A new daily fixing mechanism gives the Chinese central bank more control over the exchange rate and reduces pressure on the renminbi in the case of renewed dollar strength.The People’s Bank of China (PBoC) recently announced the introduction of a “counter cyclical adjustment factor” (CCAF) to calculate the daily USD/CNY reference rate (the “fixing rate”). The previous formula used two factors: the USD/CNY spot close of the previous day and an adjustment factor taking into account overnight changes in demand and supply in the FX markets. The PBoC’s justification for the inclusion of a third factor, the CCAF, is to increase the weighting of macroeconomic fundamentals in the exchange rate price quotation.The CCAF mechanism could be used by the PBoC to reduce the impact of the USD/CNY spot

Topics:

Luc Luyet & Dong Chen considers the following as important: China capital outflows, Chinese currency controls, Macroview, renimbi exchange rate, renminbi depreciation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

A new daily fixing mechanism gives the Chinese central bank more control over the exchange rate and reduces pressure on the renminbi in the case of renewed dollar strength.

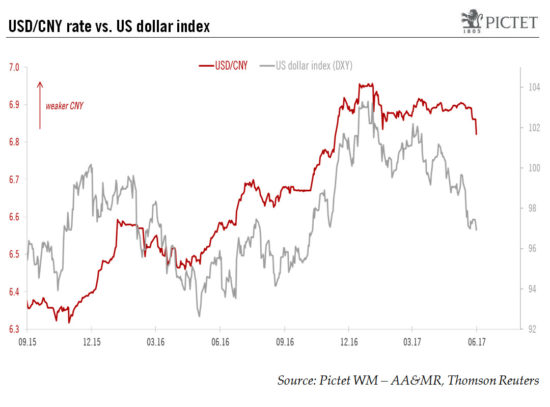

The People’s Bank of China (PBoC) recently announced the introduction of a “counter cyclical adjustment factor” (CCAF) to calculate the daily USD/CNY reference rate (the “fixing rate”). The previous formula used two factors: the USD/CNY spot close of the previous day and an adjustment factor taking into account overnight changes in demand and supply in the FX markets. The PBoC’s justification for the inclusion of a third factor, the CCAF, is to increase the weighting of macroeconomic fundamentals in the exchange rate price quotation.

The CCAF mechanism could be used by the PBoC to reduce the impact of the USD/CNY spot close on the fixing. By doing so, the central bank regains some control over the USD/CNY exchange rate and has gained an alternative approach to straight FX market intervention.

Put in the context of the Chinese regulators’ efforts to push for deleveraging of the financial system, the PBoC’s latest move will likely reduce external risks due to sustained expectations of renminbi depreciation caused by capital outflows. The CCAF might be seen as a step back from a market-based exchange rate regime. However, between exchange rate liberalisation and financial stabilisation, the PBoC would seem to have chosen the latter, at least for the time being.

Following the introduction of the CCAF, we believe the likelihood of the USD/CNY rate moving above the CNY7.00/USD1 threshold in the next 12 months has declined quite significantly. Indeed, a move above CNY7.00 per USD means the renminbi would have to depreciate by at least 3% from its current level, which, in our view, is unlikely given our forecast of only moderate USD appreciation.

The introduction of the new fixing mechanism has revealed that Chinese policy makers intend to thwart self-fulfilling market expectations of significant renminbi weakness against the US dollar. In a strong USD environment, part of the upward dollar pressure can be “absorbed” by an appreciation of the renminbi index, which has been weak this year, instead of allowing the USD/CNY to rise significantly.