See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Purveyors of Economic Stability It’s almost like magic. The Fed can say something, or in the case of this Wednesday it can say nothing, and gold and especially silver get a boost of rocket fuel. Actually, the Fed said both yes to rate hikes—in the future—and no to a rate hike now. This was good, if not for people, at least for gold. Well, if not for gold, at least the price of the metal. And especially silver. The price of silver had been up sharply on Monday, it inched up on Tuesday, and shot up another 60 cents on Wednesday, the day of the announcement. We have expressed our view many times that this is not gold or silver going up, but the dollar going down. Measured in grams of silver, the dollar went down from 1.66 last week to end this week at 1.58, -0.08g or -4.8%. It’s ironic that last week, we said this: Just repeat after me: “the Fed makes the economy more stable.” The dollar is down nearly 5% in terms of one form of honest money. In a week. More stable. Could we be forgiven for quoting the Princess Bride? “You use that word stable. I do not think that this word means what you think that it means.

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold, Gold and its price, gold basis, Gold co-basis, gold silver ratio, newsletter, Precious Metals, silver, silver basis, Silver co-basis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Purveyors of Economic StabilityIt’s almost like magic. The Fed can say something, or in the case of this Wednesday it can say nothing, and gold and especially silver get a boost of rocket fuel. Actually, the Fed said both yes to rate hikes—in the future—and no to a rate hike now. This was good, if not for people, at least for gold. Well, if not for gold, at least the price of the metal. And especially silver. The price of silver had been up sharply on Monday, it inched up on Tuesday, and shot up another 60 cents on Wednesday, the day of the announcement. We have expressed our view many times that this is not gold or silver going up, but the dollar going down. Measured in grams of silver, the dollar went down from 1.66 last week to end this week at 1.58, -0.08g or -4.8%. It’s ironic that last week, we said this:

The dollar is down nearly 5% in terms of one form of honest money. In a week. More stable. Could we be forgiven for quoting the Princess Bride? “You use that word stable. I do not think that this word means what you think that it means.” |

|

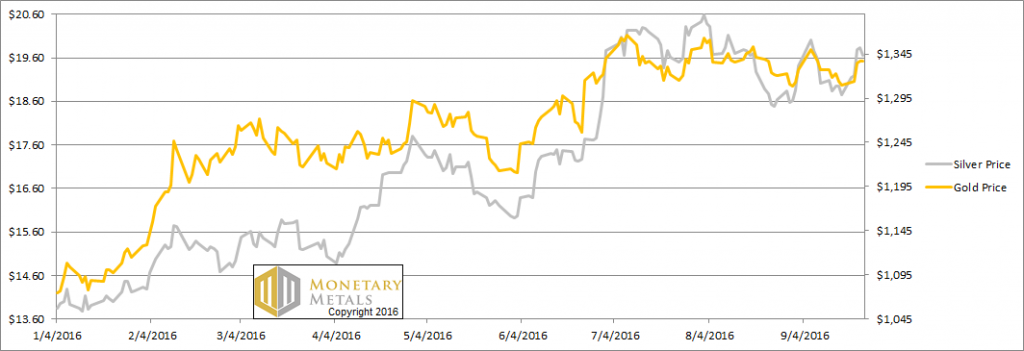

Fundamental DevelopmentsAs always, the central question to be answered in this report is simple. Is this a change in the fundamentals of supply and demand? Read on for the only true picture of the fundamentals of the monetary metals. But first, here’s the graph of the metals’ prices. |

Prices of Gold and Silver(see more posts on Gold, silver, ) |

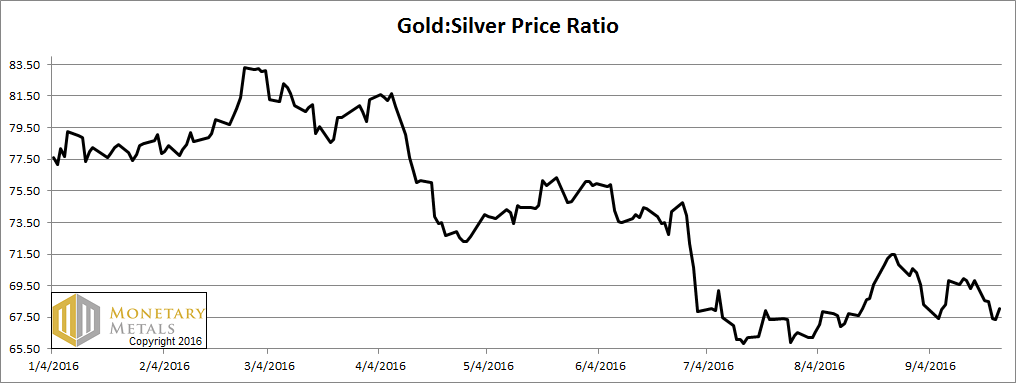

Gold-silver ratioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It was down sharply last week.

