Analysis suggests that earnings growth should reach double digits in most major markets, helping to underpin equity markets.Corporate earnings growth for Q1 2017 surprised positively across major economies. Among the key trends of this earnings season has been the synchronisation not only of the macroeconomic cycle, but also the earnings cycle. Indeed, all markets exhibited strong trends in corporate profit growth. In particular, Japan and Europe provided significant positive surprises. The strong Q1 2017 reporting season has anchored full year earnings growth estimates at more than 10% most major economic areas. On the S&P 500, 62% of companies’ earnings came in above expectations, making it the best reporting season of the 2010s so far. Whereas just 45% of companies on the Stoxx Europe

Topics:

Wilhelm Sissener and Jacques Henry considers the following as important: corporate earnings, earnings cycle, earnings growth, earnings surprises, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Analysis suggests that earnings growth should reach double digits in most major markets, helping to underpin equity markets.

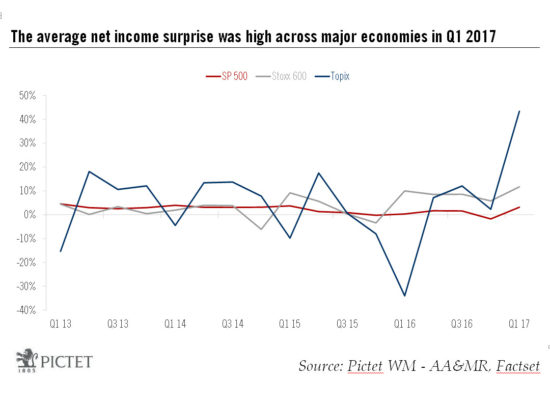

Corporate earnings growth for Q1 2017 surprised positively across major economies. Among the key trends of this earnings season has been the synchronisation not only of the macroeconomic cycle, but also the earnings cycle. Indeed, all markets exhibited strong trends in corporate profit growth. In particular, Japan and Europe provided significant positive surprises.

The strong Q1 2017 reporting season has anchored full year earnings growth estimates at more than 10% most major economic areas. On the S&P 500, 62% of companies’ earnings came in above expectations, making it the best reporting season of the 2010s so far. Whereas just 45% of companies on the Stoxx Europe 600 reported earnings above expectations in Q1 2011 (during the euro crisis), the proportion reached 60.5% in Q1 2017, similar to the US level. European profit margins surprised positively, with top-line coming in above expectations by an average of 2.9%. In Japan, almost 70% of companies on the Topix 500 reported earnings above expectations. This marks a stark improvement compared to Q4 2015, when the figure stood at a weak 40%. The average net income surprise went from 2.3% in the case of the S&P500 and 11.7% for the Stoxx Europe 600 to a stellar 43% in the case of the Topix.

Earnings growth expectations were high going into 2017, and these hopes were not disappointed in the first quarter. Resilient earnings in the current favourable macroeconomic environment should support further rises in equity markets. This is the case across all regions, although currently emerging markets and Europe stand to benefit more from earnings trends than the US and Japan.

From the beginning of the year to 29 May, equity market returns have been stellar (in local currency), especially in emerging markets (+14.1% for the MSCI Emerging Markets Index), followed by Europe (+10.1% for the Stoxx Europe 600), the US (+8.8% for the S&P 500) and Japan (+4.4% for the TOPIX). Earnings are the common factor explaining these strong returns. Earnings figures have not disappointed and have even surprised positively, especially in emerging markets, followed by Europe.