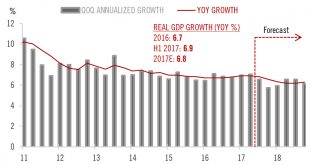

Chinese GDP higher than forecast in Q2; we expect 2017 GDP growth of 6.8%.Chinese GDP for Q2 2017 grew by 6.9% year-on-year (y-o-y) in real terms, the same pace of expansion as in Q1. The growth figure beats both the consensus forecast and our own estimate. We have decided to revise our Chinese GDP growth forecast for 2017 to 6.8% from 6.5%, and the forecast for 2018 to 6.3% from 6.2%. These revisions reflect both the stronger-than-expected growth in Q2 and a better outlook for the near term...

Read More »Euro area: Bank credit standards eased slighlty in Q2

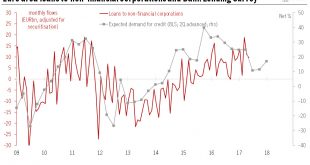

The latest Bank Lending Survey from the ECB showed that credit standards for loans to enterprises eased slightly in net terms in Q2. Our GDP growth forecast for the euro area remains unchanged. The July Bank Lending Survey (BLS), released by the ECB today, showed that bank credit standards for loans to enterprises eased slightly in Q2 2017, following a net easing in the previous quarter. This came despite expectations in the previous survey round that these standards would tighten...

Read More »Major currencies’ outlook

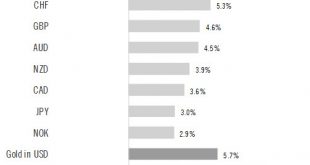

Although close to the end of a long-term up-cycle, the dollar has the potential to recover ground lost recently given the outlook for Fed rate rises and balance sheet reduction.Our latest forecasts for major currencies over the coming months can be summarised as follows:US dollar. In terms of duration and valuation, the USD up-cycle is likely close to ending. However, the USD is likely to remain strong on the back of robust US growth and the outlook for inflation. It should also benefit from...

Read More »Monthly Investment Strategy Highlights, July 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationAs central bank support starts to be withdrawn, volatility could well rise.We are still slightly long equities, since fundamentals are supportive, but have bought put options on the S&P 500 to guard against downside risks. A rise in volatility will create opportunities for tactical trading and especially hedge funds.CommoditiesOil prices fell again in June, but now appear close to what we assess as the...

Read More »US job market remains strong, but wage growth still disappoints

The latest non-farm payroll report is unlikely to make the Fed deviate from plans for policy normalisation.All in all, today’s employment report was healthy. In the end, job creation was actually quite robust overall in Q2, ‘aggregate weekly payrolls’ rose strongly q-o-q, and if unemployment rebounded a little in June, it was only because of higher participation, not a lack of employment growth. However, once again, wage data brought some disappointment, with average hourly earnings...

Read More »Upbeat PMIs in China point to solid growth momentum in Q2

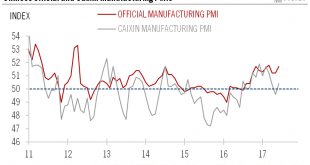

June PMI surveys suggest that economic activity moderated only slightly in the last quarter, but we maintain our view the deceleration in Chinese growth will be more notable in the second half.China’s official manufacturing PMI rose to 51.7 in June, the second highest reading in 2017. The Markit manufacturing PMI also rebounded to 50.4 in June after having dropped below the 50 threshold in the previous month. The rise in both indices in June suggests that China’s growth momentum in the...

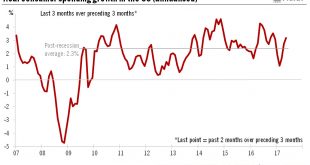

Read More »U.S. consumer spending picks up, but inflation is still soft

Just-released figures lead us to revise our forecasts for US spending and inflation.Real consumer spending increased by just 0.1% month-on-month in May. However, Q1 and April consumption figures were revised higher. The overall result was that between Q1 and April-May, US personal consumption grew by a strong 3.2% annualised. The strong bounce back in consumption growth expected has been confirmed, so that our forecast of 2.7% growth in consumer spending for Q2 overall now looks too low. We...

Read More »Rebound in euro area core inflation

While core inflation was slightly stronger than expected in June, we believe it will rise only slowly for the rest of this year.Euro area ‘flash’ HICP inflation eased to 1.3% y-o-y in June (down from 1.4% in May) while core inflation increased to 1.1% (up from 0.9% in May). Both figures were slightly above consensus expectations, but our overall assessment is unchanged. The bottom line from the June inflation report is that the broad picture remains unchanged – we continue to expect euro...

Read More »Risks for high-yield bonds are rising

High yield bonds are vulnerable to a rise in spreads from their current low levels. Default levels could also rise for US high yield.US and euro high yield have performed strongly between Donald Trump’s election as US president and the end of June. However, our analysis of fair value suggests there is potential for a widening of spreads and a rise in default rates ahead.Our multi-factor model of high-yield corporate spreads enables us to forecast US and euro high-yield spread levels based on...

Read More »The dollar should rebound in the coming months

The euro rose sharply against the US dollar after a speech by Mario Draghi today. We still expect the US dollar to strengthen in the coming months.The euro appreciated significantly against the US dollar (by as much as 1.4% at one stage) on 27 June, reaching a 10-month high. The main reaon was a speech by ECB President Mario Draghi at the ECB forum on central banking at Sintra. To a lesser extent, the ongoing struggle to find legislative consensus among the US Republican Party, highlighted...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org