While de-escalation looks possible, there is a risk that tensions rise further, with implications for the global economy and financial markets.The move by Saudi Arabia and its allies to cut diplomatic relations with Qatar and impose a de facto blockade of the country abruptly deepens a key line of fracture in the Middle East. There is a risk that tensions rise further. If Qatar turns to Iran for support, a direct escalation between Saudi Arabia and Iran would be possible. A de-escalation,...

Read More »U.S. job creation softens, but unemployment lowest in 16 years

The May nonfarm payroll report was mixed, but still unlikely to modify the case for a Fed hike this month. We still expect the Fed to raise rates twice more this year (in June and September).May was a mixed month for US employment data. Job creation was softer than expected, the figures for the previous couple of months were revised down and average hourly earnings data were somewhat disappointing. However, the unemployment rate unexpectedly fell further, reaching its lowest level since...

Read More »New fixing mechanism limits renminbi depreciation against the U.S. dollar

A new daily fixing mechanism gives the Chinese central bank more control over the exchange rate and reduces pressure on the renminbi in the case of renewed dollar strength.The People’s Bank of China (PBoC) recently announced the introduction of a “counter cyclical adjustment factor” (CCAF) to calculate the daily USD/CNY reference rate (the “fixing rate”). The previous formula used two factors: the USD/CNY spot close of the previous day and an adjustment factor taking into account overnight...

Read More »Core inflation clouds ECB’s next move

Although flash inflation was down in May, we expect core prices to pick up gradually and the ECB to move very cautiously toward policy normalisation.Euro area ‘flash’ HICP inflation came in at 1.4% y-o-y in May (down from 1.9% in April) while core inflation eased to 0.94% (down from 1.2%), both slightly below consensus expectations, as energy-related base effects and Easter distortions faded. We forecast euro area inflation to remain relatively stable in the next few months before core...

Read More »Resilient earnings growth across all regions

Analysis suggests that earnings growth should reach double digits in most major markets, helping to underpin equity markets.Corporate earnings growth for Q1 2017 surprised positively across major economies. Among the key trends of this earnings season has been the synchronisation not only of the macroeconomic cycle, but also the earnings cycle. Indeed, all markets exhibited strong trends in corporate profit growth. In particular, Japan and Europe provided significant positive surprises. The...

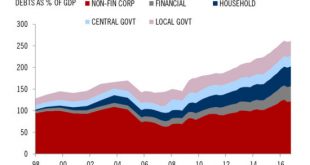

Read More »China: rising debts a long-term concern, but short-term crisis unlikely

Moody’s downgraded China’s sovereign rating last week. We believe the country is well equipped to deal with debt issues in the short term, but faces profound challenges in the longer term.Moody’s announced on 24 May that it had downgraded China’s long-term local currency and foreign currency issuer ratings to A1 from Aa3, due to its concerns about the rising debt in China. According to our estimate, China’s total debt amounted to Rmb203 trillion as of the end of 2016, equivalent to 261% of...

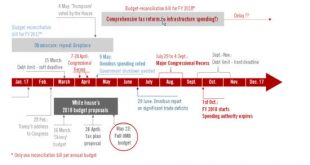

Read More »Trump’s proposed budget is light on details

Heavy on spending cuts, but containing dubious revenue calculations, the president’s budget plan is unlikely to be adopted by Congress. But we still expect tax cuts by year’s end.President Trump’s budget request was issued yesterday. Higher defence and infrastructure spending are proposed, more than compensated for by drastic cuts in other spending. The consequence is that total outlays are reduced dramatically.On the revenue side, the budget plan was very short on details. It assumes that...

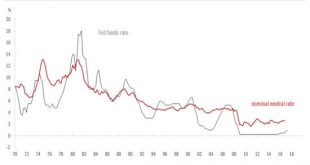

Read More »Fed funds rate back to 3%?

Analysis of the ‘neutral’ rate of interest suggests there is considerable market complacency surrounding the potential for further hikes in the Fed funds rate.Janet Yellen refers regularly to the concept of ‘neutral’ interest rate as a reference point for monetary policy. The neutral rate is very helpful in determining whether the Fed’s monetary stance is relaxed or restrictive and can also provide insight into the Fed’s next possible moves.The financial crisis has had a considerable impact...

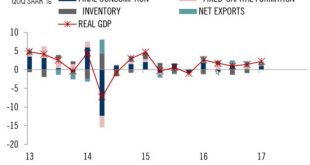

Read More »Moderate recovery underway in Japan

While we are revising up our forecast for GDP growth this year, we expect the Bank of Japan will continue with its qualitative and quantitative easing policies.Japan’s GDP grew by 1.6% year-over-year in Q1 in real terms. On a quarter-over-quarter basis, the economy expanded by 2.2% annualised, the highest growth rate since Q1 2016. In light of the stronger-than-expected Q1 figure, we have decided to revise up our 2017 GDP growth forecast for Japan to 1.3% from 0.8% previously.Exports...

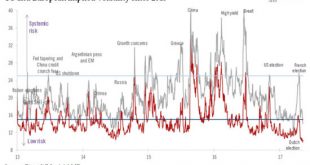

Read More »The populist tide may be yet to peak

Populism could remain a feature of politics in the western world, with the resultant volatility likely to have wide-ranging implications for investors.Populist parties have been on the rise in Western democracies in recent years. They have already achieved two landmark successes, with Brexit and Trump, and are threatening breakthroughs elsewhere. We see six main drivers of the populist surge: rising economic insecurity, globalisation, a technological innovation shock, cultural backlash,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org