20 Minutes. Swiss post has said it will deliver the first packages by air this summer. The first deliveries will be made between two medical laboratories on the southern side of the Alps. Swiss Post Drone - Click to enlarge . Test flights were conducted in the canton of Bern last year. Now Swiss Post is ready to make commercial deliveries starting in Lugano. The two medical labs, one kilometre apart, belong to the...

Read More »The Long Run Economics of Debt Based Stimulus

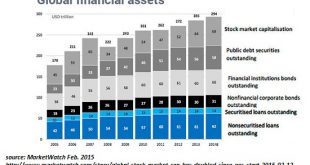

Onward vs. Upward Something both unwanted and unexpected has tormented western economies in the 21st century. Gross domestic product (GDP) has moderated onward while government debt has spiked upward. Orthodox economists continue to be flummoxed by what has transpired. What happened to the miracle? The Keynesian wet dream of an unfettered fiat debt money system has been realized, and debt has been duly expanded at...

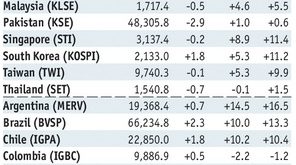

Read More »Emerging Markets: What has Changed

Summay The PBOC increased the rates it charges for OMO and MLF by 10 bp. Indian Prime Minister Modi’s BJP won elections in the state of Uttar Pradesh. Czech central bank broached the possibility of a koruna cap exit later than mid-2017. Kuwait became the first OPEC member to call for extended output cuts. Moody’s raised the outlook on Brazil’s Ba2 rating from negative to stable. Brazilian prosecutor Janot has given the...

Read More »Further Unanchoring Is Not Strictly About Inflation

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate. In those days, transparency was no virtue but rather it was widely...

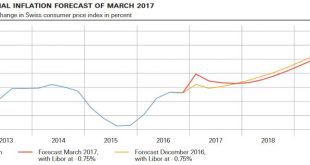

Read More »SNB Monetary Policy Assessment March 2017

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at–0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into...

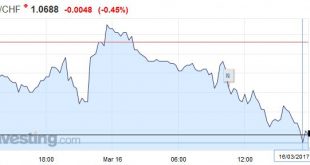

Read More »FX Daily, March 16: Greenback Consolidates Losses as Yields Stabilize

Swiss Franc EUR/CHF - Euro Swiss Franc, March 16(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP/CHF Sterling vs the Swiss Franc has fallen again as the US Federal Reserve have raised interest rates last night. This has seen the Pound fall against most major currencies and the safe haven status of the Swiss Franc has once again helped to improve CHF/GBP rates We now also have the news...

Read More »Federal Reserve Hikes, but Changes Little Else

Summary: Fed made mostly minor changes in the statement as it hiked the Fed funds rate for the third time in the cycle. The average and median dot for Fed funds crept slightly higher. There was only one dissent to the decision. The Federal Reserve delivered the much-anticipated rate hike. There was one dissent, the Minneapolis Fed President Kashkari. In the first paragraph of the FOMC statement tweaked the...

Read More »Global Asset Allocation Update

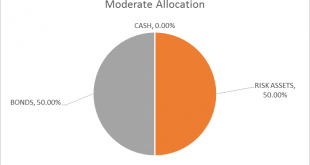

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle. Post meeting, a lot of the rise came out of the market. Nominal and...

Read More »Now That Everyone’s Been Pushed into Risky Assets…

A funny thing happened on the way to a low-risk environment: loans in default (non-performing loans) didn’t suddenly become performing loans. If we had to summarize what’s happened in eight years of “recovery,” we could start with this: everyone’s been pushed into risky assets while being told risk has been transformed from something to avoid (by buying risk-off assets) to something you chase to score essentially...

Read More »Swiss Producer and Import Price Index in February 2017: -0.2 percent

The Producer Price Index (PPI) or officially named "Producer and Import Price Index" describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org