2017. The term/topic has clearly moved from the specialist realm to the mainstream. I’ve been writing about the Deep State, and specifically, the fractures in the Deep State, for years. [embedded content] Amusingly, now that...

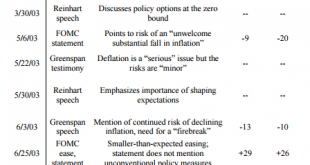

Read More »All In The Curves

If the mainstream is confused about exactly what rate hikes mean, then they are not alone. We know very well what they are supposed to, but the theoretical standards and assumptions of orthodox understanding haven’t worked out too well and for a very long time now. The benchmark 10-year US Treasury is today yielding less than it did when the FOMC announced their second rate hike in December. Thus, despite two rate...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org