…but it could start tightening at the end of this yearAt its latest quarterly monetary policy assessment unveiled today, the Swiss National Bank (SNB) maintained its accommodative monetary policy. The target range for the 3-month Libor was kept between -1.25% and -0.25%, the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%, and the central bank reiterated its willingness to intervene in the foreign exchange market if needed.Importantly, the central...

Read More »Too early for Switzerland’s central bank to change policy…

…but it could start tightening at the end of this year. At its latest quarterly monetary policy assessment unveiled today, the Swiss National Bank (SNB) maintained its accommodative monetary policy. The target range for the 3-month Libor was kept between -1.25% and -0.25%, the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%, and the central bank reiterated its willingness to...

Read More »US consumption update – Getting stingy

Retail sales posted their third consecutive monthly decline in February, but there is no need to worry, for now.The US consumer has shown surprising stinginess lately. Soft February retail sales data continue the uneven pattern of consumption data since the beginning of the year. On a y-o-y basis (and nominal terms) they were up only 4.0% in February, below the 1-year average of 4.4%.This soft consumption data is even more surprising as all consumption signals are flashing green for the US...

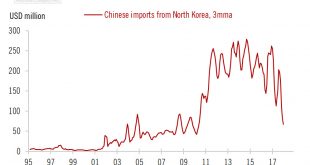

Read More »A surprising turn of events in North Korea

Huge uncertainties hang over the proposed summit between the US and North Korea leaders.The South Korean national security director announced that the US President Donald Trump had accepted an offer of a meeting from Kim Jong Un, the leader of North Korea before May. While it has long been our view that a military conflict between the US and North Korea is relatively improbable, the announcement still came as a surprise.The proposed summit is definitely a big step in the right direction that...

Read More »US chart of the week – Corporate euphoria

CEO sentiment reaches a record high, but protectionist tendencies could impact confidence down the road.US businesses are feeling good – in fact, they are borderline euphoric. The latest evidence comes from the quarterly Business Roundtable CEO economic outlook index, a survey of 137 CEOs, conducted in February, which rose to its highest level since the survey began 15 years ago. All three sub-indices (capex, employment, sales) rose to fresh highs.Particularly encouraging was the sharp rise...

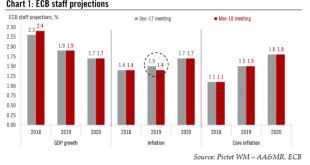

Read More »ECB begins to rotate forward guidance

The ECB made one small change to its communication in March consistent with a normalisation process that is likely to remain very gradual. In line with our expectations, today the Governing Council (unanimously) decided to drop its commitment to increase asset purchases “in terms of size and/or duration” if needed, which had steadily become more difficult to justify and less credible anyway. In effect, the ECB has...

Read More »Europe chart of the week – SNB FX intervention

Despite tensions since the beginning of the year, there is no evidence of FX market interventions by the Swiss central bank. SNB FX Intervention In the wake of the financial crisis, the Swiss National Bank (SNB) increased massively the monetary base to provide liquidity and limit the Swiss franc’s appreciation. The expansion in the monetary base can essentially be seen in the form of an increase in sight deposits held...

Read More »US employment—Goldilocks again

After a solid February job report, we continue to expect four Fed rate hikes this year (and two in 2019).There are two main conclusions to be drawn from the February US employment report. First, the US economy’s underlying momentum is particularly robust, consistent with our view that GDP growth will pick up to 3.0% this year, from 2.3% in 2017. Second, while the labour market is tight, there is still some slack left; in other words, the US labour market is not (yet) overheating.That...

Read More »Europe chart of the week – SNB FX intervention

Despite tensions since the beginning of the year, there is no evidence of FX market interventions by the Swiss central bank.In the wake of the financial crisis, the Swiss National Bank (SNB) increased massively the monetary base to provide liquidity and limit the Swiss franc’s appreciation. The expansion in the monetary base can essentially be seen in the form of an increase in sight deposits held by domestic Swiss banks at the SNB. The SNB does not communicate on its interventions in the...

Read More »The Brazilian real and Russian rouble are still the most attractive EM currencies

Our EM currencies scoreboard shows valuation factors driving the Chinese renminbi turning negative, while idiosyncratic factors behind the South Africa rand have improved.Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks.There have been only few changes over the past month. Our EM FX scorecard still shows the Brazilian...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org