|

Gold Silver Ratio(see more posts on gold silver ratio, ) |

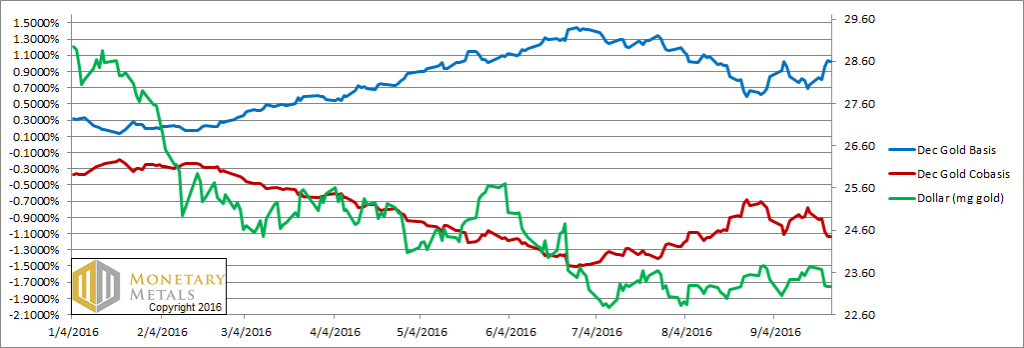

Here is the gold graph.

Gold Basis and Co-Basis and the Dollar PriceIt’s clear from this graph, that the fundamentals of gold did not change. The price of gold was up. On this graph, that appears as a falling dollar price (from 23.75mg gold last week to 23.26mg this week, or about -0.5mg which is -2%). However, along with this new, higher price of gold we see a new, higher basis (i.e., abundance of gold to the market). The basis is the annualized profit you can make to carry gold, that is buy a bar and simultaneously sell a futures contract. The December basis increase from 0.74% to 1.02%. One percent is not a bad return to make for an investment that will mature in 3 months. However, it shows just how the gold market is currently structured. The price is held up by speculators buying futures (with leverage, of course). The Monetary Metals calculated fundamental price hardly budged (+$3). It’s $35 below the market price. |

Gold Basis and Co-Basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

Now let’s look at silver.

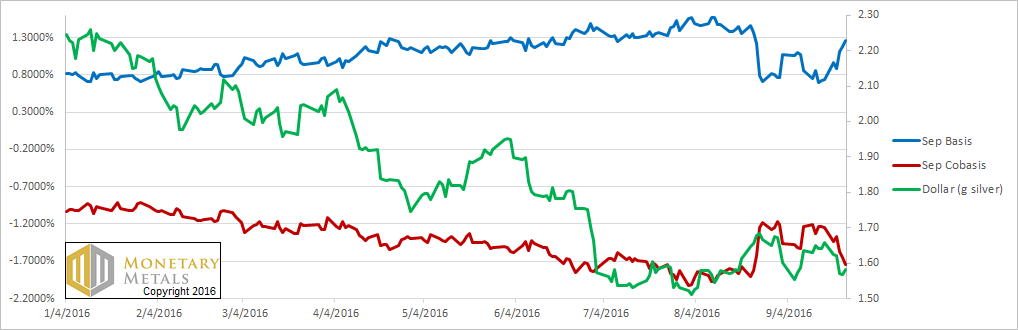

Silver Basis and Co-Basis and the Dollar PriceThe silver graph shows the same pattern, only with more stark clarity. The drop in the green line (the price of the dollar, here measured in grams of silver) is much larger than in the gold chart above. And the rise in the silver basis is similarly much larger. It went from 0.73% last week (almost identical to gold) to 1.26%, about double the gain compared to the gold basis. The frantic bidding up of the silver price in response to the Fed non-announcement is like the dogs salivating in response to Pavlov’s bell. Automatic and unthinking. There are actually two false premises underlying this knee-jerk reaction. One is that the non-hike by the Fed is going to cause the quantity of dollars to increase. At least compared to whatever market participants previously expected. We’ll leave the debate over the quantity of what is now called money to others. We will just note that the total debt in the system continues on its exponentially rising trend, because it must. There is no extinguisher of debt in our irredeemable currency. The other flawed idea is that if the number of dollars goes up, then so must the price of gold. The price of gold is not exactly up since 2011 but the quantity of dollars sure is. M0 money supply has nearly doubled in the time that the price of gold has fallen from over $1,900 to its current $1,337. And silver is much more extreme, with its price falling from over $49 to its current level under $20. |

Silver Basis and Co-Basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

By the way, the Monetary Metals fundamental price of silver didn’t budge this week either.

Charts by: © 2016 Monetary Metals