As widely expected, core PCE inflation picked up further in January, but the increase was surprisingly pronounced. However, we do not expect much more upside over the rest of the year. In Friday’s report on income and consumption, data were also published on the Personal Consumption Expenditures (PCE) deflator, the price measure targeted by the Fed. Following higher-than-expected CPI numbers the week before, a relatively marked monthly increase was also expected last Friday. However, the...

Read More »Euro area: large drop in core inflation delivers the final blow to the ECB

Today’s inflation report raises the likelihood of an even bigger easing package to be delivered at the 10 March meeting. Not only were today’s preliminary inflation figures for the euro area very weak, but the breakdown raised new concerns over the underlying trend in consumer prices – a potential headache for the ECB, independently of recent developments in the real economy and financial markets. According to Eurostat’s estimates, euro area HICP inflation fell to -0.19% y-o-y in...

Read More »Euro area: Credit rebounds sharply

After a large and unexpected fall in December, largely due to a collapse in lending to non-financial corporations in the Netherlands, euro area bank credit flows rebounded sharply in January, in line with other indicators such as the ECB’s Bank Lending Survey We continue to believe that the credit cycle has legs and we therefore maintain our forecast for the euro area GDP growth unchanged at 1.8% for 2016. Nevertheless, we also remain cautious. January bank credit flows came before the...

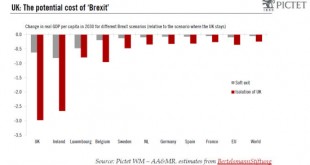

Read More »UK: To Brexit, or not to Brexit?

We expect the UK to remain in the EU, but the risks are high. Opinion polls suggest a close result, and unless the gap widens markedly between the “Ins” and “Outs”, a prolonged period of uncertainty beckons. Moreover, in the event of Brexit, negotiations could go on for years. Having secured a deal at the European Council meeting on 19 February, PM David Cameron announced that the referendum on UK EU membership will be held on 23 June. Based on the reactions on both sides, it looks like...

Read More »Euro area: Revisiting the ECB’s Lower Bound

Financial stress is threatening the fragile euro area recovery, especially the credit cycle. More negative rates are likely to be part of the ECB’s response We expect the ECB to cut the deposit rate to -0.50% by June, probably in two steps (by 10bp in March and by another 10bp in June), as part of its response to weaker inflation prospects and tighter financial conditions. That said, the adverse consequences of negative rates are becoming increasingly visible as foreign central banks are...

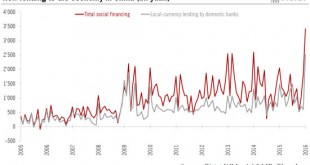

Read More »China policy moves: encouraging for the short term

Recent moves will reassure financial markets. Nevertheless, excess credit growth raises the risk of a crash in China in a few years’ time. Lending to the economy reached record levels in China in January, suggesting that the authorities are prepared to do more to support growth. A stabilisation of the yuan and an admission by the authorities of mistakes in their approach to financial markets are also positive signs. Market fears around China may therefore temporarily abate. However,...

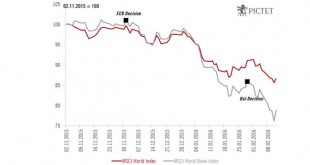

Read More »The dark side of negative interest rates

Recent equity market peaks coincided with the ECB and BoJ decisions to impose negative rates. From December 1st to last Friday, the MSCI World index declined by 14%. During the same period, the MSCI world banks index declined by 24%. Recent chronology of events Since 2009 and up until recently, central bank action has helped to stabilise equity markets. Looking at recent events, it now seems that the opposite is becoming true. The last two monetary decisions (ECB on 3 December 2015 and BoJ...

Read More »Reasons behind the stress in corporate High-Yield

High-Yield in both the US and euro zone has experienced significant stress since the start of the year, posting negative total return performances. High-Yield (HY) corporate bonds have continued to suffer since the start of the year, posting a negative total return of 4.6% for the US index and 3.6% for the equivalent index in euro. It comes as no surprise that the worst-performing US sector was energy, down 18.3%, and the best performer was super retail, with a meagre 0.1% gain. Many...

Read More »United States: we remain optimistic on consumption growth in 2016

Today’s retail sales report was reassuring. We remain sanguine on consumption growth in 2016. Unsurprisingly, Fed Chair Yellen acknowledged the downside risks to the growth outlook but did not rule out a hike in March. Nominal total retail sales rose by 0.2% m-o-m in January, slightly above consensus expectations (+0.1%). Moreover, December’s number was revised up from -0.1% to +0.2%. Total sales were dented by a 3.1% m-o-m fall in nominal sales at gasoline stations (on the back of lower...

Read More »Euro area: the economy remains resilient so far

Euro area real GDP grew by 0.3% q-o-q in Q4, in line with consensus expectations. Based on evidence from core countries, private consumption was once again the main driver of GDP growth. According to Eurostat’s preliminary estimate, euro area real GDP grew by 0.3% q-o-q in Q4 (1.1% q-o-q annualised; 1.5% y-o-y), in line with consensus expectations and at the same pace as in Q3. No breakdown is available at this stage, but evidence from core countries suggests that private consumption was...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org