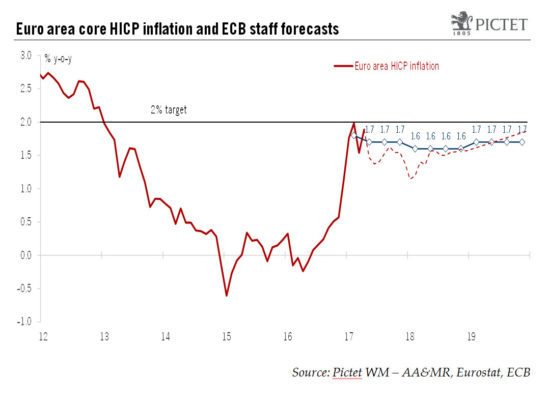

Although flash inflation was down in May, we expect core prices to pick up gradually and the ECB to move very cautiously toward policy normalisation.Euro area ‘flash’ HICP inflation came in at 1.4% y-o-y in May (down from 1.9% in April) while core inflation eased to 0.94% (down from 1.2%), both slightly below consensus expectations, as energy-related base effects and Easter distortions faded. We forecast euro area inflation to remain relatively stable in the next few months before core inflation starts to edge gradually higher in H2, albeit at a slower pace than expected by the ECB.As Mario Draghi said again this week, it is far too early to tell whether inflation is on a “self-sustained upward adjustment” yet. Still, we suspect that the ECB’s broad message will remain largely unchanged

Topics:

Frederik Ducrozet considers the following as important: ECB inflation projections, euro area core inflation, Euro area inflation, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Although flash inflation was down in May, we expect core prices to pick up gradually and the ECB to move very cautiously toward policy normalisation.

Euro area ‘flash’ HICP inflation came in at 1.4% y-o-y in May (down from 1.9% in April) while core inflation eased to 0.94% (down from 1.2%), both slightly below consensus expectations, as energy-related base effects and Easter distortions faded. We forecast euro area inflation to remain relatively stable in the next few months before core inflation starts to edge gradually higher in H2, albeit at a slower pace than expected by the ECB.

As Mario Draghi said again this week, it is far too early to tell whether inflation is on a “self-sustained upward adjustment” yet. Still, we suspect that the ECB’s broad message will remain largely unchanged at this stage—in other words, cautiously optimistic over the medium term.

We continue to expect the ECB to remove the most dovish elements from its forward guidance at its 8 June meeting, including downside risks to growth and the easing bias, while asking its internal committees to study all exit strategy options. Looking ahead, we see a risk that a tapering announcement will be postponed to the 26 October meeting in order for the ECB to secure a more convincing upward adjustment in core inflation.