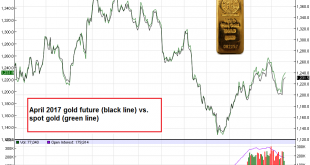

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Probabilistic Technical Analysis vs. the Mechanics of Arbitrage We talk about the supply and demand fundamentals every week. We were surprised to see an article about us this week. The writer thought that our technical analysis cannot see what is going on in the market. We don’t want to fight with people, we prefer to...

Read More »Swiss Trade Balance February 2017: imports “outperform” exports

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity increases, while REER assumes constant productivity in comparison to trade partners. On the other side, a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to...

Read More »The Best Ways to Invest in Gold Today

The Best Ways to Invest in Gold Today – The cost of buying and selling gold – How to buy gold on the cheap – How to avoid paying capital gains tax (CGT) on your gold – Open an account with one of the online bullion dealers – the likes of GoldMoney, GoldCore or Bullion Vault – Gold Sovereigns and Gold Britannias make for a considerable saving on cost because of the CGT exemption Gold Britannias and Sovereigns are free...

Read More »Digital Gold – For Now Caveat Emptor

Digital Gold On The Blockchain – For Now Caveat Emptor – Bitcoin surpasses gold price – a psychological and arbitrary headline – Royal Mint blockchain gold asks you to trust in the UK government – Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers – Invest in a gold mine using cryptocurrency – but wait until 2022 for your gold...

Read More »Was There Ever A ‘Skills Mismatch’? Notable Differences In Job Openings Suggest No

Perhaps the most encouraging data produced by the BLS has been within its JOLTS figures, those of Job Openings. It is one data series that policymakers watch closely and one which they purportedly value more than most. While the unemployment and participation rates can be caught up in structural labor issues (heroin and retirees), Job Openings are related to the demand for labor rather than the complications on the...

Read More »Solutions Abound–on the Local Level

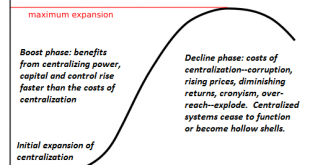

Rather than bemoan the inevitable failure of centralized “fixes,” let’s turn our attention and efforts to the real solutions: decentralized, networked, localized. Those looking for centralized solutions to healthcare, jobs and other “macro-problems” will suffer inevitable disappointment. The era in which further centralization provided the “solution” has passed: additional centralization (Medicare for All, No Child Left...

Read More »Weekly Sight Deposits and Speculative Positions: EUR/CHF suddenly higher after ECB

Headlines Week March 20, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Last week: The EUR/CHF suddenly appreciated with the ECB meeting,...

Read More »Weekly Speculative Position: After ECB, Reduction of Euro Shorts

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Divergence Theme Questioned

Recent developments have given rise to doubts over the divergence theme, which we suggested have shaped the investment climate. There are some at the ECB who suggest rates can rise before the asset purchases end. The Bank of England left rates on hold, but it was a hawkish hold, as there was a dissent in favor of an immediate rate hike, and the rest of the Monetary Policy Committee showed that their patience with both...

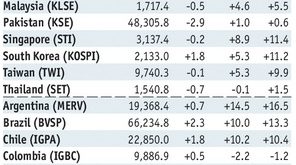

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX had a stellar week, ending on a strong note in the aftermath of what the market perceived as a dovish Fed hike Wednesday. Every EM currency except ARS was up on the week vs. USD, with the best performers ZAR, TRY, COP, and MXN. There are some risks ahead for EM this week, with many Fed speakers lined up and perhaps willing to push back against the market’s dovish take on the FOMC. Stock Markets...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org